Beyond Investing

-

DATABASE (131)

-

ARTICLES (254)

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Tiger Brokers: At the right place, at the right time

China’s new middle-class elite is educated and tech-savvy – and they want to put their money in US stocks. A fintech app is cashing in on this

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Spotahome CTO: Room for more real estate disruption, beyond rentals

Bryan McEire, CTO and co-founder of the Spanish proptech startup, details their expansion plans this year and more, in a wide-ranging interview

Dronak looks beyond the skies to a future of robotics

Dronak CEO Fabia Silva wants to make the world a better place through robotics innovation, but needs funding so the company can spread its tech wings past drones

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

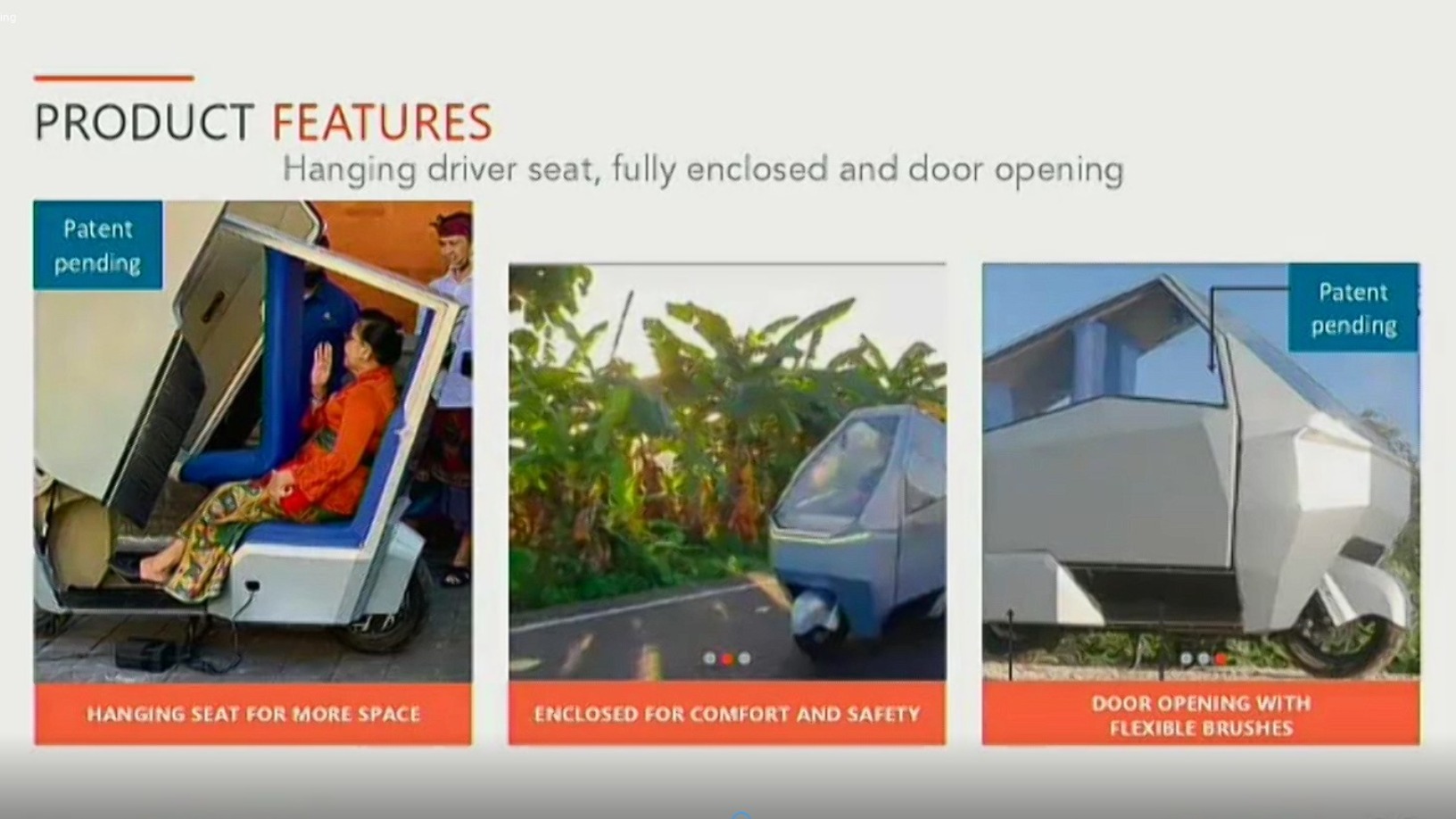

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Sorry, we couldn’t find any matches for“Beyond Investing”.