Beyond Investing

-

DATABASE (131)

-

ARTICLES (254)

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Founder and CEO of Tiger Brokers

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Founder and CEO of Tiger Brokers. Wu Tianhua received his B.S. & M.S in Computer Science from Tsinghua University. Later, he co-founded Youdao, a new online education startup under the Nasdaq-listed NetEase group. By the time he left, Youdao’s user base had grown to the hundreds of millions. Wu had begun to familiarize himself with investing when he was an undergraduate and started to invest in the US stock market around 2010. Investing in the US stock market was very complicated then and in 2014, he decided to build his own service to make investing easier.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Founder and CEO of Estay

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Co-founder and former Business Developer of Ontruck

Antonio Lu Lee is one of the co-founders of OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology. Whilst there, he managed the company’s business development and its fleet community until March 2018. He previously worked in shipping and logistics in Hanjin Shipping. He has also worked in a seafood company and in oil and gas ship brokerage. He holds a master's in Value Investing and Cycle Theory from Madrid's Manuel Ayau Online Center.

Antonio Lu Lee is one of the co-founders of OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology. Whilst there, he managed the company’s business development and its fleet community until March 2018. He previously worked in shipping and logistics in Hanjin Shipping. He has also worked in a seafood company and in oil and gas ship brokerage. He holds a master's in Value Investing and Cycle Theory from Madrid's Manuel Ayau Online Center.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Chief Creative Officer and co-founder of Beyond Leather Materials / Leap

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

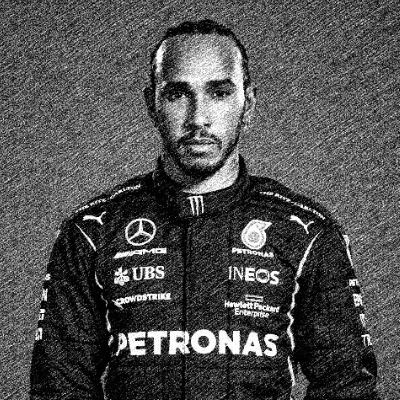

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

CEO and co-founder of Beyond Leather Materials / Leap

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

COO and co-founder of Modulous Tech

Christopher Mortensen is co-founder and Chief Operating Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. Before that, he worked for two years as technical director at engineering, sustainability and energy consultancy Hydrock. Previously, he was at Atelier Ten for ten years working as a senior engineer, an environmental design consultant, a building services engineer and a lighting designer. Mortensen’s previous posts were all in his native US: as a mechanical project engineer at Oregon-based Interface Engineering 2004-8, as a mechanical designer at Philadelphia-based Associated Engineering Consultants, and as an assistant hut master at the Appalachian Mountain Club. He holds an Executive MBA from Cass Business School in London and also studied Blockchain in 2018 at the University of Oxford’s Said Business School Mortensen is a keen public speaker and, in 2017, gave a TedX talk on ’Beyond Sustainable Design.’

Christopher Mortensen is co-founder and Chief Operating Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. Before that, he worked for two years as technical director at engineering, sustainability and energy consultancy Hydrock. Previously, he was at Atelier Ten for ten years working as a senior engineer, an environmental design consultant, a building services engineer and a lighting designer. Mortensen’s previous posts were all in his native US: as a mechanical project engineer at Oregon-based Interface Engineering 2004-8, as a mechanical designer at Philadelphia-based Associated Engineering Consultants, and as an assistant hut master at the Appalachian Mountain Club. He holds an Executive MBA from Cass Business School in London and also studied Blockchain in 2018 at the University of Oxford’s Said Business School Mortensen is a keen public speaker and, in 2017, gave a TedX talk on ’Beyond Sustainable Design.’

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Game developer Digital Happiness promotes Indonesia with its ghosts and ghouls

The Indonesian studio behind the popular horror game, DreadOut, recently released a sequel after its first game saw 2.5m downloads worldwide and raked in $7.5m, and was even made into a movie

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

TOPDOX relaunched: from consumer to corporate

Half a million users later, productivity software startup TOPDOX made the jump to B2B. Its co-founder and CEO, Nelson Pereira, tells us why

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

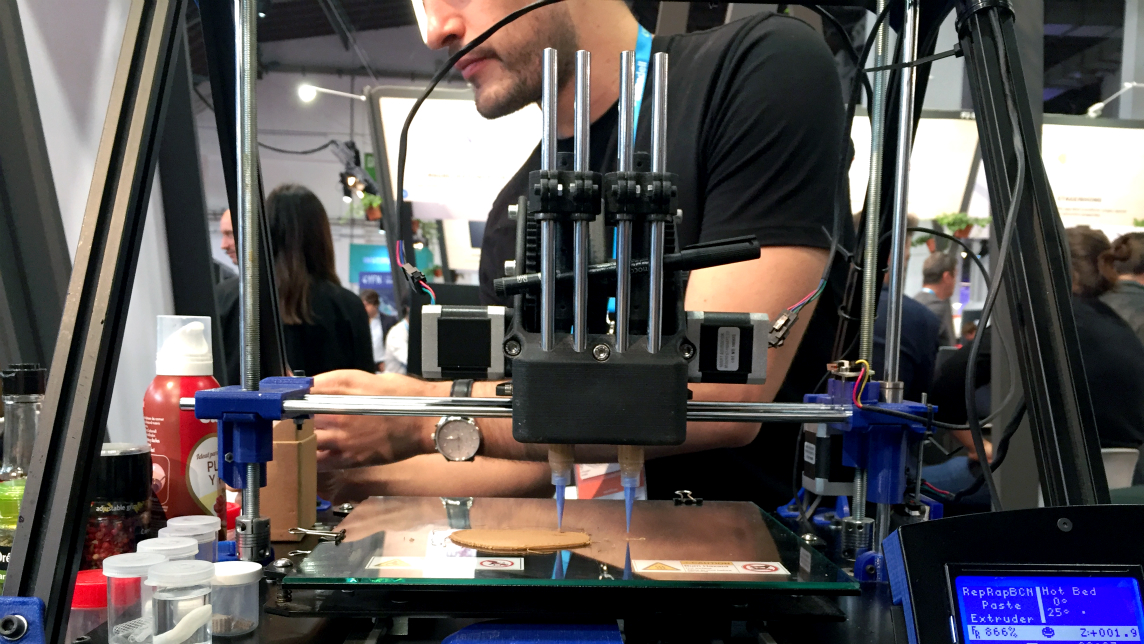

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Sorry, we couldn’t find any matches for“Beyond Investing”.