Beyond Meat

-

DATABASE (52)

-

ARTICLES (209)

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Beyond Leather Materials / Leap

Vegan leather made from apple waste is recyclable and biodegradable; produces 85% less CO2, uses 99% less water than leather; for sustainable textiles and fashion.

Vegan leather made from apple waste is recyclable and biodegradable; produces 85% less CO2, uses 99% less water than leather; for sustainable textiles and fashion.

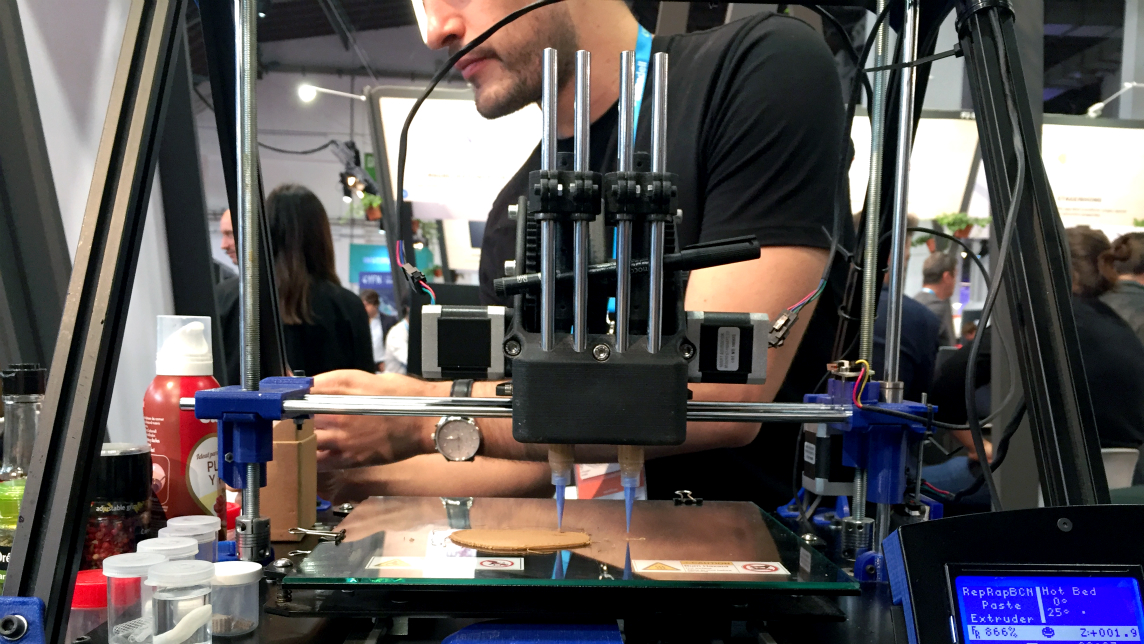

Co-founder, CCO of Cocuus

Patxi Larumbe is the Spanish CCO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Larumbe founded and directed eight other companies, the majority, like Cocuus, also based in Pamplona, Navarre. During his extensive entrepreneurial career, Larumbe had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Before Cocuus, he was a director at his building materials distribution company, On Clima, for two years, which was preceded by a two-year stint heading up Tohama, an IoT tech developer for Somfy products. Prior to that, he was commercial director for 20 years at building services company Terradisa and also founded its Catalonia offices.From 2000–2013, Larumbe was the founder and board member at Acustica Arquitectonica, an acoustic architectural design company and from 1995–2005, he had the same responsibilities at his hospitality company, Ostatu Zaharra. Other companies he founded were were Render (1990–96), Netcorp Factory (1996–2000) and No Solo Futbol ("Not Just Soccer") (2000–2004). Larumbe studied electronics at first degree level in Pamplona.

Patxi Larumbe is the Spanish CCO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Larumbe founded and directed eight other companies, the majority, like Cocuus, also based in Pamplona, Navarre. During his extensive entrepreneurial career, Larumbe had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Before Cocuus, he was a director at his building materials distribution company, On Clima, for two years, which was preceded by a two-year stint heading up Tohama, an IoT tech developer for Somfy products. Prior to that, he was commercial director for 20 years at building services company Terradisa and also founded its Catalonia offices.From 2000–2013, Larumbe was the founder and board member at Acustica Arquitectonica, an acoustic architectural design company and from 1995–2005, he had the same responsibilities at his hospitality company, Ostatu Zaharra. Other companies he founded were were Render (1990–96), Netcorp Factory (1996–2000) and No Solo Futbol ("Not Just Soccer") (2000–2004). Larumbe studied electronics at first degree level in Pamplona.

Co-founder, COO of Cocuus

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

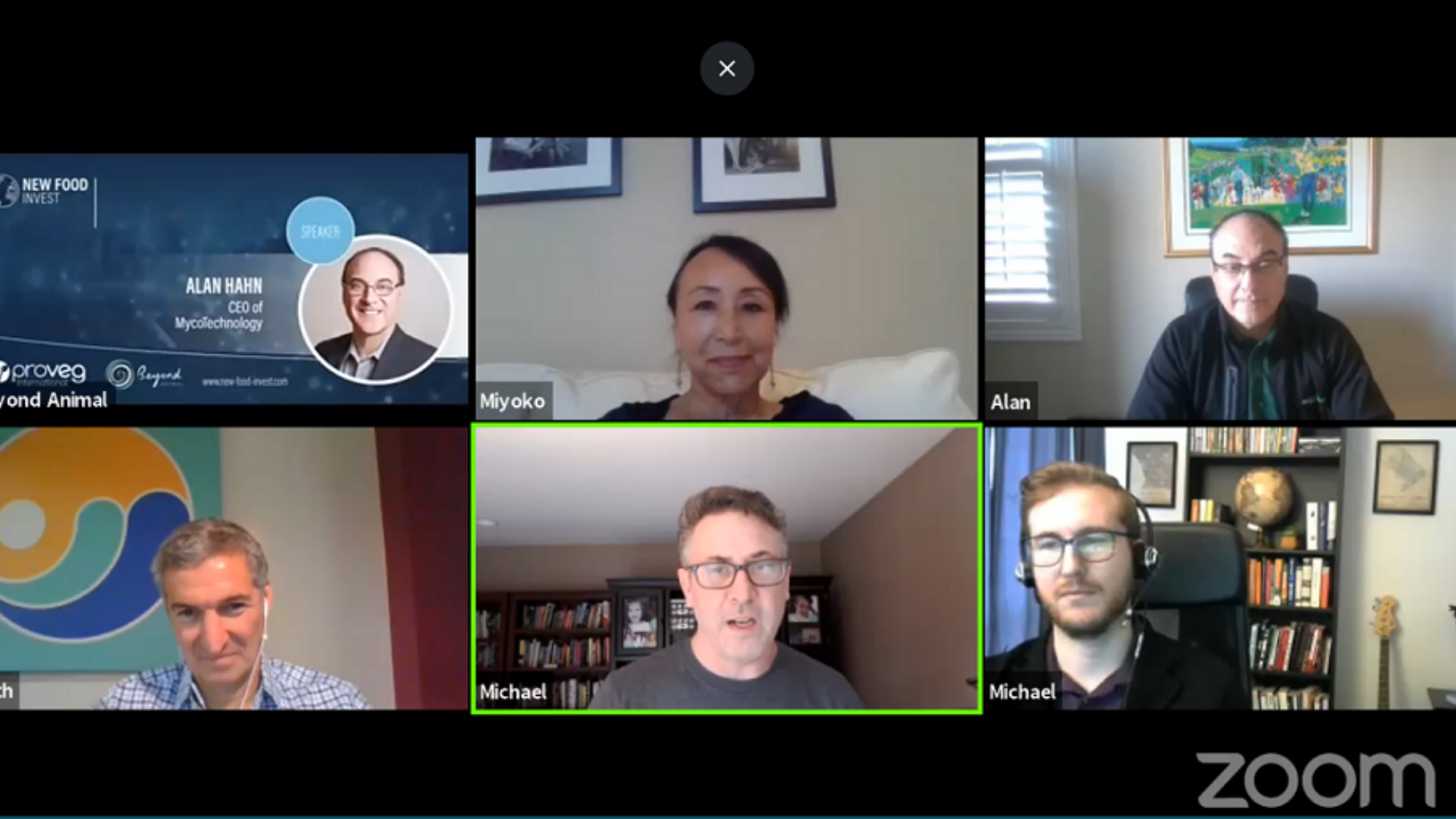

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

NotCo: Will this Bezos-backed plant-based foodtech be Chile's first unicorn?

Armed with $85m Series C funding, NotCo has expanded to the US, competing head-on with popular US alt-protein brands for a foothold in the multibillion-dollar vegan market

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Sorry, we couldn’t find any matches for“Beyond Meat”.