Beyond Meat

-

DATABASE (52)

-

ARTICLES (209)

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

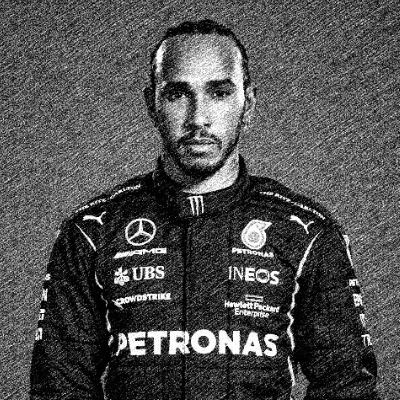

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Co-founder, CTO of Meatable

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Co-founder, CEO of Meatable

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

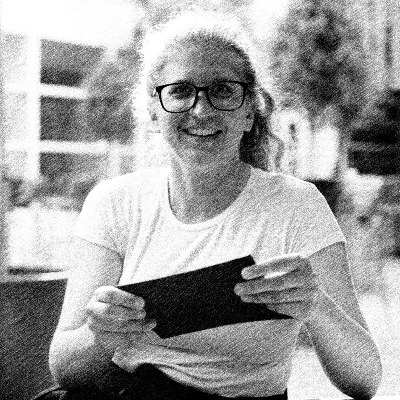

Chief Creative Officer and co-founder of Beyond Leather Materials / Leap

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

CEO and co-founder of Beyond Leather Materials / Leap

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

CEO and co-founder of Because Animals

Shannon Falconer graduated with a master’s in botany at the University of Vancouver in 2006. She also completed a PhD in biochemistry at The McMaster University in 2014. She went on to work as a postdoctoral researcher at Stanford University until 2016 when she decided to become the CEO and co-founder of biotech startup Because Animals. She also led the biotech’s R&D team to develop plant-based nutritional cookies and treats for dog and cats. Because Animals now aims to produce the world’s first cell-based cultured meat products for pets.

Shannon Falconer graduated with a master’s in botany at the University of Vancouver in 2006. She also completed a PhD in biochemistry at The McMaster University in 2014. She went on to work as a postdoctoral researcher at Stanford University until 2016 when she decided to become the CEO and co-founder of biotech startup Because Animals. She also led the biotech’s R&D team to develop plant-based nutritional cookies and treats for dog and cats. Because Animals now aims to produce the world’s first cell-based cultured meat products for pets.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

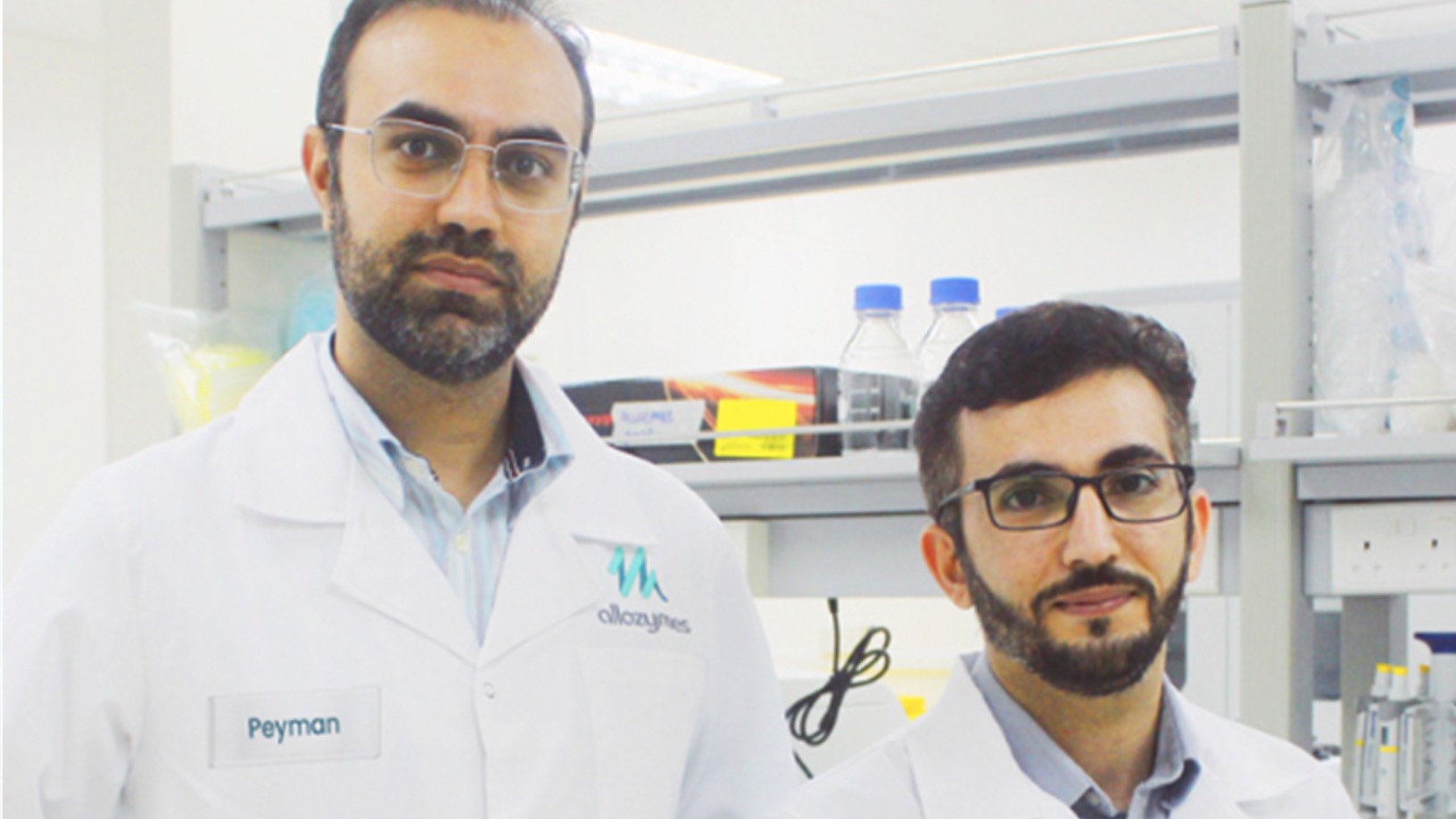

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

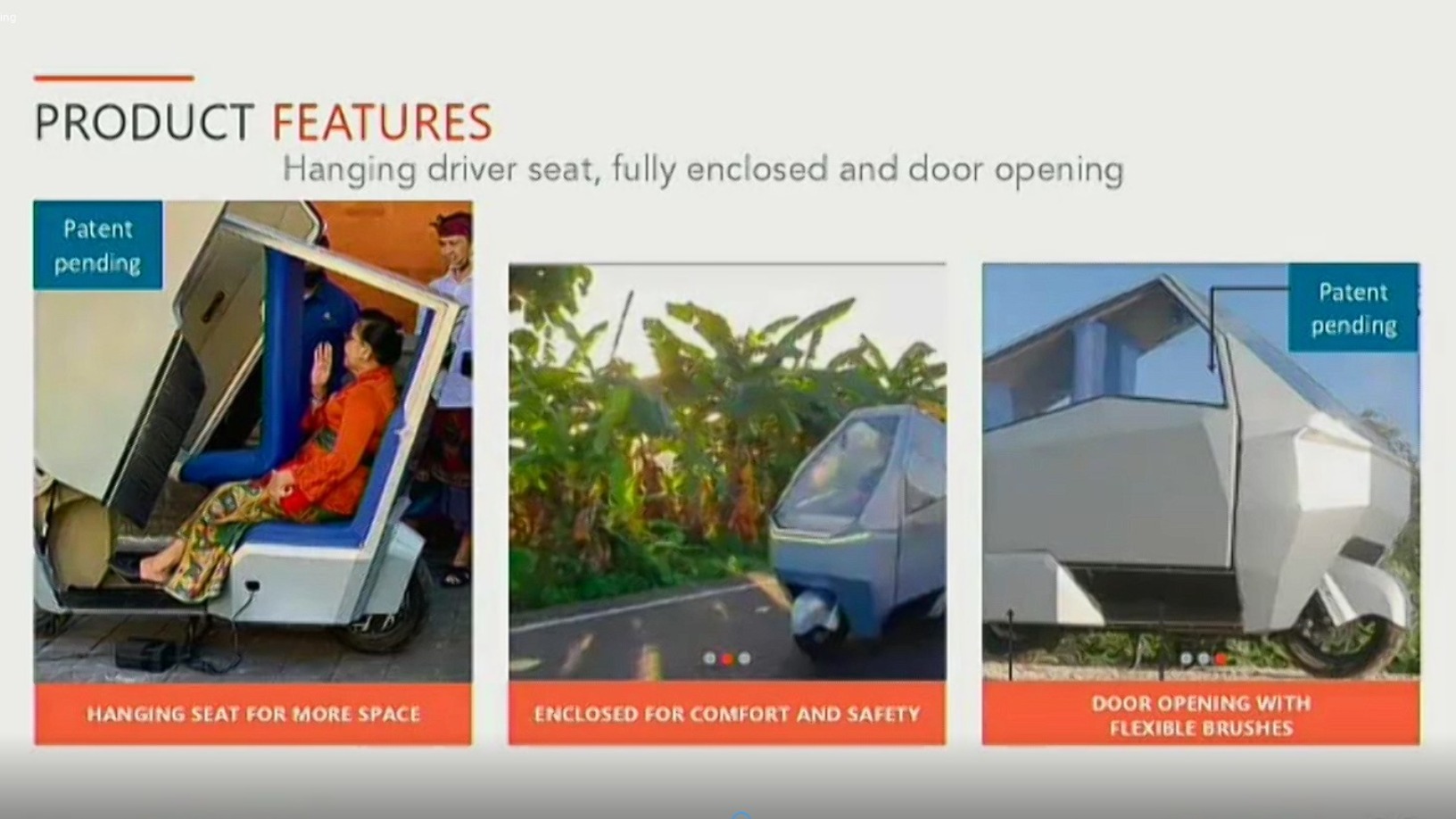

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Kibus Petcare: World's first auto-cook and -dispense healthy pet food device

Kibus Petcare applies the healthy eating revolution to the ever-growing pet-care business, eyes sales in 25 countries after crowdfunding launch

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

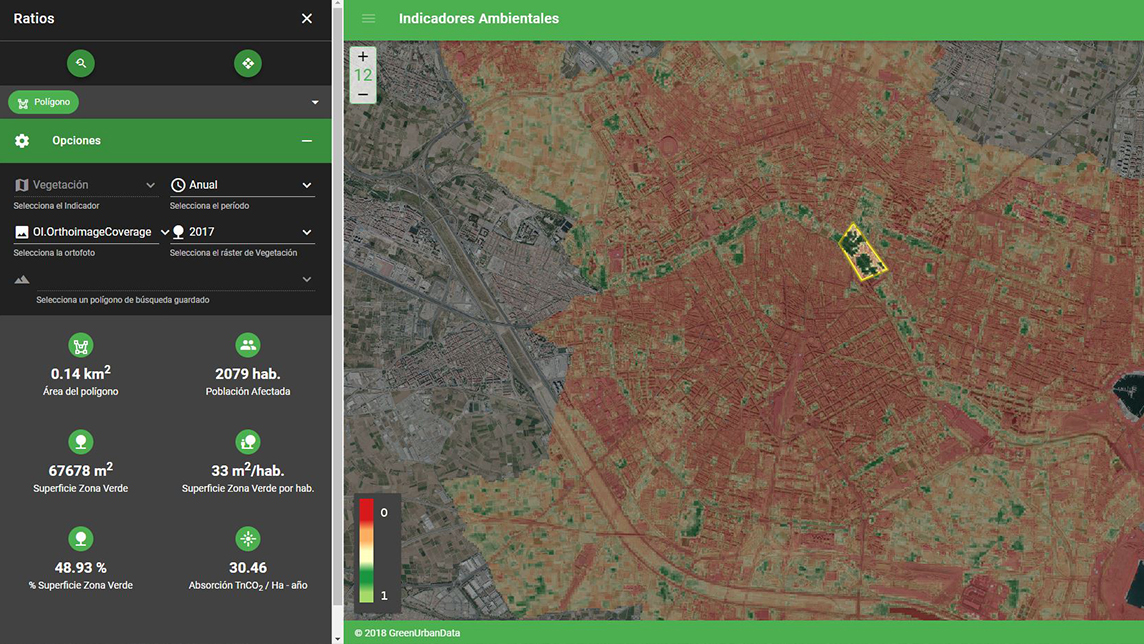

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Alipay opens its platform to speed up digitalization of Chinese service providers amid Covid-19

As Alipay continues to battle WeChat for super-app supremacy, it's created a stronghold in China’s services industry, where 80% of businesses still operate under brick-and-mortar models

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Game developer Digital Happiness promotes Indonesia with its ghosts and ghouls

The Indonesian studio behind the popular horror game, DreadOut, recently released a sequel after its first game saw 2.5m downloads worldwide and raked in $7.5m, and was even made into a movie

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Sorry, we couldn’t find any matches for“Beyond Meat”.