Blue Bio Value

-

DATABASE (83)

-

ARTICLES (287)

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Co-Founder and CMO of Sociolla

Graphic designer-turned-marketer Chrisanti Indiana, also known as Santi, holds a Bachelor of Applied Design in Design and Visual Communications from Billy Blue College of Design. Previous to Sociolla, Santi was a graphic designer for The Creative Method and Boheem Design in Sydney, Australia.

Graphic designer-turned-marketer Chrisanti Indiana, also known as Santi, holds a Bachelor of Applied Design in Design and Visual Communications from Billy Blue College of Design. Previous to Sociolla, Santi was a graphic designer for The Creative Method and Boheem Design in Sydney, Australia.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Founder and President of Mobike

Armed with a decade of experience in journalism and media before founding Mobike, the 34-year-old Hu Weiwei also founded GeekCar, a new media automobile and technology company, in 2010. She used to write for the National Business Daily, The Beijing News, Business Value and Geek Park. She is a graduate of Zhejiang University.

Armed with a decade of experience in journalism and media before founding Mobike, the 34-year-old Hu Weiwei also founded GeekCar, a new media automobile and technology company, in 2010. She used to write for the National Business Daily, The Beijing News, Business Value and Geek Park. She is a graduate of Zhejiang University.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Co-founder and former Business Developer of Ontruck

Antonio Lu Lee is one of the co-founders of OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology. Whilst there, he managed the company’s business development and its fleet community until March 2018. He previously worked in shipping and logistics in Hanjin Shipping. He has also worked in a seafood company and in oil and gas ship brokerage. He holds a master's in Value Investing and Cycle Theory from Madrid's Manuel Ayau Online Center.

Antonio Lu Lee is one of the co-founders of OnTruck, an innovation-oriented logistics company that optimizes road freight transportation through technology. Whilst there, he managed the company’s business development and its fleet community until March 2018. He previously worked in shipping and logistics in Hanjin Shipping. He has also worked in a seafood company and in oil and gas ship brokerage. He holds a master's in Value Investing and Cycle Theory from Madrid's Manuel Ayau Online Center.

Founder of RRQ (Rex Regum Qeon)

Riki Kawano Suliawan is the founder of RRQ, one of the most popular Indonesian eSports team. Riki founded and is CEO of Qeon Interactive, a Jakarta-based ICT company which provides online gaming and Internet value-added services. He also founded and is CEO of Flashads, which provides digital advertisements on a location-based service within free hotspot areas of Internet provider Biznet Hotspot. He studied at Santa Clara University and is the son of prominent businessman and MidPlaza Holdings founder Rudy Suliawan.

Riki Kawano Suliawan is the founder of RRQ, one of the most popular Indonesian eSports team. Riki founded and is CEO of Qeon Interactive, a Jakarta-based ICT company which provides online gaming and Internet value-added services. He also founded and is CEO of Flashads, which provides digital advertisements on a location-based service within free hotspot areas of Internet provider Biznet Hotspot. He studied at Santa Clara University and is the son of prominent businessman and MidPlaza Holdings founder Rudy Suliawan.

Used car trading platform Tutuche has experienced appraisers run the cars through 200+ tests, determining their safety, market value – improving a messy, fraud-ridden market.

Used car trading platform Tutuche has experienced appraisers run the cars through 200+ tests, determining their safety, market value – improving a messy, fraud-ridden market.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

CEO and Founder of Xiaoe Tech

Bao Chunjian graduated from the University of Science and Technology of China in 2006 with a master’s degree in Computer Science. He then joined Tencent where he worked for nine years on the R&D of major data-related technologies rising to the level of a T4 expert engineer (the highest title an engineer can achieve in Tencent). In 2015, Bao Chunjian recruited a few former Tencent employees and founded a startup to help blue-collar workers find jobs but that business failed in 2016. He then started Xiaoe Tech.

Bao Chunjian graduated from the University of Science and Technology of China in 2006 with a master’s degree in Computer Science. He then joined Tencent where he worked for nine years on the R&D of major data-related technologies rising to the level of a T4 expert engineer (the highest title an engineer can achieve in Tencent). In 2015, Bao Chunjian recruited a few former Tencent employees and founded a startup to help blue-collar workers find jobs but that business failed in 2016. He then started Xiaoe Tech.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Oimo: Biodegradable marine-based bioplastics for environmentally friendly food packaging

Its pellets already work well in current factory machinery, so Oimo wants to scale when the EU’s ban on single-use plastics kicks in next year

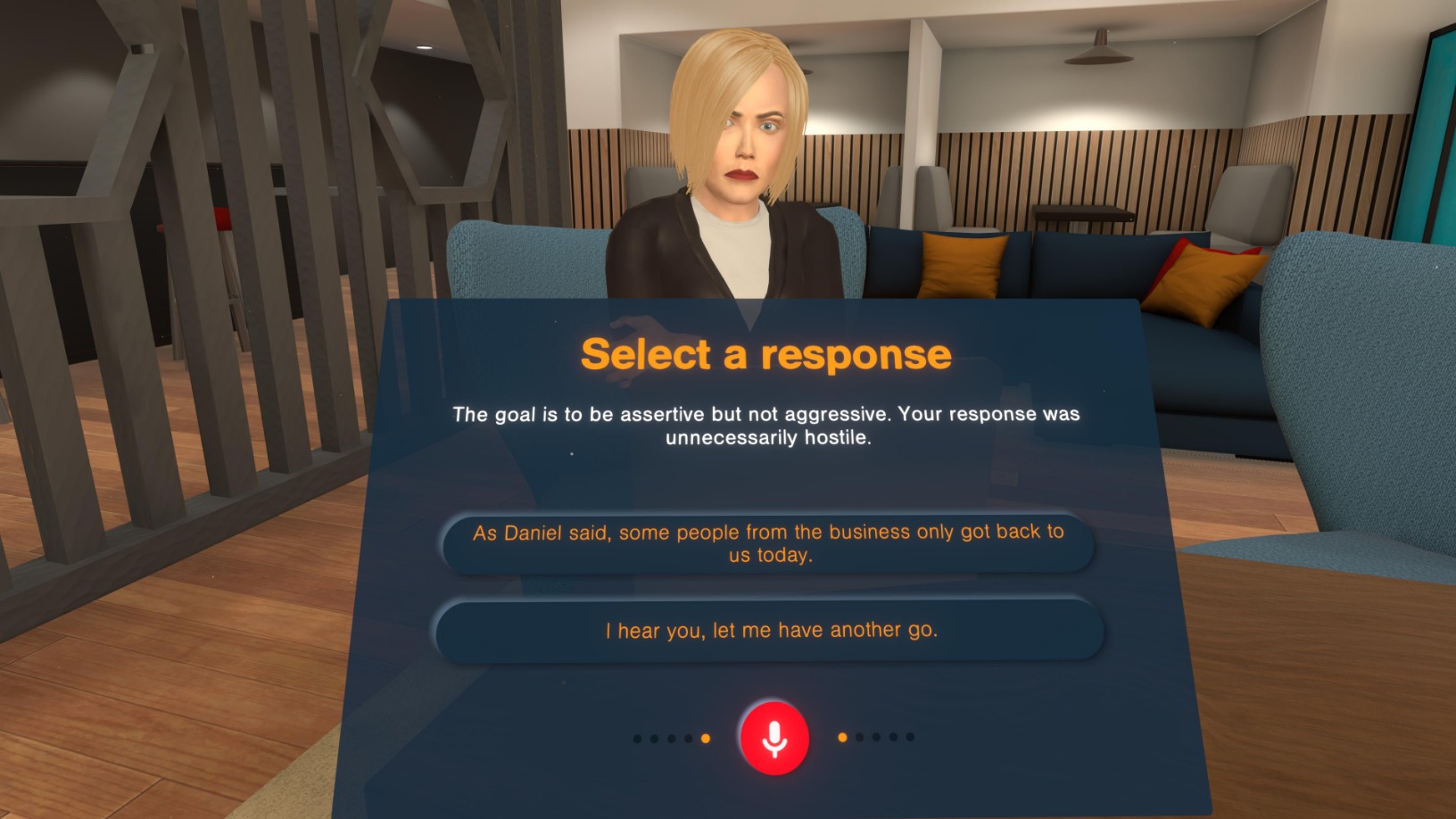

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Sorry, we couldn’t find any matches for“Blue Bio Value”.