Blue economy

-

DATABASE (51)

-

ARTICLES (191)

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Co-Founder and CMO of Sociolla

Graphic designer-turned-marketer Chrisanti Indiana, also known as Santi, holds a Bachelor of Applied Design in Design and Visual Communications from Billy Blue College of Design. Previous to Sociolla, Santi was a graphic designer for The Creative Method and Boheem Design in Sydney, Australia.

Graphic designer-turned-marketer Chrisanti Indiana, also known as Santi, holds a Bachelor of Applied Design in Design and Visual Communications from Billy Blue College of Design. Previous to Sociolla, Santi was a graphic designer for The Creative Method and Boheem Design in Sydney, Australia.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

Founder of Luoji Siwei

TV celebrity and influencer Luo Zhenyu holds a PhD in Journalism and Communications from the Communication University of China. After working at CCTV for eight years producing shows on finance and the economy, he resigned from the organization in 2008. Since then Luo has embarked on a journey he describes as “showing this fat face to all,” which he began by hosting popular TV shows on business and the economy and continued by founding Luoji Siwei in 2014.

TV celebrity and influencer Luo Zhenyu holds a PhD in Journalism and Communications from the Communication University of China. After working at CCTV for eight years producing shows on finance and the economy, he resigned from the organization in 2008. Since then Luo has embarked on a journey he describes as “showing this fat face to all,” which he began by hosting popular TV shows on business and the economy and continued by founding Luoji Siwei in 2014.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

CEO and Founder of Xiaoe Tech

Bao Chunjian graduated from the University of Science and Technology of China in 2006 with a master’s degree in Computer Science. He then joined Tencent where he worked for nine years on the R&D of major data-related technologies rising to the level of a T4 expert engineer (the highest title an engineer can achieve in Tencent). In 2015, Bao Chunjian recruited a few former Tencent employees and founded a startup to help blue-collar workers find jobs but that business failed in 2016. He then started Xiaoe Tech.

Bao Chunjian graduated from the University of Science and Technology of China in 2006 with a master’s degree in Computer Science. He then joined Tencent where he worked for nine years on the R&D of major data-related technologies rising to the level of a T4 expert engineer (the highest title an engineer can achieve in Tencent). In 2015, Bao Chunjian recruited a few former Tencent employees and founded a startup to help blue-collar workers find jobs but that business failed in 2016. He then started Xiaoe Tech.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

N.A.

Established in 2016, Roaming Capital invests mainly in early-stage startups in the sectors of mobile internet, new media, sharing economy, AR/VR, artificial intelligence, etc. The equity funds and digital assets under its management are worth over RMB 2bn.

Established in 2016, Roaming Capital invests mainly in early-stage startups in the sectors of mobile internet, new media, sharing economy, AR/VR, artificial intelligence, etc. The equity funds and digital assets under its management are worth over RMB 2bn.

CEO of Fundeen

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

CO2 Revolution: One man's quest to reforest the world

Juan Carlos Sesma is not just a man on a mission – he wants to change the world via his reforestation startup, CO2 Revolution, combining drones, intelligent seeds and big data. Sesma discusses his revolutionary yet scalable plans with CompassList at the recent Madrid South Summit

Nutrinsect: Aiming at insects for human consumption for the planet's sake

Nutrinsect expects insect-based foodstuffs to supplement meat to satisfy the ever-growing hunger for protein

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

Game Prime 2019 – Let the games commence!

This month, Jakarta's annual game exhibition to showcase more than 50 developers, promoting the industry’s potential locally and abroad

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

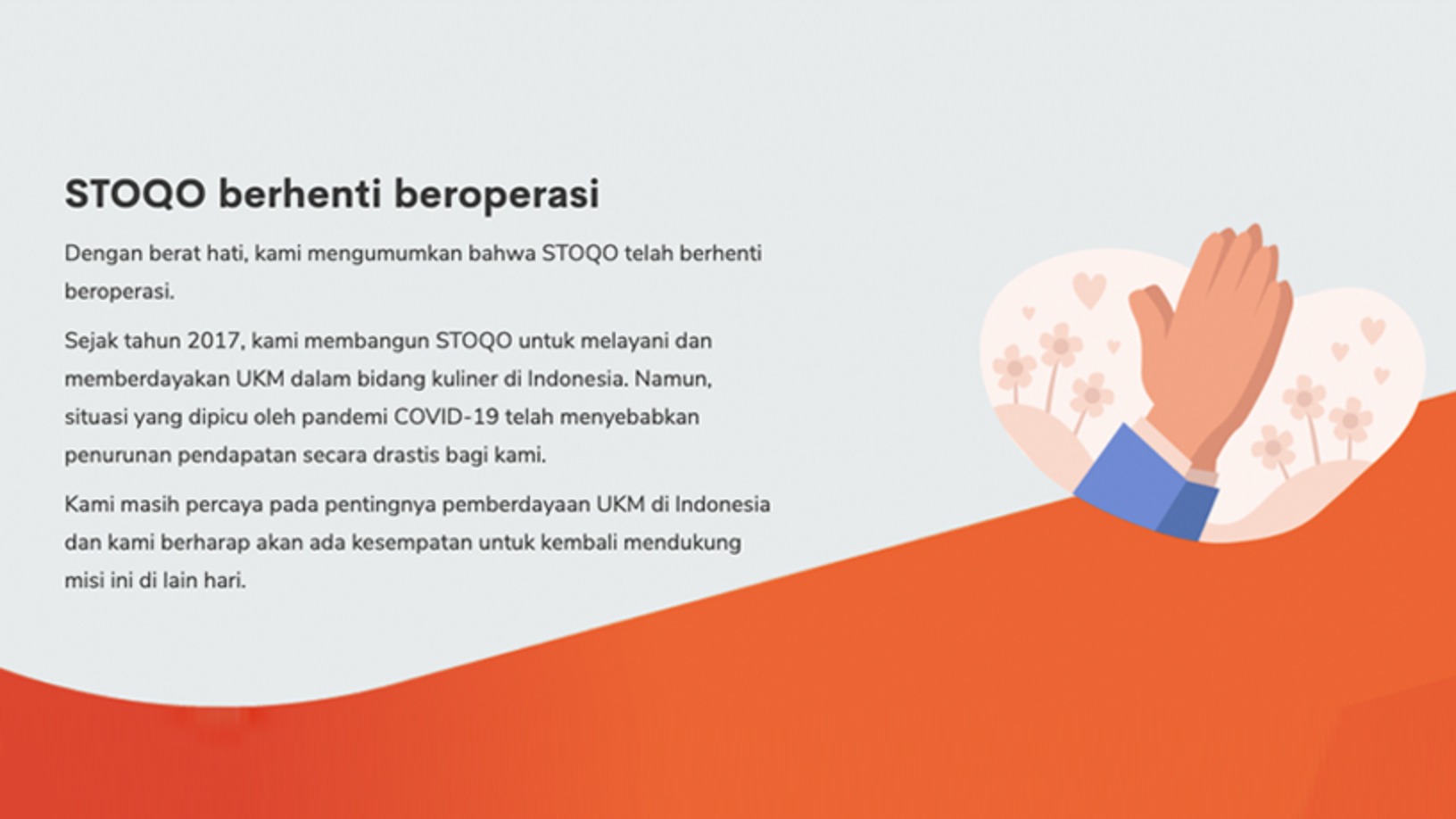

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Sorry, we couldn’t find any matches for“Blue economy”.