Business France

-

DATABASE (749)

-

ARTICLES (655)

CEO and co-founder of Aimentia

Edgar Jorba is CEO and co-founder at Aimentia, which runs the first AI-powered cloud-based virtual clinic for mental health patients. He has been based in Spain since 2018. Jorba previously worked in mental health research for more than two years in Spain and in France. Seeing the need for digitalization and improvement in mental health assessments and long wait times experienced by patients gave him the inspiration to start Aimentia.Jorba is currently studying for a bachelor’s degree in telecommunications technologies and services engineering at the Open University of Catalonia. He also holds a degree in industrial engineering from IQS in Barcelona.

Edgar Jorba is CEO and co-founder at Aimentia, which runs the first AI-powered cloud-based virtual clinic for mental health patients. He has been based in Spain since 2018. Jorba previously worked in mental health research for more than two years in Spain and in France. Seeing the need for digitalization and improvement in mental health assessments and long wait times experienced by patients gave him the inspiration to start Aimentia.Jorba is currently studying for a bachelor’s degree in telecommunications technologies and services engineering at the Open University of Catalonia. He also holds a degree in industrial engineering from IQS in Barcelona.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

Co-founder of Therapixal

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

News aggregator app Kurio brings back the pleasure of reading by selecting and showing only the most relevant and interesting Indonesian-language materials, reducing content overload.

News aggregator app Kurio brings back the pleasure of reading by selecting and showing only the most relevant and interesting Indonesian-language materials, reducing content overload.

Indonesia’s startup IPO pioneer Kioson is poised to grab a lion’s share of the local O2O e-commerce and financial services by targeting unbanked communities.

Indonesia’s startup IPO pioneer Kioson is poised to grab a lion’s share of the local O2O e-commerce and financial services by targeting unbanked communities.

Benefiting from the increasing consumption of fish worldwide, IWAK’s crowdfunding enterprise offers up to a 55% profit-share to investors of portable fish farms in Indonesia.

Benefiting from the increasing consumption of fish worldwide, IWAK’s crowdfunding enterprise offers up to a 55% profit-share to investors of portable fish farms in Indonesia.

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

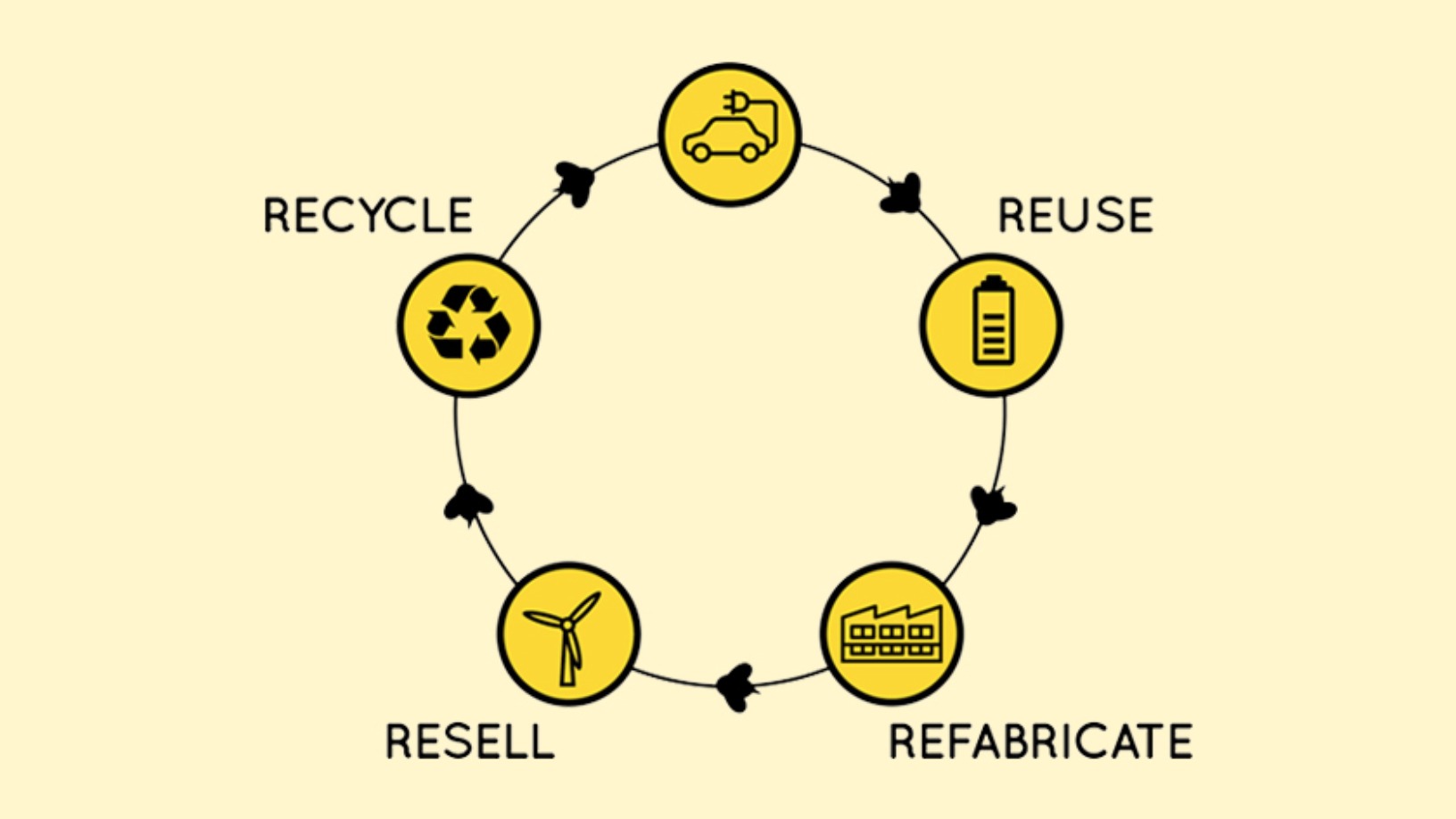

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

After emulating Chinese business models, Indonesian startups seek success abroad

Indonesia adapted and furthered the successful business models that created unicorns in China. Now, it's exporting its own to the rest of Southeast Asia, even beyond

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Ecojoko: Using AI, real-time data to save electricity

The French startup’s energy-saving assistant and mobile app show how much electricity is being used and how much can be saved for every household appliance

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Covid-19: Indonesia's P2P lenders ready for slower business, default risk

P2P lending startups set up stricter scrutiny, budget reserves; playing key role in helping Indonesian businesses survive the Covid-19 crisis

Sorry, we couldn’t find any matches for“Business France”.