Buy Yourself

-

DATABASE (29)

-

ARTICLES (190)

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Founded in 1993, as part of the Consortium of Vigo Free Trade Zone, the firm invests in startups from the Spanish autonomous region of Galicia throughout the seed, growth and acquisition stages. Vigo normally takes minority stakes of 5–40%. It also provides loans and participates in leveraged acquisitions, including management buy-outs, buy-ins or a mixture of both.

Founded in 1993, as part of the Consortium of Vigo Free Trade Zone, the firm invests in startups from the Spanish autonomous region of Galicia throughout the seed, growth and acquisition stages. Vigo normally takes minority stakes of 5–40%. It also provides loans and participates in leveraged acquisitions, including management buy-outs, buy-ins or a mixture of both.

Founded in 1982, Ade Gestión Sodical is an investment firm that specializes in the direct funding of startups at seed, early and growth stages. It also provides finance for VC and management buy-out /buy-in ventures.Sodical mainly focuses on enterprises connected to the Spanish region of Castilla y León to promote economic development in local areas. It normally invests between €180,000 and €2 million, taking minority stakes in small and medium-sized companies.

Founded in 1982, Ade Gestión Sodical is an investment firm that specializes in the direct funding of startups at seed, early and growth stages. It also provides finance for VC and management buy-out /buy-in ventures.Sodical mainly focuses on enterprises connected to the Spanish region of Castilla y León to promote economic development in local areas. It normally invests between €180,000 and €2 million, taking minority stakes in small and medium-sized companies.

Founder and CEO of Nongfenqi

Founder and CEO of Nongfenqi. Serial entrepreneur. Zhou studied E-commerce at the Dongbei University of Finance and Economics. Before founding Nongfenqi, he spent ten years trying to start other businesses. Zhou tried building websites for tourism, private detectives, etc. His real success was a company that helped computer game users buy virtual game tokens. Zhou used the same team and the money he made from his computer game company to found Nongfenqi.

Founder and CEO of Nongfenqi. Serial entrepreneur. Zhou studied E-commerce at the Dongbei University of Finance and Economics. Before founding Nongfenqi, he spent ten years trying to start other businesses. Zhou tried building websites for tourism, private detectives, etc. His real success was a company that helped computer game users buy virtual game tokens. Zhou used the same team and the money he made from his computer game company to found Nongfenqi.

Co-founder and advisor of Goola

Benz Budiman graduated in Business Administration at the University of Southern California and returned to Indonesia in 2014 to work for snack food manufacturer PT Mitrasatrya Perkasa Utama.He left the business development role in 2015 and established adtech Pomona in 2016. He is also the CEO of Pomona that offers cashbacks to customers who buy products promoted by clients. In addition, he became the president director of PT Tennova Cipta in 2016. He became an investor and co-founder of Indonesian beverage drinks startup Goola in 2018.

Benz Budiman graduated in Business Administration at the University of Southern California and returned to Indonesia in 2014 to work for snack food manufacturer PT Mitrasatrya Perkasa Utama.He left the business development role in 2015 and established adtech Pomona in 2016. He is also the CEO of Pomona that offers cashbacks to customers who buy products promoted by clients. In addition, he became the president director of PT Tennova Cipta in 2016. He became an investor and co-founder of Indonesian beverage drinks startup Goola in 2018.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

CEO and Co-founder of Tuvalum

Alejandro Pons Ballester is a young entrepreneur and public speaker. In 2013, Pons worked for a few months as a trainee engineer at a Jamaican company in Kingston, while reading a degree in Industrial Engineering Management at the Polytechnic University of Valencia (UPV) . He also gained some work experience as a community officer at NGO Engineering Without Borders (EWB) in 2011. After his graduation in 2014, he decided to become an entrepreneur and co-founded Tuvalum, a web marketplace to buy and sell used bikes and accessories. He is currently the company’s CEO.

Alejandro Pons Ballester is a young entrepreneur and public speaker. In 2013, Pons worked for a few months as a trainee engineer at a Jamaican company in Kingston, while reading a degree in Industrial Engineering Management at the Polytechnic University of Valencia (UPV) . He also gained some work experience as a community officer at NGO Engineering Without Borders (EWB) in 2011. After his graduation in 2014, he decided to become an entrepreneur and co-founded Tuvalum, a web marketplace to buy and sell used bikes and accessories. He is currently the company’s CEO.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

TaniHub Group's farm-to-table marketplace and agri-crowdfunding offers a two-pronged approach to help farmers to increase earnings and grow their business.

TaniHub Group's farm-to-table marketplace and agri-crowdfunding offers a two-pronged approach to help farmers to increase earnings and grow their business.

Shenma, which uses new data sources to check rural borrowers’ credit, has made more than 10 billion loans to vehicle dealers and customers.

Shenma, which uses new data sources to check rural borrowers’ credit, has made more than 10 billion loans to vehicle dealers and customers.

Eragano is gearing up to become a one-stop mobile platform that provides end-to-end farming and financing solutions to Indonesia’s 37 million smallholder farmers.

Eragano is gearing up to become a one-stop mobile platform that provides end-to-end farming and financing solutions to Indonesia’s 37 million smallholder farmers.

Duozhuayu is an online platform that collects, refurbishes and sells second-hand books. It aims to be a large-scale recycled product platform for educated Chinese youth.

Duozhuayu is an online platform that collects, refurbishes and sells second-hand books. It aims to be a large-scale recycled product platform for educated Chinese youth.

The first cryptocurrency project to be backed by a central bank, Coinffeine disrupted bitcoin exchanges with its decentralized P2P model.

The first cryptocurrency project to be backed by a central bank, Coinffeine disrupted bitcoin exchanges with its decentralized P2P model.

- 1

- 2

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

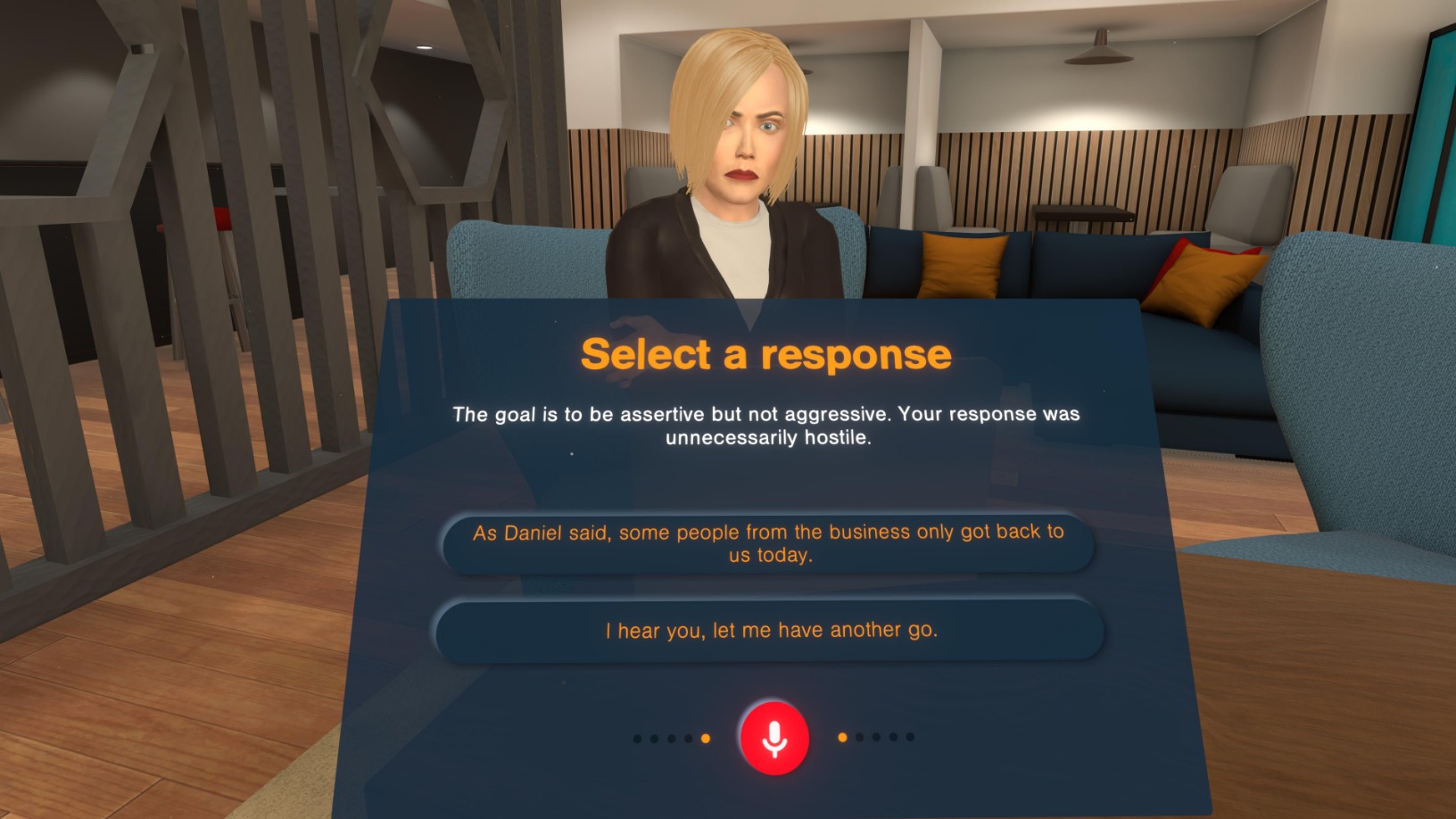

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Modern China Tea Shop: Cool hangout for yuppies in Chairman Mao's Hunan

The tea house in Changsha, the provincial capital of Hunan, is creating a storm in a teacup, serving tea lattes that go viral across China

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

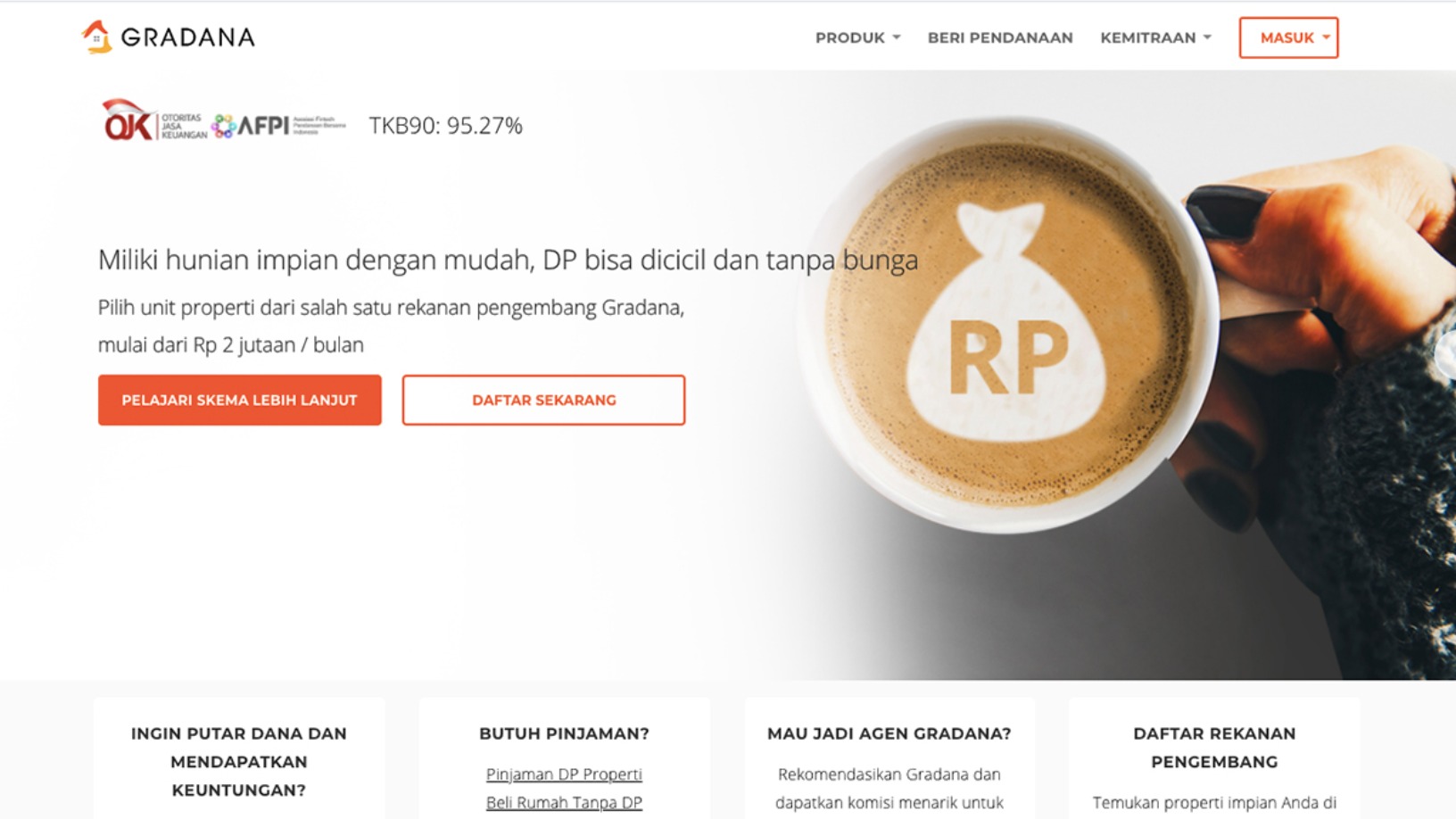

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

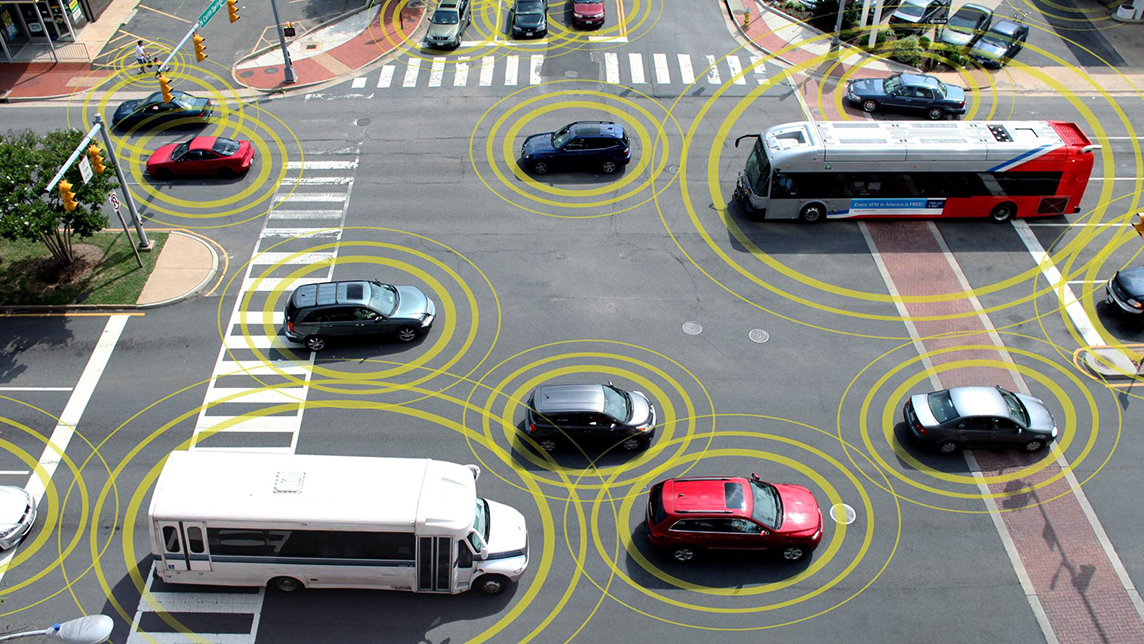

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

Spotahome CTO: Room for more real estate disruption, beyond rentals

Bryan McEire, CTO and co-founder of the Spanish proptech startup, details their expansion plans this year and more, in a wide-ranging interview

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Du'Anyam: Empowering rural women to work independently and learn financial planning skills

Du’Anyam had to cancel bulk orders to survive the Covid-19 downturn, pivoting to B2C online sales, until the tourism and hospitality sectors recover

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

Sorry, we couldn’t find any matches for“Buy Yourself”.