CDH Investments

-

DATABASE (431)

-

ARTICLES (161)

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2010, People.cn Co., Ltd., publishes online news in China and abroad. Its information exchange platform People.cn is the online portal of the People's Daily, the Chinese Communist Party’s official newspaper. It was listed on China's A-share market in 2012. The company makes investments in early-stage media startups.

Founded in 2010, People.cn Co., Ltd., publishes online news in China and abroad. Its information exchange platform People.cn is the online portal of the People's Daily, the Chinese Communist Party’s official newspaper. It was listed on China's A-share market in 2012. The company makes investments in early-stage media startups.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

Agentes y Asesores Financieros

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

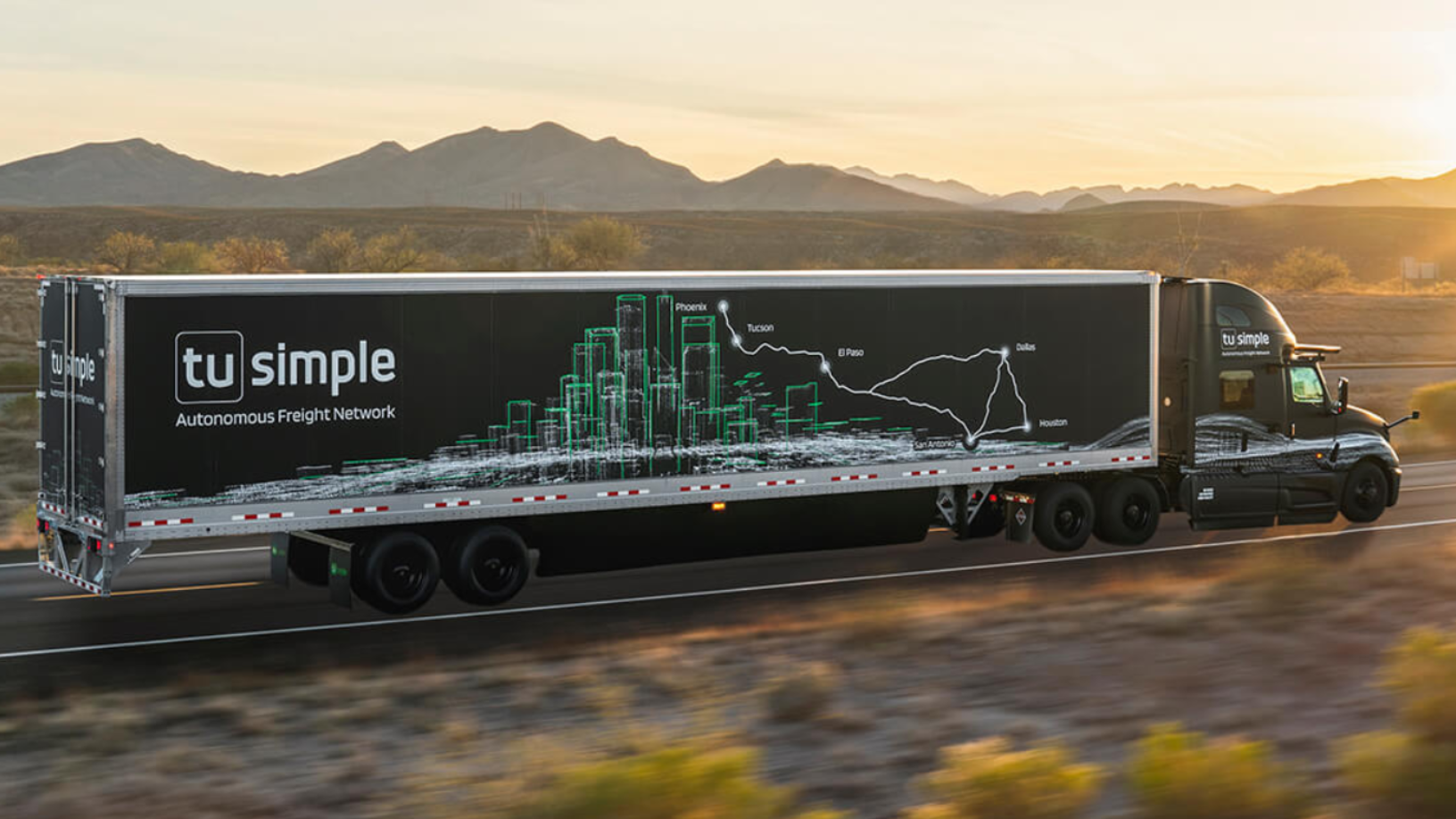

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

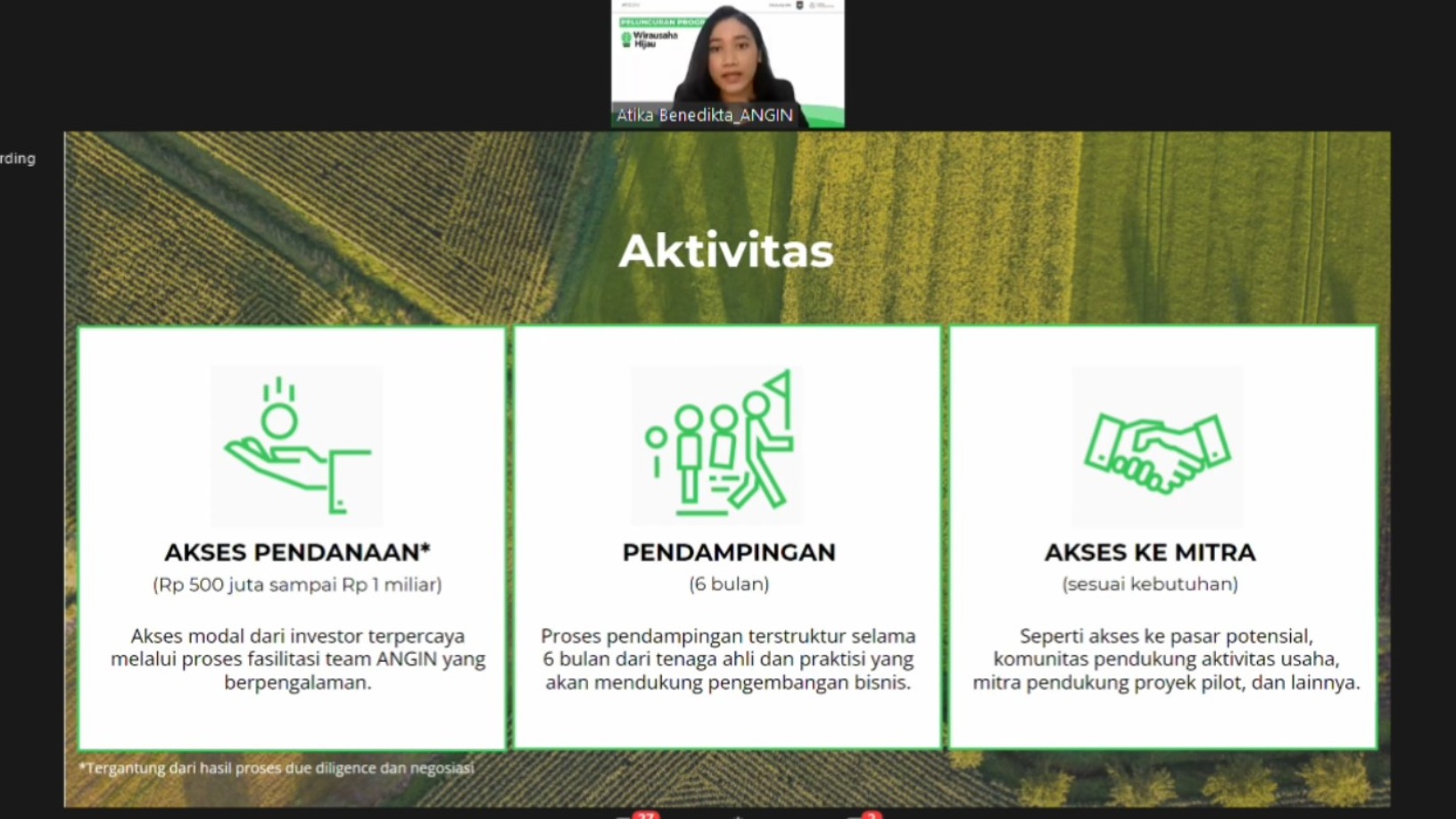

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Beyond billion dollar investment rounds, Indonesia and Singapore are working together to harness the potential of their startup ecosystems

Sorry, we couldn’t find any matches for“CDH Investments”.