CDH Investments

-

DATABASE (431)

-

ARTICLES (161)

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

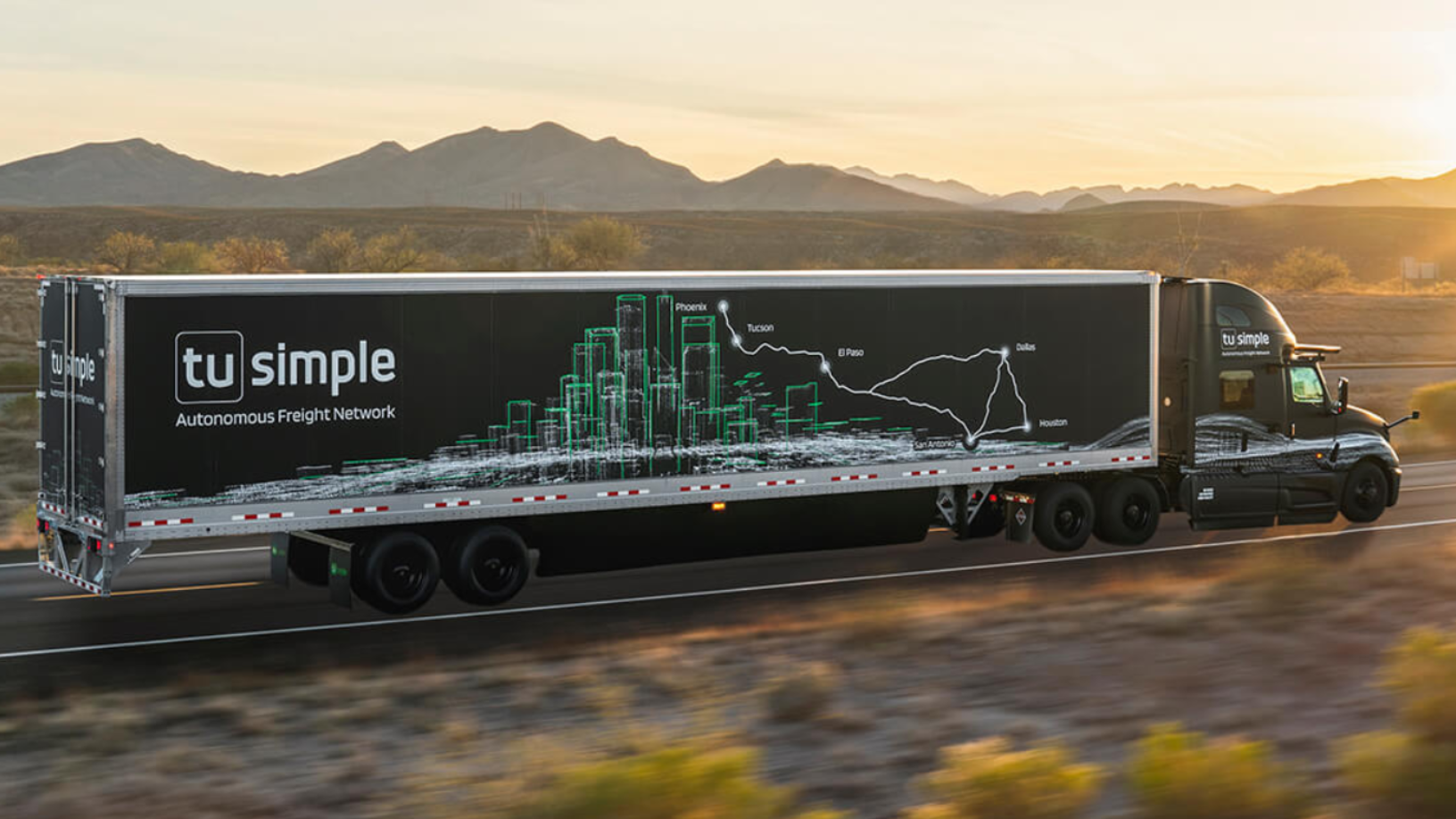

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Beyond billion dollar investment rounds, Indonesia and Singapore are working together to harness the potential of their startup ecosystems

Sorry, we couldn’t find any matches for“CDH Investments”.