CDH Investments

-

DATABASE (431)

-

ARTICLES (161)

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Headquartered in Hong Kong, Summer Capital was founded by senior UBS banker Joseph Chee in 2015. Focused on both public and private investments, it mainly invests in sectors of healthcare, consumer products, education, logistics and fintech.

Headquartered in Hong Kong, Summer Capital was founded by senior UBS banker Joseph Chee in 2015. Focused on both public and private investments, it mainly invests in sectors of healthcare, consumer products, education, logistics and fintech.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

SIG’s China venture capital and private equity activities are operated through SIG Asia Investments. SIG invests in companies at various stages of development, from early stage to later stage companies, with focus on consumer, service, healthcare and digital media/internet sectors.

SIG’s China venture capital and private equity activities are operated through SIG Asia Investments. SIG invests in companies at various stages of development, from early stage to later stage companies, with focus on consumer, service, healthcare and digital media/internet sectors.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

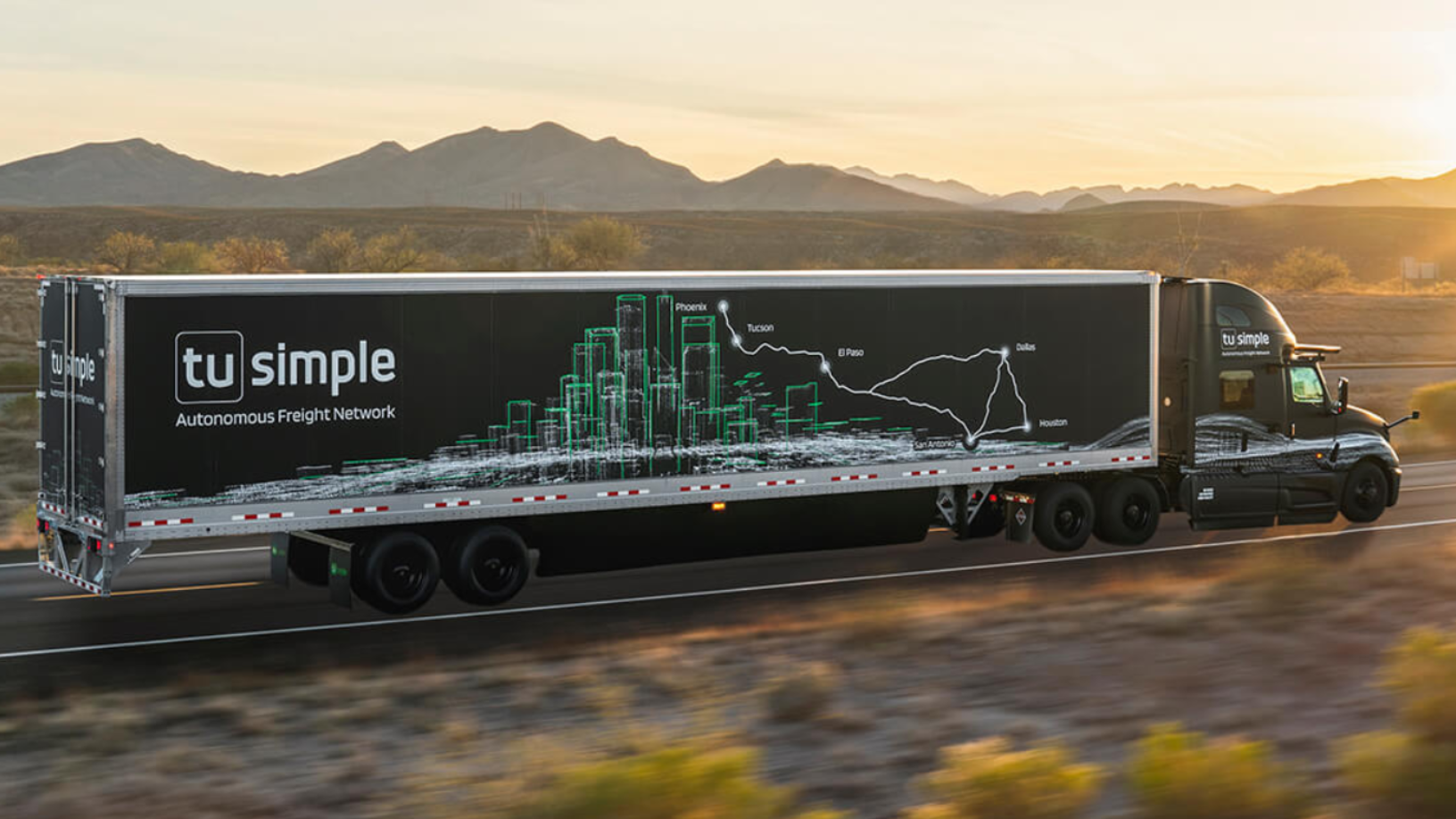

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Beyond billion dollar investment rounds, Indonesia and Singapore are working together to harness the potential of their startup ecosystems

Sorry, we couldn’t find any matches for“CDH Investments”.