CDH Investments

-

DATABASE (431)

-

ARTICLES (161)

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

YI Capital was founded in 2014 by Chen Wenjiang and Li Muqing, both formerly of CDH Investments. YI Capital’s investment focuses are housing, finance, automotive, express delivery, e-commerce and lifestyle. It manages around RMB 2.5 billion in capital.

YI Capital was founded in 2014 by Chen Wenjiang and Li Muqing, both formerly of CDH Investments. YI Capital’s investment focuses are housing, finance, automotive, express delivery, e-commerce and lifestyle. It manages around RMB 2.5 billion in capital.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Enlightened Hospitality Investments (EHI)

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Portofolio: Showing rookie investors the ropes without the rip-offs

Through investment education and the guidance of master traders, Portofolio aims to show aspiring forex and derivatives traders and investors how to avoid scams and stabilize their returns

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

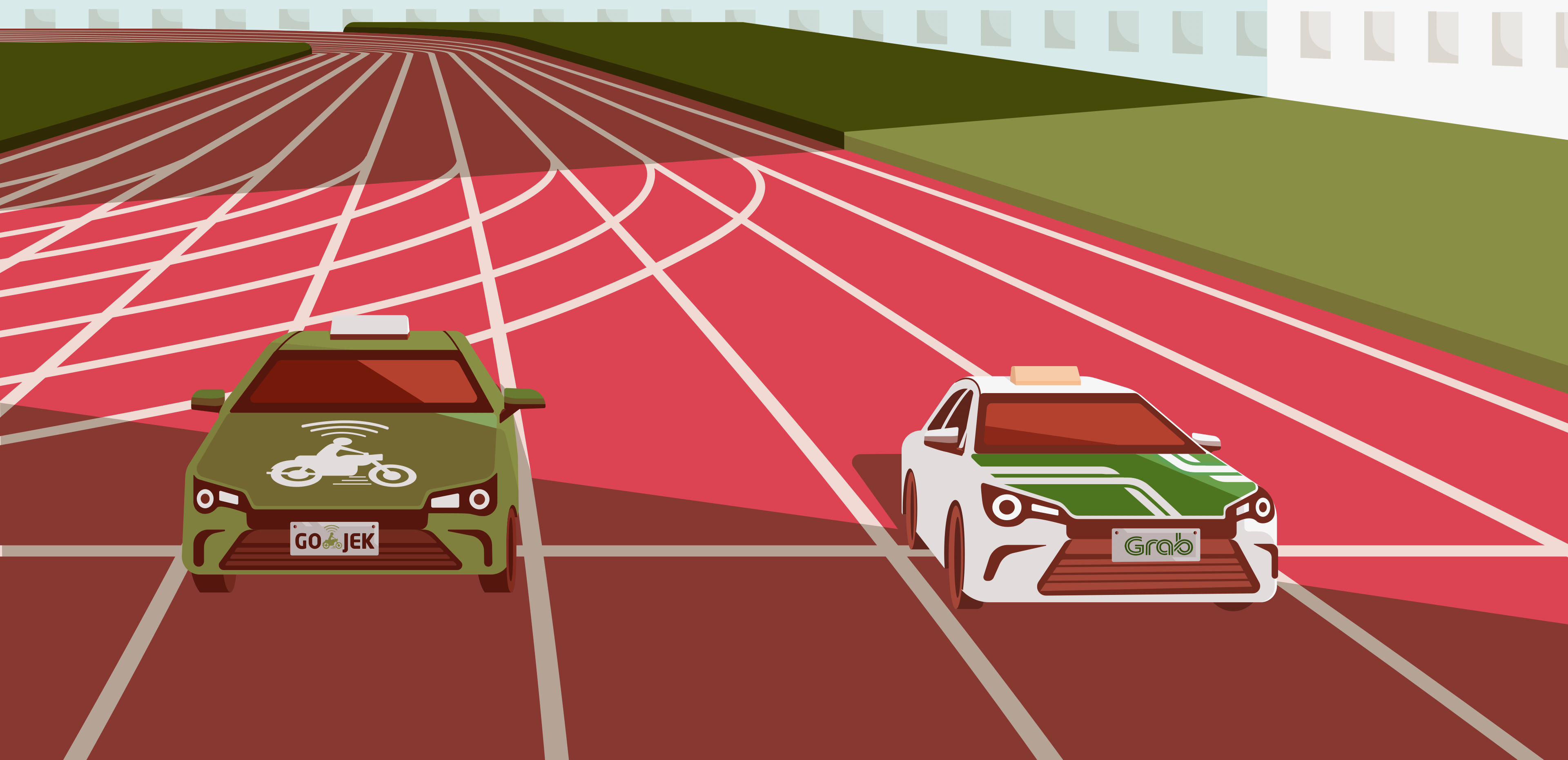

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Sorry, we couldn’t find any matches for“CDH Investments”.