CO2 emissions

DATABASE (29)

ARTICLES (94)

Delivery service Koiki is a social enterprise that offers employment opportunities for vulnerable people while reducing the carbon impact of last-mile deliveries.

Delivery service Koiki is a social enterprise that offers employment opportunities for vulnerable people while reducing the carbon impact of last-mile deliveries.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Founder, CEO of CO2 Revolution

Juan Carlos Sesma Fraguas (b. 1983) is Founder and CEO of CO2 Revolution, based in Melida, near Tudela, Navarre, Spain. He established the company in May 2018, after two years spent developing intelligent seeds, known as 'Iseeds', that he also patented. Before setting up CO2 Revolution, he worked in logistics and management at Aldi, El Corte Inglés and the International Meal Company. He previously completed an MBA at the European Forum School of Business of Navarre.

Juan Carlos Sesma Fraguas (b. 1983) is Founder and CEO of CO2 Revolution, based in Melida, near Tudela, Navarre, Spain. He established the company in May 2018, after two years spent developing intelligent seeds, known as 'Iseeds', that he also patented. Before setting up CO2 Revolution, he worked in logistics and management at Aldi, El Corte Inglés and the International Meal Company. He previously completed an MBA at the European Forum School of Business of Navarre.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

- 1

- 2

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

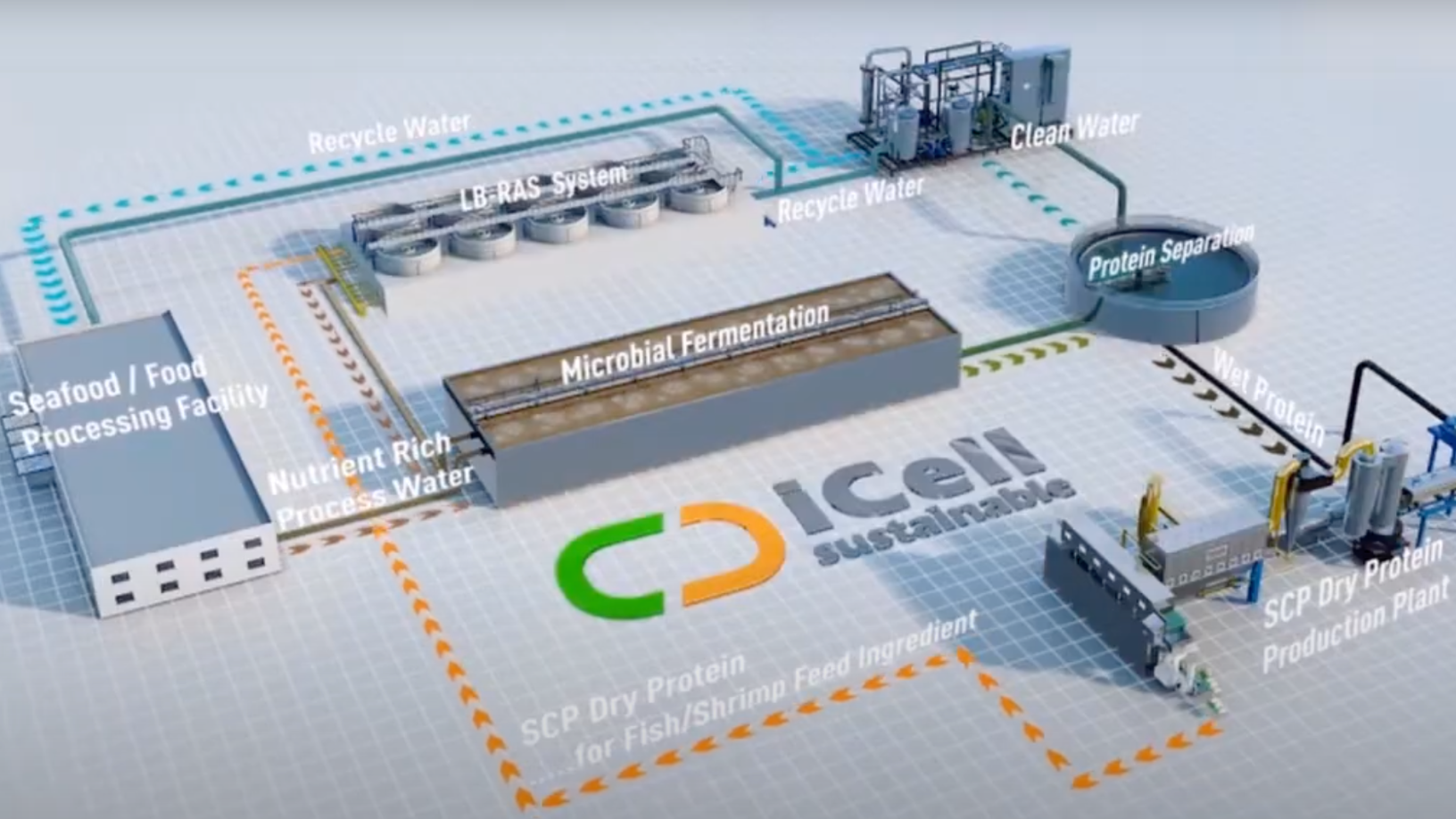

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

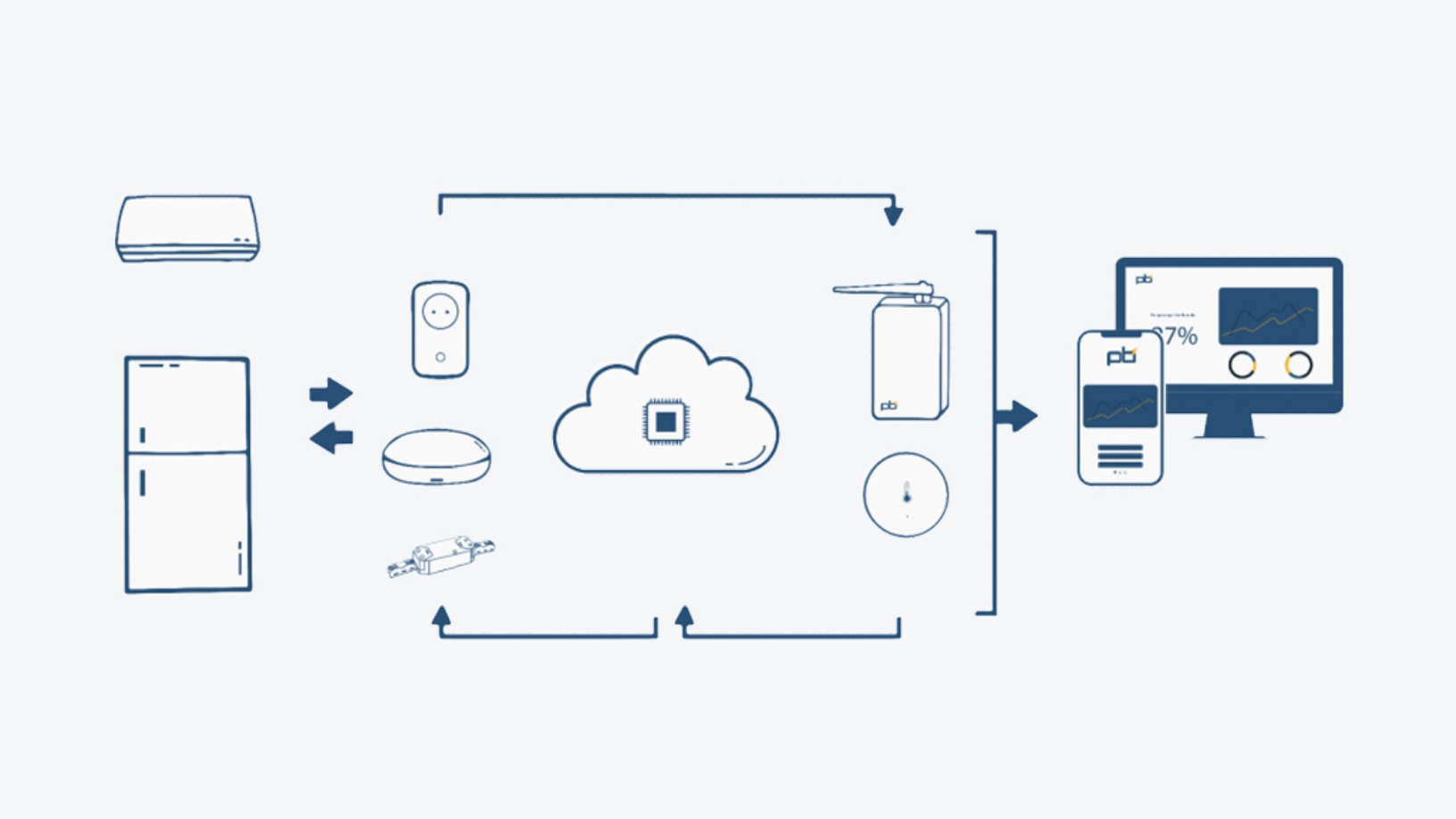

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Mi Terro turns milk waste into eco-friendly clothing and packaging

With food giants like Danone, Arla and Dole as partners, US-Sino startup Mi Terro plans to extend its technology to plant-based food waste like soy to get plastic and fiber alternatives

Sorry, we couldn’t find any matches for“CO2 emissions”.