CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Supported by major insurers and backed by Indonesia’s largest unicorns, PasarPolis targets the underserved market for affordable personal insurance coverage.

Supported by major insurers and backed by Indonesia’s largest unicorns, PasarPolis targets the underserved market for affordable personal insurance coverage.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Fresh Capital is an equity fund that invests in consumption upgrade. It was founded by Steven Hu, former partner of Cathay Capital, and Xiao xiao who used to work as Vice President at Cathay Capital.

Fresh Capital is an equity fund that invests in consumption upgrade. It was founded by Steven Hu, former partner of Cathay Capital, and Xiao xiao who used to work as Vice President at Cathay Capital.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

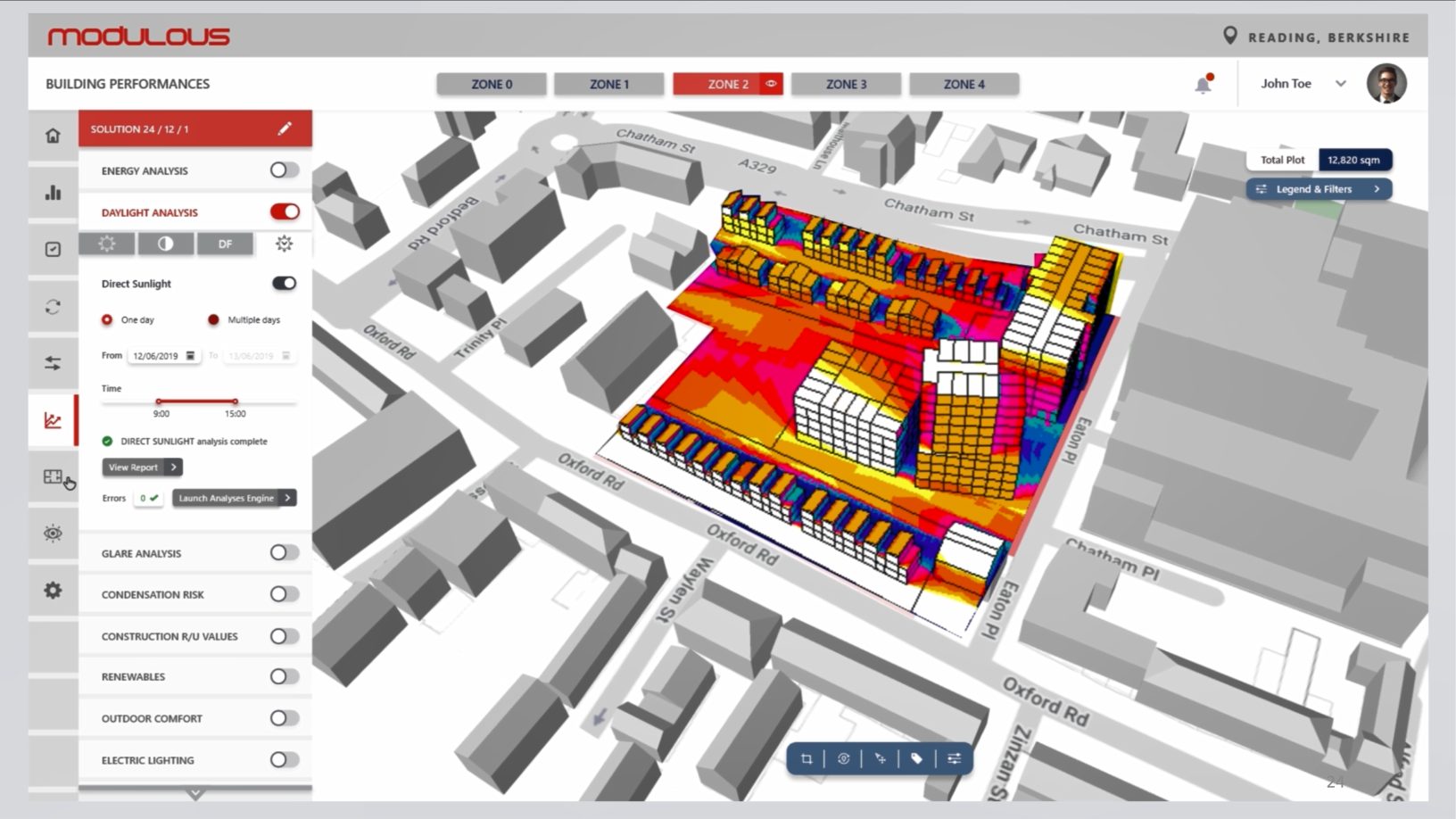

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.