CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Onroad Capital was founded in 2015 and is headquartered in Shenzhen. It invests in TMT and focuses on cloud computing, big data, IoT, artificial intelligence, SaaS and consumption.

Onroad Capital was founded in 2015 and is headquartered in Shenzhen. It invests in TMT and focuses on cloud computing, big data, IoT, artificial intelligence, SaaS and consumption.

Headquartered in Hangzhou, Yiqichuang Capital was established in 2015. It invests mainly in the TMT, consumer goods and healthcare sectors.

Headquartered in Hangzhou, Yiqichuang Capital was established in 2015. It invests mainly in the TMT, consumer goods and healthcare sectors.

Tongdaoo Capital was founded in October 2014, with headquarters in Kunshan, Jiangsu Province. The VC specializes in private equity funds.

Tongdaoo Capital was founded in October 2014, with headquarters in Kunshan, Jiangsu Province. The VC specializes in private equity funds.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

Founded in 2013, Qiao Jing Capital is an investment management firm focuses on healthcare, consumer health, and supply-chain finance industry. The co-founder, Jin Dan, is the former executive director at Cube Capital.

Founded in 2013, Qiao Jing Capital is an investment management firm focuses on healthcare, consumer health, and supply-chain finance industry. The co-founder, Jin Dan, is the former executive director at Cube Capital.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

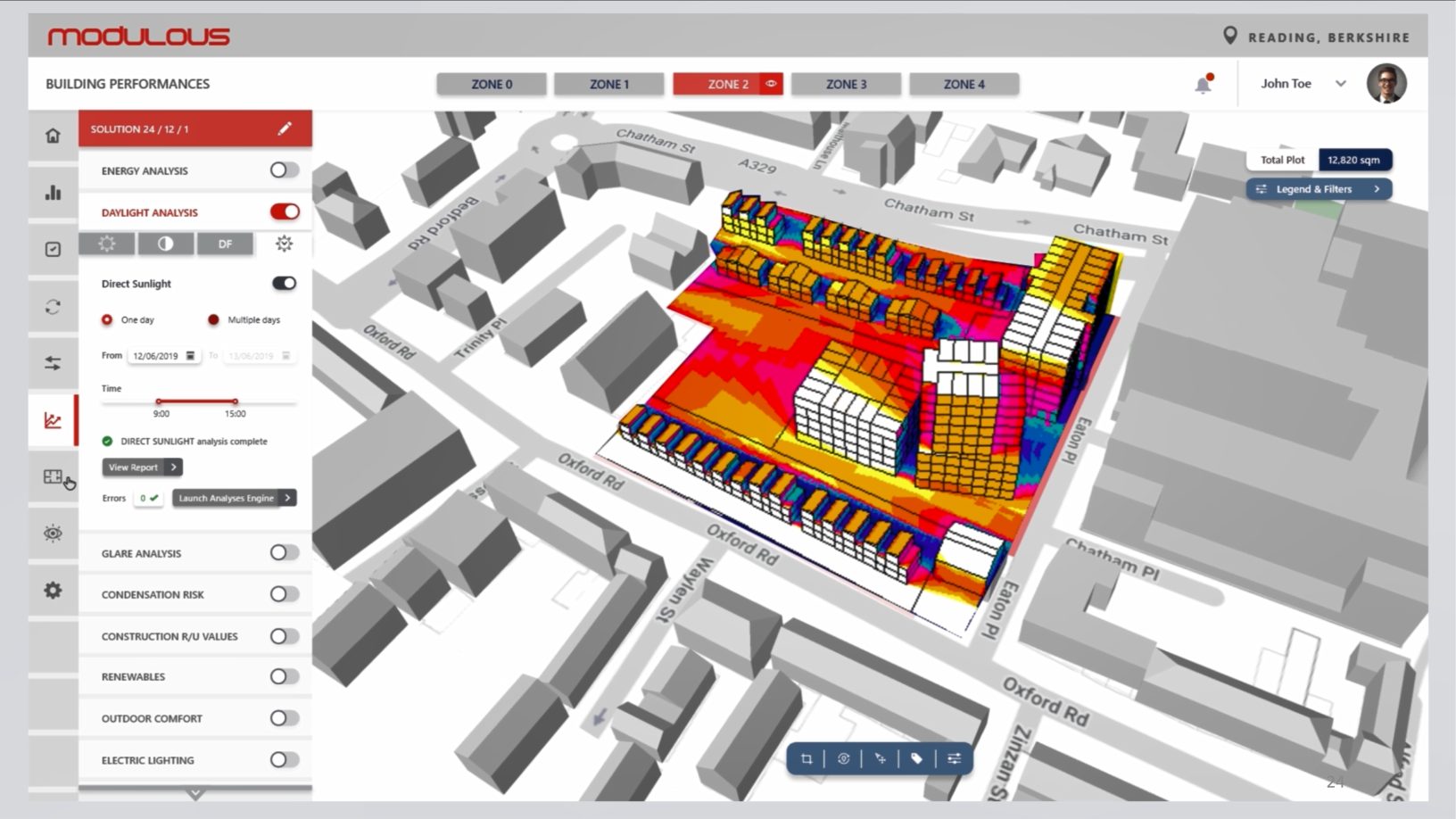

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.