CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Evolution Media China (EMC) was founded in Beijing by Evolution Media Partners, the investment arm of American talent and sports agency Creative Artists Agency and Evolution Media Capital, in early 2016. EMC currently manages a total of US$350 million in assets. The firm invests primary in startups with potential from the Asia-Pacific region, with a focus on China, in sectors such as media, entertainment, sports, advertising and lifestyle.

Evolution Media China (EMC) was founded in Beijing by Evolution Media Partners, the investment arm of American talent and sports agency Creative Artists Agency and Evolution Media Capital, in early 2016. EMC currently manages a total of US$350 million in assets. The firm invests primary in startups with potential from the Asia-Pacific region, with a focus on China, in sectors such as media, entertainment, sports, advertising and lifestyle.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Zhangjiang Torch Venture Capital

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Beijing Zhis-mags Capital was founded in 2014 by Zhisland and Mags Capital. It focuses on the transformation of traditional industries into internet-ready models.

Beijing Zhis-mags Capital was founded in 2014 by Zhisland and Mags Capital. It focuses on the transformation of traditional industries into internet-ready models.

Co-founder of Waterdrop and general manager of Shuidi Chou of Waterdrop (Shuidi)

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Orient Hontai Capital is a subsidiary of Shanghai Orient Securities Capital. HQ is in Beijing.Founded in 2014, it has invested in many companies both in and outside China and mainly focuses on TMT and healthcare areas. Cases closed includes: 1. Invest Shanda games, $430MM, 23% shares, Sep. 2014;2. Acquire CMGE and delist it from Nasdaq, $365MM, 48% shares, July 2015;3. Acquire FunPlus game business, $288MM, 32% shares, Sep. 2015;

Orient Hontai Capital is a subsidiary of Shanghai Orient Securities Capital. HQ is in Beijing.Founded in 2014, it has invested in many companies both in and outside China and mainly focuses on TMT and healthcare areas. Cases closed includes: 1. Invest Shanda games, $430MM, 23% shares, Sep. 2014;2. Acquire CMGE and delist it from Nasdaq, $365MM, 48% shares, July 2015;3. Acquire FunPlus game business, $288MM, 32% shares, Sep. 2015;

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

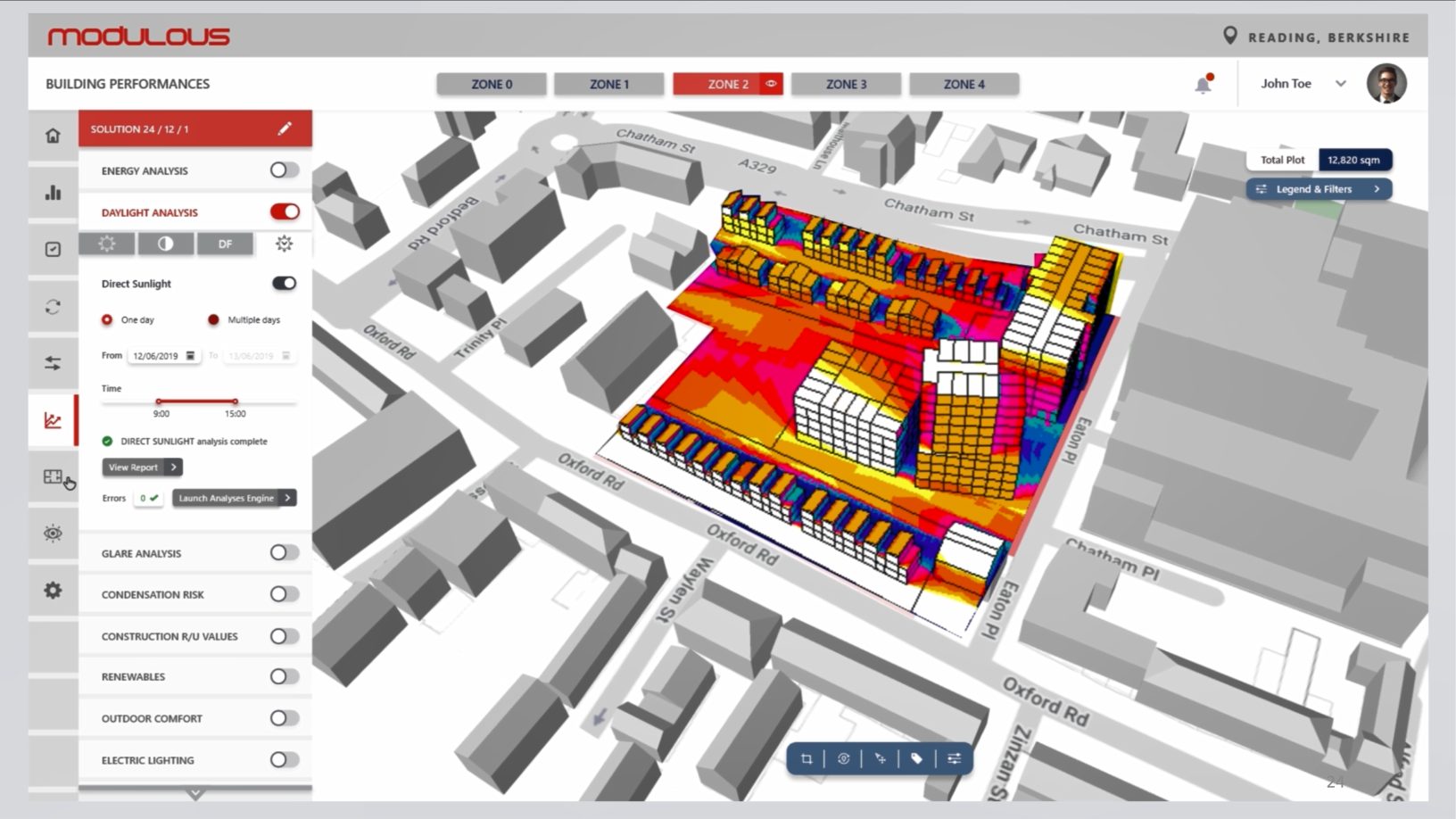

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.