CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Wu Yongming, a co-founder of Alibaba, and Wang Qi in 2015. With nearly RMB 2 billion under management, Vision Plus Capital invests in startups mainly in their Series A and Series B financing rounds.

Founded by Wu Yongming, a co-founder of Alibaba, and Wang Qi in 2015. With nearly RMB 2 billion under management, Vision Plus Capital invests in startups mainly in their Series A and Series B financing rounds.

Woodford Patient Capital Trust

The Woodford Patient Capital Trust is part of the larger group Woodford Funds. The company is based in Oxford and was formed in 2014, headed by veteran fund manager Neil Woodford. The Patient Capital Trust focuses on early- and early-growth-stage companies, with target returns of more than 10% yearly. The bulk of their portfolio comprises healthcare companies.

The Woodford Patient Capital Trust is part of the larger group Woodford Funds. The company is based in Oxford and was formed in 2014, headed by veteran fund manager Neil Woodford. The Patient Capital Trust focuses on early- and early-growth-stage companies, with target returns of more than 10% yearly. The bulk of their portfolio comprises healthcare companies.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

PowerCloud Venture Capital was founded in 2014 by UAV manufacturer PowerVision Group, Innovation Angel Funds and Beijing Jiaxun Feihong Electrical Co., Ltd. It invests mainly in early-stage startups in the robotics, drone, artificial intelligence and big data sectors.

PowerCloud Venture Capital was founded in 2014 by UAV manufacturer PowerVision Group, Innovation Angel Funds and Beijing Jiaxun Feihong Electrical Co., Ltd. It invests mainly in early-stage startups in the robotics, drone, artificial intelligence and big data sectors.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

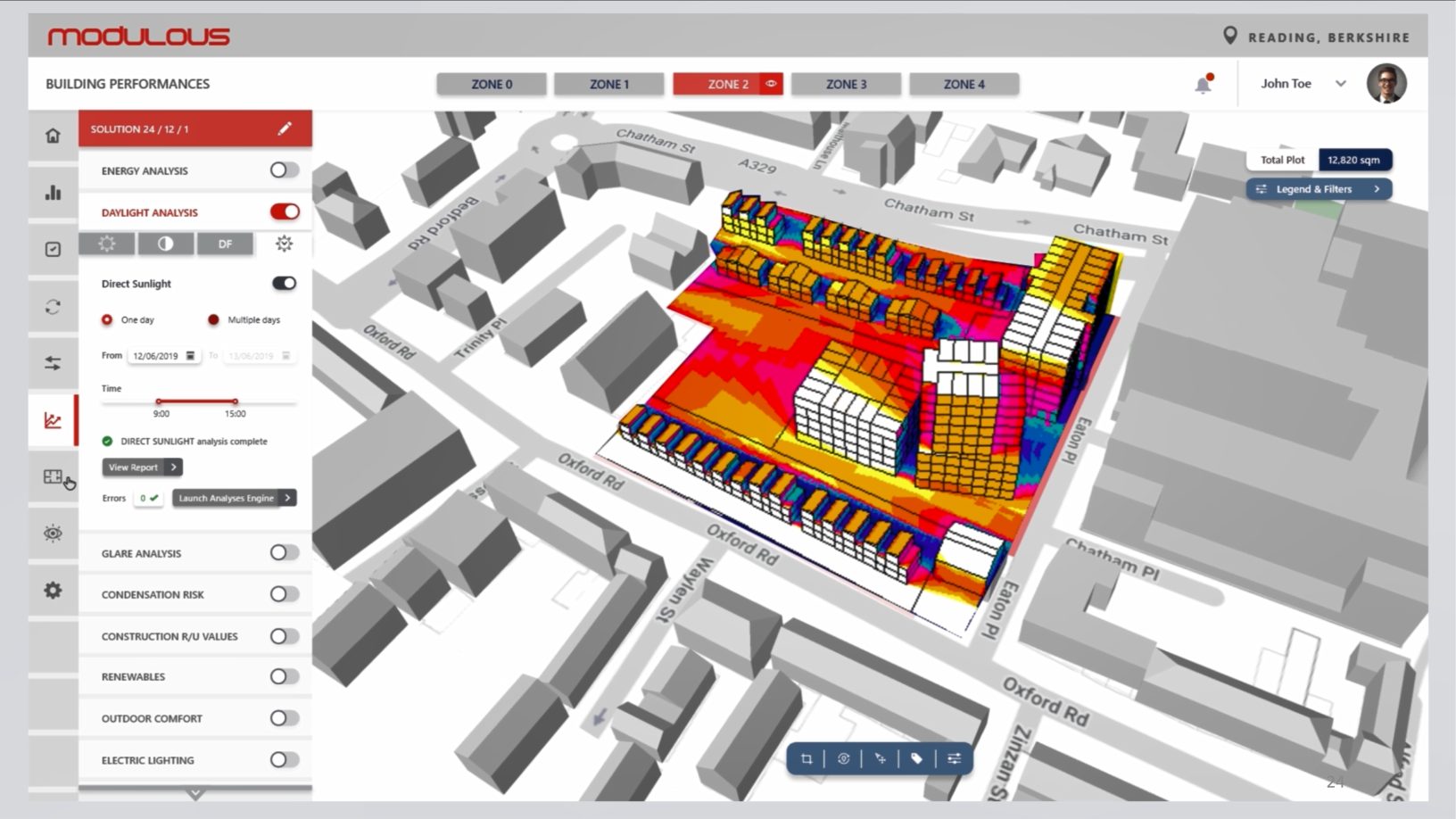

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.