CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Guangkong Zhongying Capital was founded in August 2016 by China Everbright, a state-owned enterprise that engages mainly in banking, securities, insurance and investment management, and Focus Media, the operator of the largest out-of-home advertising network in China. It invests mainly in the sectors of consumption upgrade, recreation, corporate services, fintech and artificial intelligence.

Guangkong Zhongying Capital was founded in August 2016 by China Everbright, a state-owned enterprise that engages mainly in banking, securities, insurance and investment management, and Focus Media, the operator of the largest out-of-home advertising network in China. It invests mainly in the sectors of consumption upgrade, recreation, corporate services, fintech and artificial intelligence.

Light-Up Capital (Dianliang Fund)

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM)

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

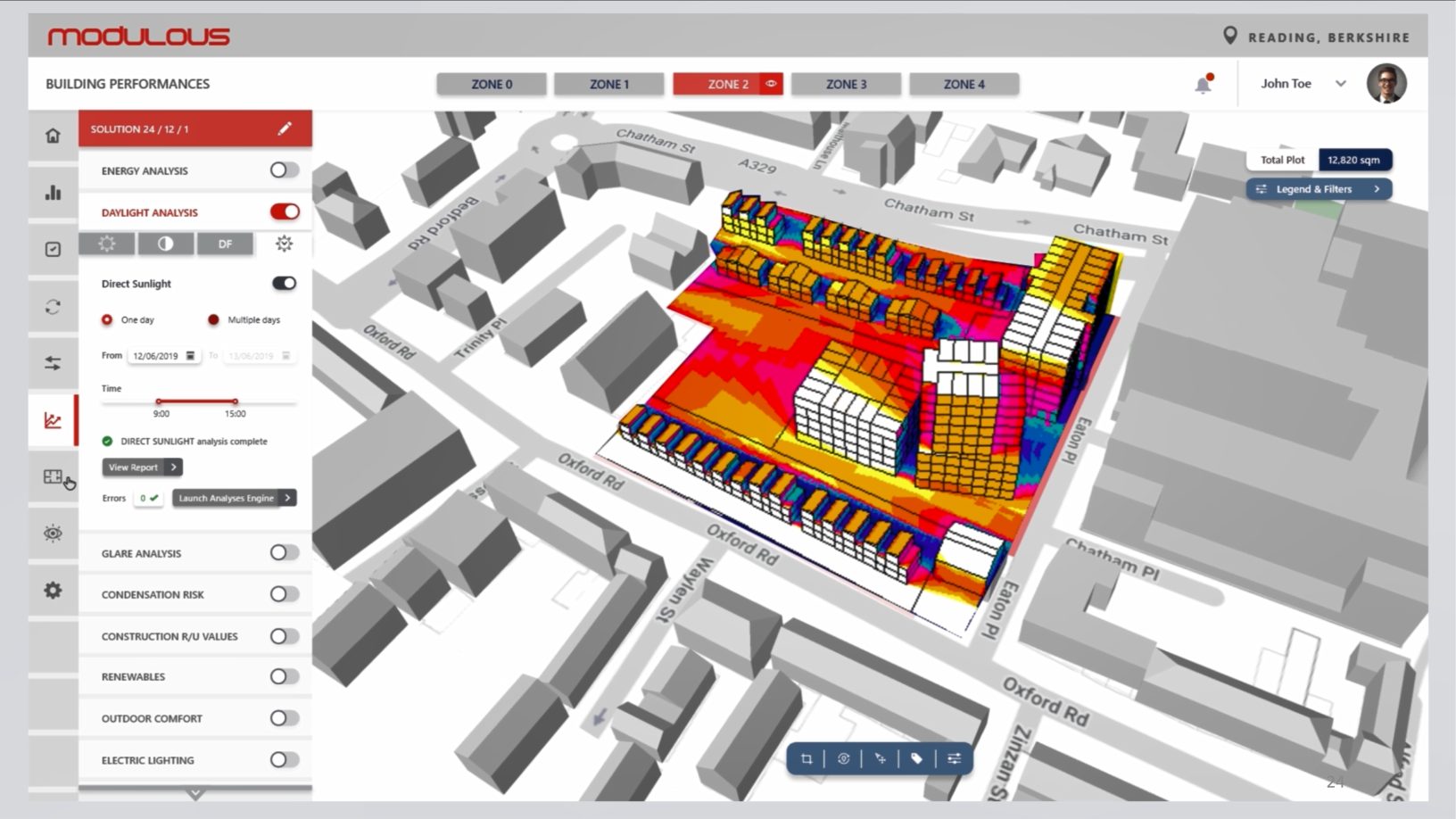

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.