CVC Capital Partners

-

DATABASE (829)

-

ARTICLES (525)

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

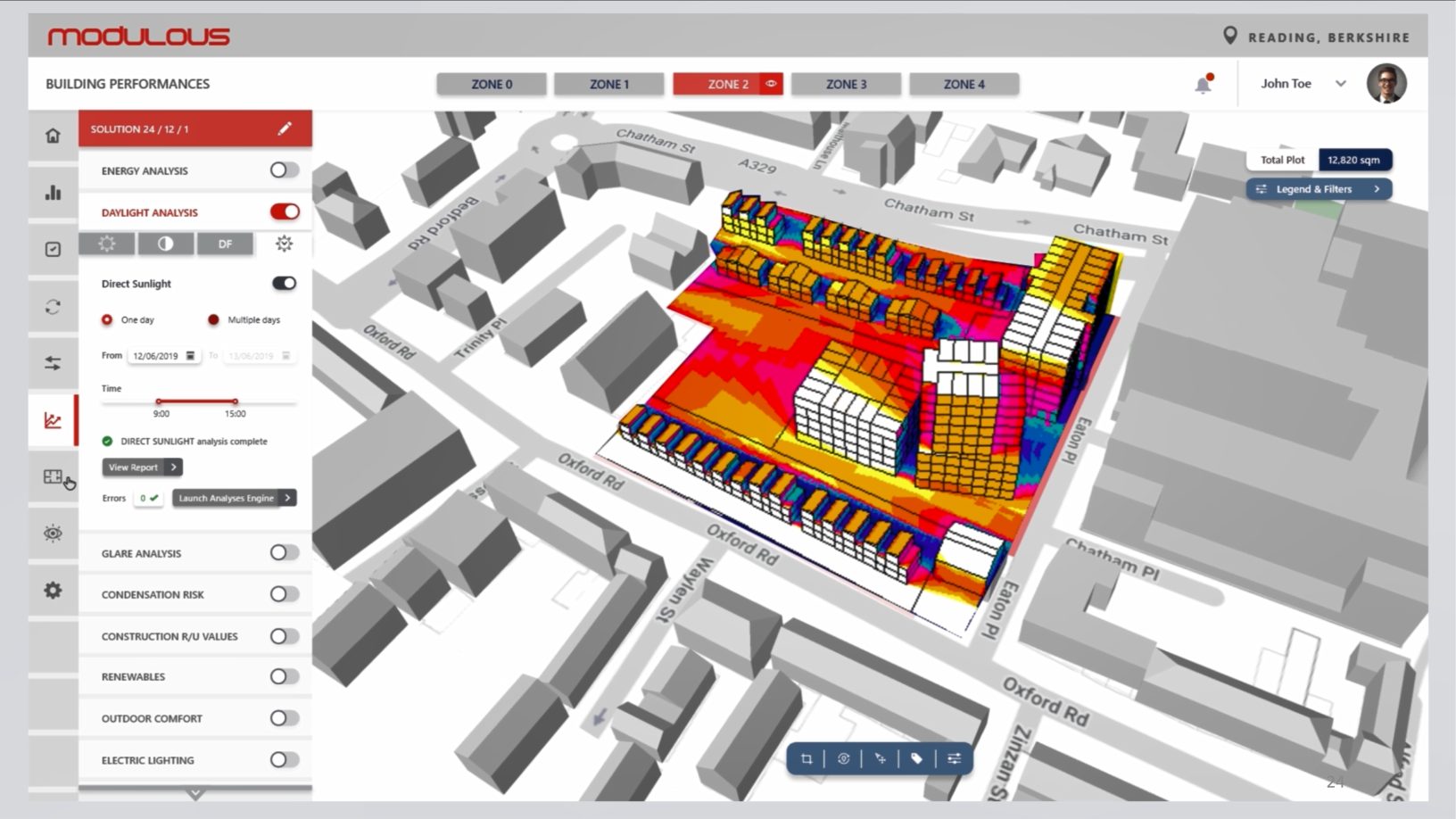

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“CVC Capital Partners”.