Caixa Capital

-

DATABASE (701)

-

ARTICLES (371)

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Zhangjiang Torch Venture Capital

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Beijing Zhis-mags Capital was founded in 2014 by Zhisland and Mags Capital. It focuses on the transformation of traditional industries into internet-ready models.

Beijing Zhis-mags Capital was founded in 2014 by Zhisland and Mags Capital. It focuses on the transformation of traditional industries into internet-ready models.

Co-founder of Waterdrop and general manager of Shuidi Chou of Waterdrop (Shuidi)

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Orient Hontai Capital is a subsidiary of Shanghai Orient Securities Capital. HQ is in Beijing.Founded in 2014, it has invested in many companies both in and outside China and mainly focuses on TMT and healthcare areas. Cases closed includes: 1. Invest Shanda games, $430MM, 23% shares, Sep. 2014;2. Acquire CMGE and delist it from Nasdaq, $365MM, 48% shares, July 2015;3. Acquire FunPlus game business, $288MM, 32% shares, Sep. 2015;

Orient Hontai Capital is a subsidiary of Shanghai Orient Securities Capital. HQ is in Beijing.Founded in 2014, it has invested in many companies both in and outside China and mainly focuses on TMT and healthcare areas. Cases closed includes: 1. Invest Shanda games, $430MM, 23% shares, Sep. 2014;2. Acquire CMGE and delist it from Nasdaq, $365MM, 48% shares, July 2015;3. Acquire FunPlus game business, $288MM, 32% shares, Sep. 2015;

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Welight Capital was founded by former senior executive at Tencent Wu Xiaoguang in 2015. The firm invests mainly in early-stage startups in the sectors of IoT, corporate services, finance, education, consumption upgrade, retail and e-commerce.

Welight Capital was founded by former senior executive at Tencent Wu Xiaoguang in 2015. The firm invests mainly in early-stage startups in the sectors of IoT, corporate services, finance, education, consumption upgrade, retail and e-commerce.

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

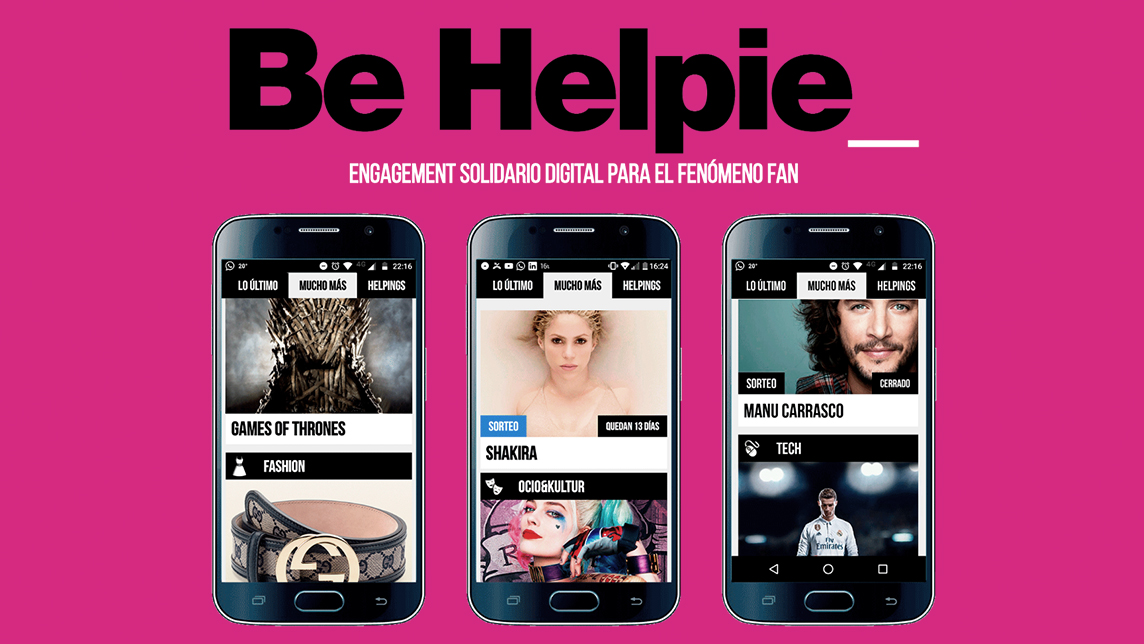

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Caixa Capital”.