Caixa Capital

-

DATABASE (701)

-

ARTICLES (371)

Co-founder and Solutions Architect of Plant on Demand

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

IRDI Capital Investissement supports innovative startups and local SMEs in southwest France, with offices in Bordeaux, Toulouse, and Montpellier. Over its 40-year history, the company has invested some €800m in more than 1,400 companies.

IRDI Capital Investissement supports innovative startups and local SMEs in southwest France, with offices in Bordeaux, Toulouse, and Montpellier. Over its 40-year history, the company has invested some €800m in more than 1,400 companies.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

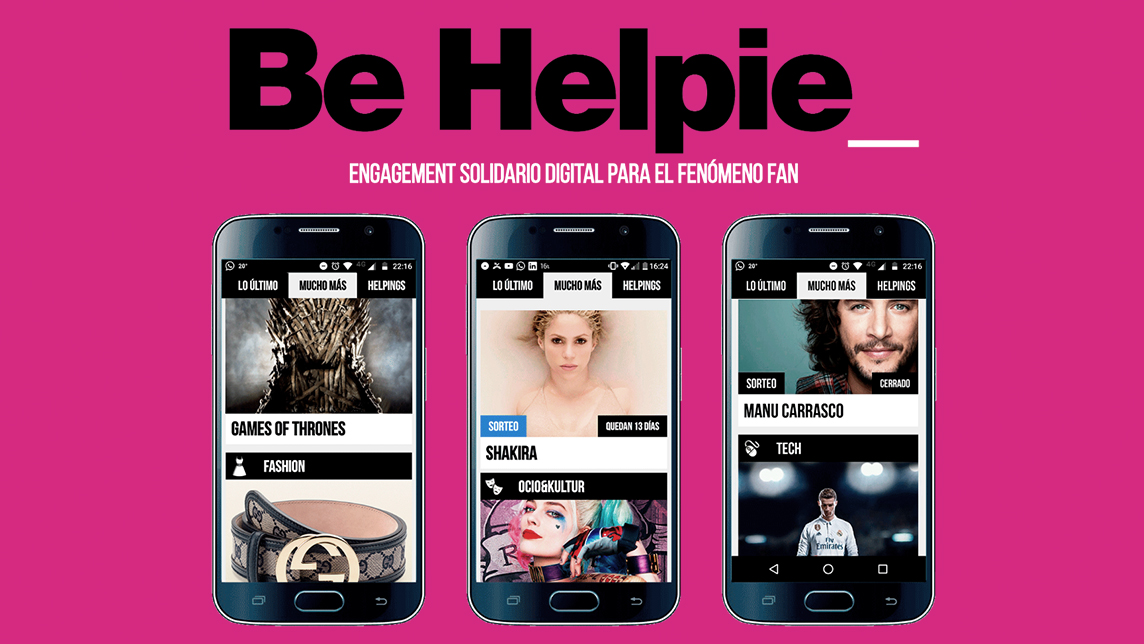

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Caixa Capital”.