Caixa Capital Risc

-

DATABASE (701)

-

ARTICLES (371)

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

Established in July 2009, GP Capital was co-funded by Shanghai International Group, Jiangsu Shagang Group, Huatai Securities and Hengdian Group. It specializes in establishing and managing industrial investment funds and private equity funds. GP Capital manages the RMB 20 billion Shanghai Financial Development Investment Fund. The Fund was sponsored by the Shanghai Municipal People’s Government with approval from the State Council and National Development and Reform Commission. Half of GP Capital's investment has gone to financial firms. It also invests in sectors such as consumer products, healthcare, new energy, culture, etc.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Baiyang Capital was founded in 2014 by BAHEAL Pharmaceutical Holdings Limited and several senior professionals in the pharmaceutical and healthcare fields. The investment management company operates multiple funds, targeting pharmaceutical and healthcare businesses.

Baiyang Capital was founded in 2014 by BAHEAL Pharmaceutical Holdings Limited and several senior professionals in the pharmaceutical and healthcare fields. The investment management company operates multiple funds, targeting pharmaceutical and healthcare businesses.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

Co-founder and CPO of Billin

As the co-founder and CPO of Billin, Diego Goya Quijano is responsible for the IT team, business and funding strategies. After graduating in Business Administration at CUNEF in 2010, he studied English for a year in California, USA. His first entrepreneurial venture was in 2009 when he co-founded Deyese Soluciones (D+S), a company specializing in cost optimization. He then worked at Smartgroup Telecomunicaciones for almost two years before co-founding Billin in 2013. He has since attended various courses relating to Venture Capital, M&A and Financing Operations at IEB. He then specialized in web development at Ironhack.

As the co-founder and CPO of Billin, Diego Goya Quijano is responsible for the IT team, business and funding strategies. After graduating in Business Administration at CUNEF in 2010, he studied English for a year in California, USA. His first entrepreneurial venture was in 2009 when he co-founded Deyese Soluciones (D+S), a company specializing in cost optimization. He then worked at Smartgroup Telecomunicaciones for almost two years before co-founding Billin in 2013. He has since attended various courses relating to Venture Capital, M&A and Financing Operations at IEB. He then specialized in web development at Ironhack.

Co-founder of Uniplaces

University of Nottingham graduate Ben Grech holds a bachelor’s degree in Finance. Prior to co-founding Uniplaces in 2011, he was a biotech analyst at KBC Peel Hunt and a business analyst at SRC Oxford. He was also an associate at private equity firm HIG Capital for a year and founded NACUE, the UK’s leading membership organization for engaging students in enterprise. Grech is British and is also the founder of Nottingham Entrepreneurs in 2007 which he also presided over until 2009. He was CEO at Uniplaces until 2018 when he left the post and became Non-Executive Chairman.

University of Nottingham graduate Ben Grech holds a bachelor’s degree in Finance. Prior to co-founding Uniplaces in 2011, he was a biotech analyst at KBC Peel Hunt and a business analyst at SRC Oxford. He was also an associate at private equity firm HIG Capital for a year and founded NACUE, the UK’s leading membership organization for engaging students in enterprise. Grech is British and is also the founder of Nottingham Entrepreneurs in 2007 which he also presided over until 2009. He was CEO at Uniplaces until 2018 when he left the post and became Non-Executive Chairman.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

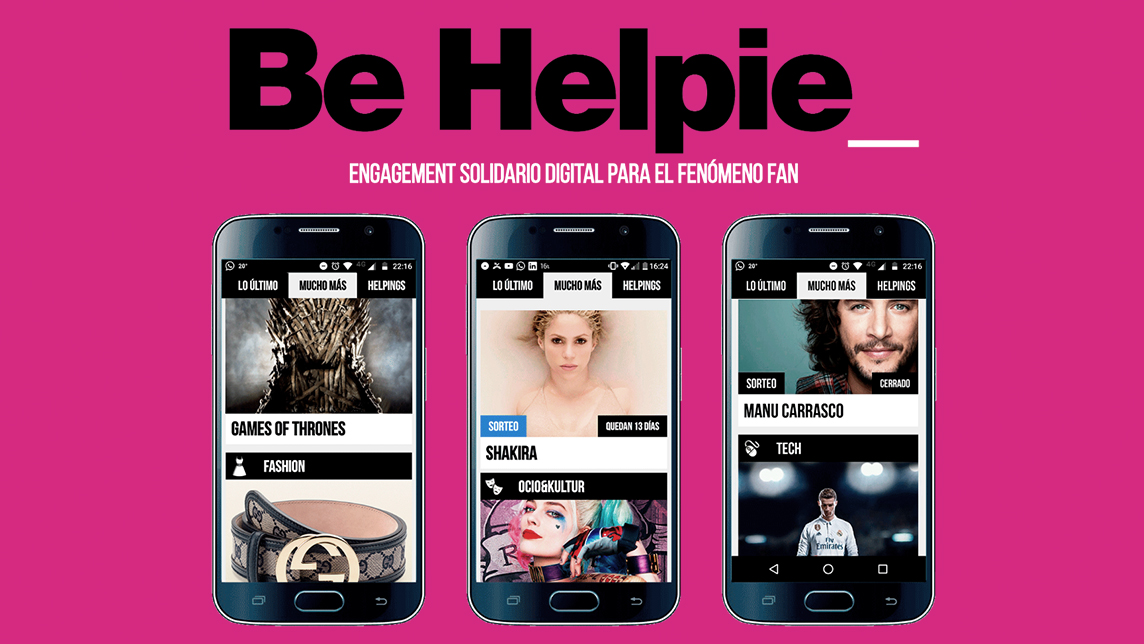

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Caixa Capital Risc”.