Caixa Capital Risc

-

DATABASE (701)

-

ARTICLES (371)

Pearson Affordable Learning Fund

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

Inveready Technology Investment Group was awarded Spain's best asset management firm in by ASCRI, the Spanish Venture Capital & Private Equity Association. It manages €92 million through six different investment vehicles, investing in technology companies through hybrid financial instruments. It has a portfolio that covers over 80 startups from B2B and B2C services to drug discovery and SaaS companies.

Inveready Technology Investment Group was awarded Spain's best asset management firm in by ASCRI, the Spanish Venture Capital & Private Equity Association. It manages €92 million through six different investment vehicles, investing in technology companies through hybrid financial instruments. It has a portfolio that covers over 80 startups from B2B and B2C services to drug discovery and SaaS companies.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Shaanxi Culture Industry Investment Group

With RMB 2.2 billion registered capital, this state-owned cultural enterprise was established by Shaanxi province. It receives subsidies from the regional government each year and currently holds total assets of more than RMB 16 billion. The group has 24 subsidiaries, which invest in a range of cultural industries: film and TV, cultural tourism, art, media, etc.

With RMB 2.2 billion registered capital, this state-owned cultural enterprise was established by Shaanxi province. It receives subsidies from the regional government each year and currently holds total assets of more than RMB 16 billion. The group has 24 subsidiaries, which invest in a range of cultural industries: film and TV, cultural tourism, art, media, etc.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

Gobi Partners is a venture capital firm with seven offices across China, Hong Kong, Singapore and Kuala Lumpur. Since it was founded in 2002, the firm has raised seven funds and has invested in over 100 portfolio companies across China, Hong Kong and Southeast Asia.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Led by Wang Mengqiu, a former technology VP at Baidu, this early stage TMT-focused venture capital fund was founded in 2012; and counts PP Zuche, Blued, Beequick, and 51Credit among its notable investments. Its self-professed investing style is "conservative," with just 10 investments in the year 2015. Preferred market segments in 2016 include children's, men's, fintech, sports and fitness.fintech, sports and fitness.

Led by Wang Mengqiu, a former technology VP at Baidu, this early stage TMT-focused venture capital fund was founded in 2012; and counts PP Zuche, Blued, Beequick, and 51Credit among its notable investments. Its self-professed investing style is "conservative," with just 10 investments in the year 2015. Preferred market segments in 2016 include children's, men's, fintech, sports and fitness.fintech, sports and fitness.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Established in 2011, PE firm Sharelink Capital manages assets of more than RMB 1.5 billion and has invested in nearly 40 enterprises.It focuses on early-stage and mid-stage investments. Its investors include the National Science and Technology Department, large state-owned enterprises, local governments, listed companies, private enterprises and high net worth individuals.

Established in 2011, PE firm Sharelink Capital manages assets of more than RMB 1.5 billion and has invested in nearly 40 enterprises.It focuses on early-stage and mid-stage investments. Its investors include the National Science and Technology Department, large state-owned enterprises, local governments, listed companies, private enterprises and high net worth individuals.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

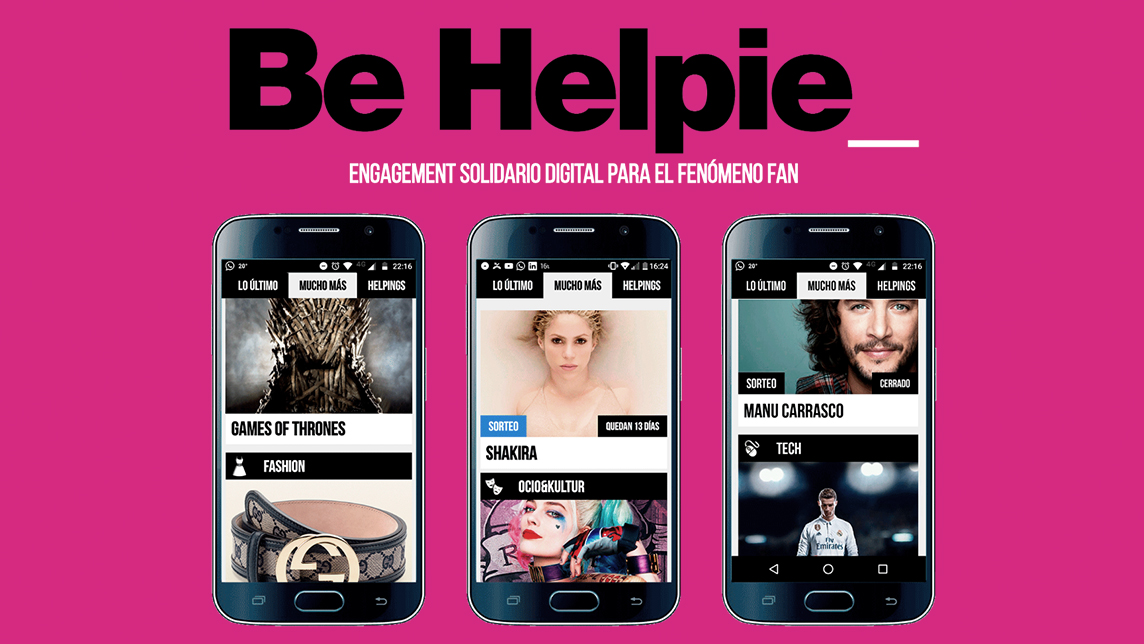

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Caixa Capital Risc”.