Caixa Capital Risc

-

DATABASE (701)

-

ARTICLES (371)

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

PT Eigerindo Multi Produk Industri

Founded in 1979 by Indonesian businessman Ronny Lukito, PT Eigerindo Multi Produk Industri is an Indonesian apparel, accessories, bags, equipment and footwear company based in Bandung, capital of Indonesia’s West Java province. Its brands focus on tropical, outdoor adventure and urban, lifestyle gear and fashion. The company owns three brands, including Eiger, Bodypack and Exsport. Digital Happiness is the first company it funded.

Founded in 1979 by Indonesian businessman Ronny Lukito, PT Eigerindo Multi Produk Industri is an Indonesian apparel, accessories, bags, equipment and footwear company based in Bandung, capital of Indonesia’s West Java province. Its brands focus on tropical, outdoor adventure and urban, lifestyle gear and fashion. The company owns three brands, including Eiger, Bodypack and Exsport. Digital Happiness is the first company it funded.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

SeedRocket is one of the biggest networks of mentors and industry experts in Spain. Founded by Jesus Monleon and Vicente Arias, the firm offers mentorship, acceleration and seed funding programs of up to €150,000 per startup. SeedRocket is headquartered in Barcelona with a branch office in the Google Campus Madrid. SeedRocket has backed 160 startups with a total capital investment of €55 million, including five exits.

SeedRocket is one of the biggest networks of mentors and industry experts in Spain. Founded by Jesus Monleon and Vicente Arias, the firm offers mentorship, acceleration and seed funding programs of up to €150,000 per startup. SeedRocket is headquartered in Barcelona with a branch office in the Google Campus Madrid. SeedRocket has backed 160 startups with a total capital investment of €55 million, including five exits.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2011 by Cyril Ebersweiler, partner of the venture capital firm SOSV, HAX has grown into the world’s first and largest hardware accelerator. It currently operates in Shenzhen and San Francisco. Funded by SOSV, HAX selects teams with hardware prototypes and turns them into functional, sustainable companies. In this way, HAX has brought 65 products to the market in the last three years.

Founded in 2011 by Cyril Ebersweiler, partner of the venture capital firm SOSV, HAX has grown into the world’s first and largest hardware accelerator. It currently operates in Shenzhen and San Francisco. Funded by SOSV, HAX selects teams with hardware prototypes and turns them into functional, sustainable companies. In this way, HAX has brought 65 products to the market in the last three years.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

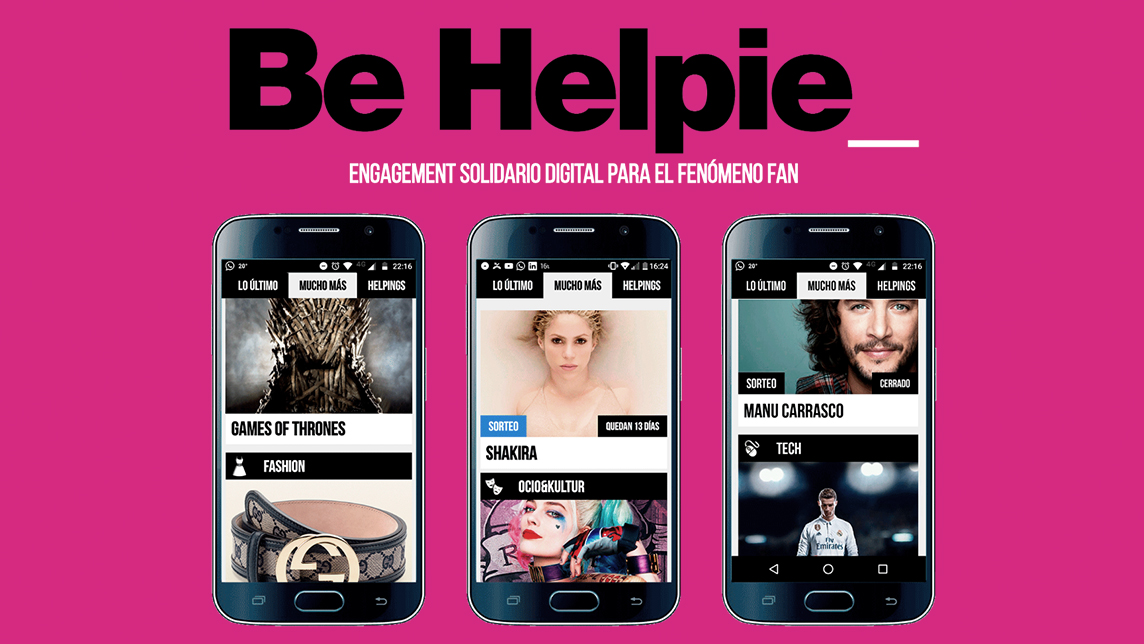

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Caixa Capital Risc”.