Carbon neutral

-

DATABASE (43)

-

ARTICLES (90)

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

CTO and co-founder of Diamond Foundry

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Co-founder of Diamond Foundry

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Co-founder of Refurbed

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Technical advisor and co-founder of Bygen

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

Carbo Culture: Adapting indigenous techniques to remove and store CO2

By turning biomass into biochar, the startup’s technology locks carbon into a stable, solid form, with a storage life of over 2,000 years

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

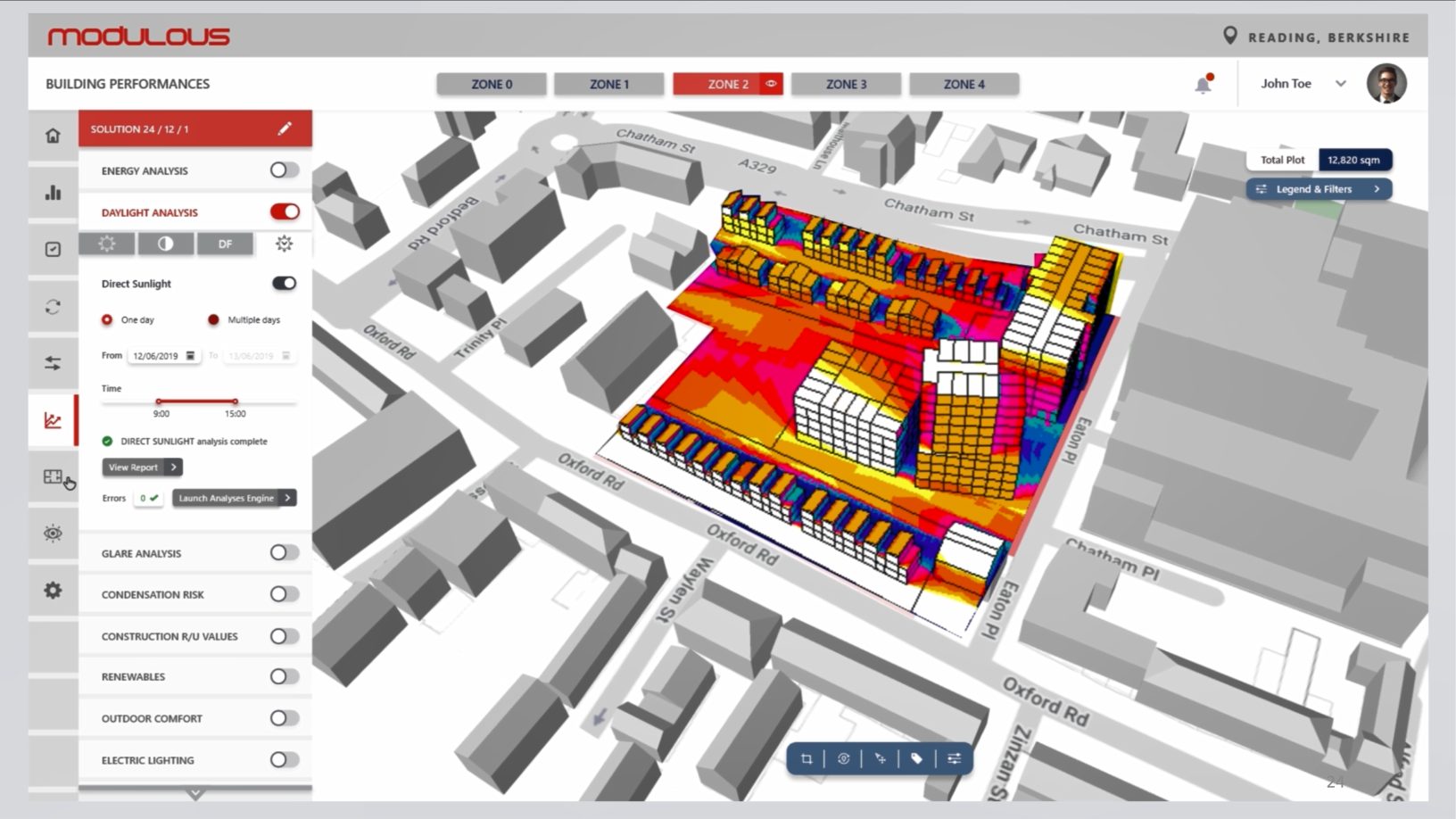

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Graviky Labs: Sustainable ink made from air pollution

Conceptualized at MIT and named among the Best Inventions of 2019 by TIME Magazine, Graviky Labs’ carbon-negative ink is made from upcycled emissions captured with a proprietary device

Sorry, we couldn’t find any matches for“Carbon neutral”.