Carbon neutral

-

DATABASE (43)

-

ARTICLES (90)

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

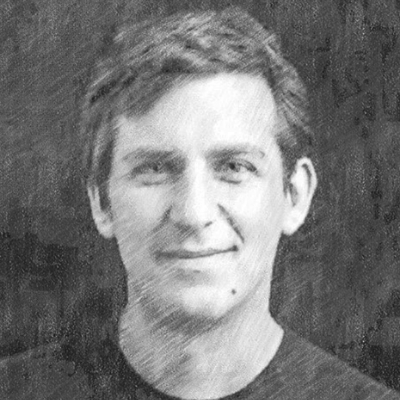

CTO and co-founder of Diamond Foundry

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

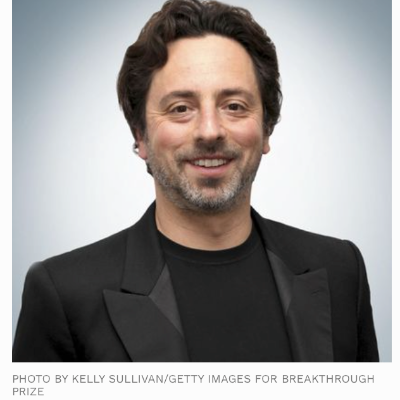

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Co-founder of Diamond Foundry

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Co-founder of Refurbed

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Technical advisor and co-founder of Bygen

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

CO2 Revolution: One man's quest to reforest the world

Juan Carlos Sesma is not just a man on a mission – he wants to change the world via his reforestation startup, CO2 Revolution, combining drones, intelligent seeds and big data. Sesma discusses his revolutionary yet scalable plans with CompassList at the recent Madrid South Summit

Mi Terro turns milk waste into eco-friendly clothing and packaging

With food giants like Danone, Arla and Dole as partners, US-Sino startup Mi Terro plans to extend its technology to plant-based food waste like soy to get plastic and fiber alternatives

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

Indonesia's HighPitch 2020: VC investors on Medan startups, deal-sourcing during Covid

Healthcare-focused edtech Appskep and e-grocer Pasar20 win regional pitch competition for Sumatra; judging VCs share their new perspectives gained on local problems and startups from outside Greater Jakarta, and more

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

Sorry, we couldn’t find any matches for“Carbon neutral”.