China

-

DATABASE (664)

-

ARTICLES (298)

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

A leading one-stop Chinese pet-care brand trusted by many pet lovers, Leepet offers on-demand services, social networking, e-commerce, offline stores, even an animal hospital.

A leading one-stop Chinese pet-care brand trusted by many pet lovers, Leepet offers on-demand services, social networking, e-commerce, offline stores, even an animal hospital.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

SIG’s China venture capital and private equity activities are operated through SIG Asia Investments. SIG invests in companies at various stages of development, from early stage to later stage companies, with focus on consumer, service, healthcare and digital media/internet sectors.

SIG’s China venture capital and private equity activities are operated through SIG Asia Investments. SIG invests in companies at various stages of development, from early stage to later stage companies, with focus on consumer, service, healthcare and digital media/internet sectors.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

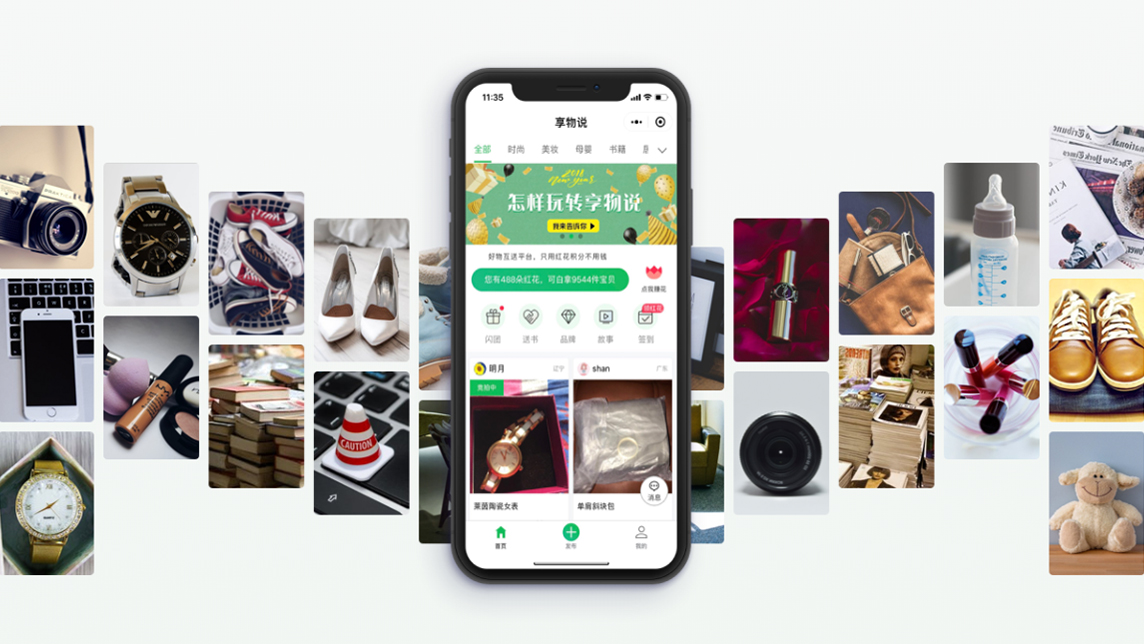

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4D ShoeTech: Digital design platform helps shoemakers to slash production time by over 60%

Armed with new funding, 4D ShoeTech is scaling its Ideation platform to offer digital modelling services to cover other popular products like suitcases

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Xiaoe Tech: Capitalizing on China’s pay-for-knowledge fever

In just two years, this startup has helped its clients sell RMB 2.2 billion worth of knowledge-based content online

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

Sorry, we couldn’t find any matches for“China”.