China Merchants Bank

-

DATABASE (780)

-

ARTICLES (417)

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

Trusted by internet finance firms, China’s largest e-contracting and e-signature platform allows for faster and more secure transactions at a lower cost.

Trusted by internet finance firms, China’s largest e-contracting and e-signature platform allows for faster and more secure transactions at a lower cost.

China Reform Capital Corporation, Ltd.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

Mandarin Chinese-speaking overseas chauffeured car service for independent travelers seeking low, transparent pricing; reliability and convenience. Easy booking via the Huiwan app.

Mandarin Chinese-speaking overseas chauffeured car service for independent travelers seeking low, transparent pricing; reliability and convenience. Easy booking via the Huiwan app.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Foxconn- and Tencent-backed Mobike is leading the fierce fight for dominance in the global dockless bike-sharing market, with ambitions for more – including logistics services.

Foxconn- and Tencent-backed Mobike is leading the fierce fight for dominance in the global dockless bike-sharing market, with ambitions for more – including logistics services.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Co-founder and CEO of Investree

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

Veteran banker Adrian Asharyanto Gunadi graduated in Accounting from the University of Indonesia and later obtained an MBA from the Rotterdam School of Management, Eramus University. Adrian started his banking career at Citibank in 1998. He was then based at the Standard Chartered Bank in Dubai, UAE, managing global Islamic finance product structuring for the Middle East and North Africa region (MENA), South Asia and Southeast Asia. He specialized in Islamic banking for over eight years at Permata Bank and Bank Muamalat in Indonesia until 2015, when he left to co-found Investree.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Co-founder and CTO of Ahlijasa

Made Dimas Astra Wijaya was a former assistant vice president at the Bank of America Merrill Lynch. He left the bank after four years in 2015 and joined Jay Jayawijayaningtyas to set up Ahlijasa. He has an Information Systems degree from the Singapore Management University and a master’s in Computing from the National University of Singapore.

Made Dimas Astra Wijaya was a former assistant vice president at the Bank of America Merrill Lynch. He left the bank after four years in 2015 and joined Jay Jayawijayaningtyas to set up Ahlijasa. He has an Information Systems degree from the Singapore Management University and a master’s in Computing from the National University of Singapore.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

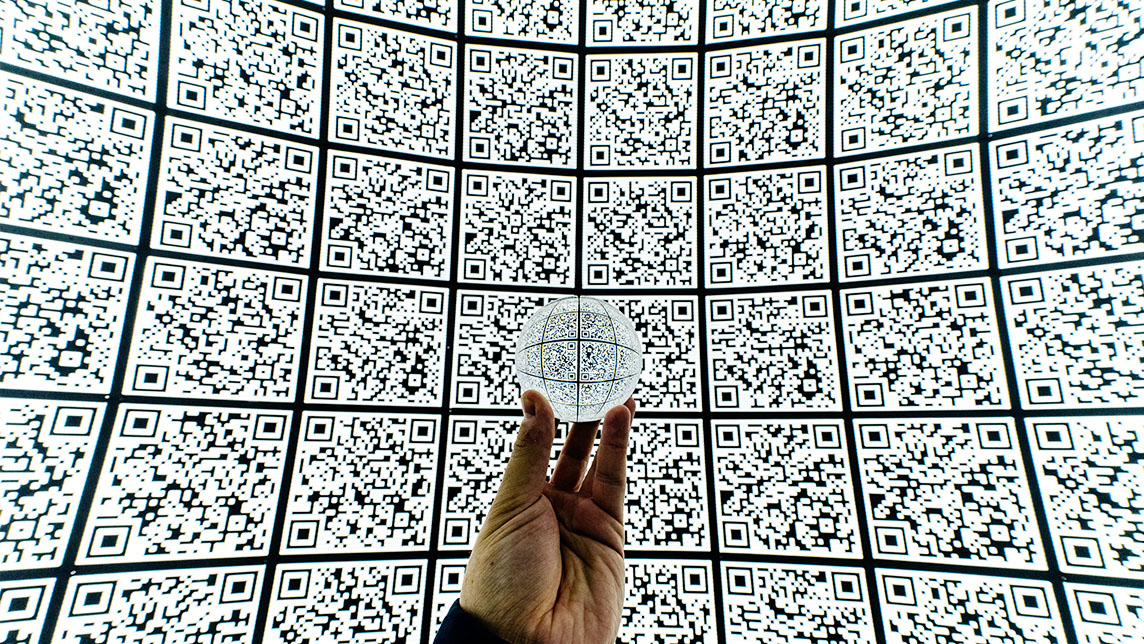

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

Alipay opens its platform to speed up digitalization of Chinese service providers amid Covid-19

As Alipay continues to battle WeChat for super-app supremacy, it's created a stronghold in China’s services industry, where 80% of businesses still operate under brick-and-mortar models

Haoyiku makes it possible to offer genuine products at lower prices

When e-commerce is combined with social media, everybody wins

China reverses ban on street vendors to boost economy, sparking new demand for digital solutions

Alibaba, Tencent, Meituan and other tech giants give roadside vendors digital makeover, so they can compete with fast-food chains like McDonald’s, KFC and Pizza Hut

Analysing and leveraging data: Interview with Datanest co-founders

From credit scoring to demand forecasting, Datanest has built many machine-learning products and looks to raise new funding, expand beyond Indonesia

Day Day Cook: Creating content that sells

She may not be a celebrity chef but Norma Chu, the analyst-turned-cook, is a familiar face in food-obsessed Hong Kong, where she has her recipe website to encourage youths to learn cooking

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, e-commerce platforms and brands bet big on live commerce

Retailers embrace shopping via livestreaming, where social media influencers hawk products and get rapid sales

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Sorry, we couldn’t find any matches for“China Merchants Bank”.