China Minsheng Bank

-

DATABASE (774)

-

ARTICLES (408)

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

China Minsheng Investment Group

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Founder and CEO of Doctor Che

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

In Indonesia, Ramadan goes hi-tech

From consumption to charity, tech startups have come to play a key role in Ramadan traditions in Indonesia

Svara helps Indonesian radio stations win back listeners and advertisers

Using Svara’s digital broadcasting SaaS, radio stations can face off the onslaught of Spotify and Soundcloud

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Civiclytics is a Covid-19 information crowdsourcing and sharing platform supported by the Inter-American Development Bank, as Citibeats reports increased demand for its data analytics and actionable insights

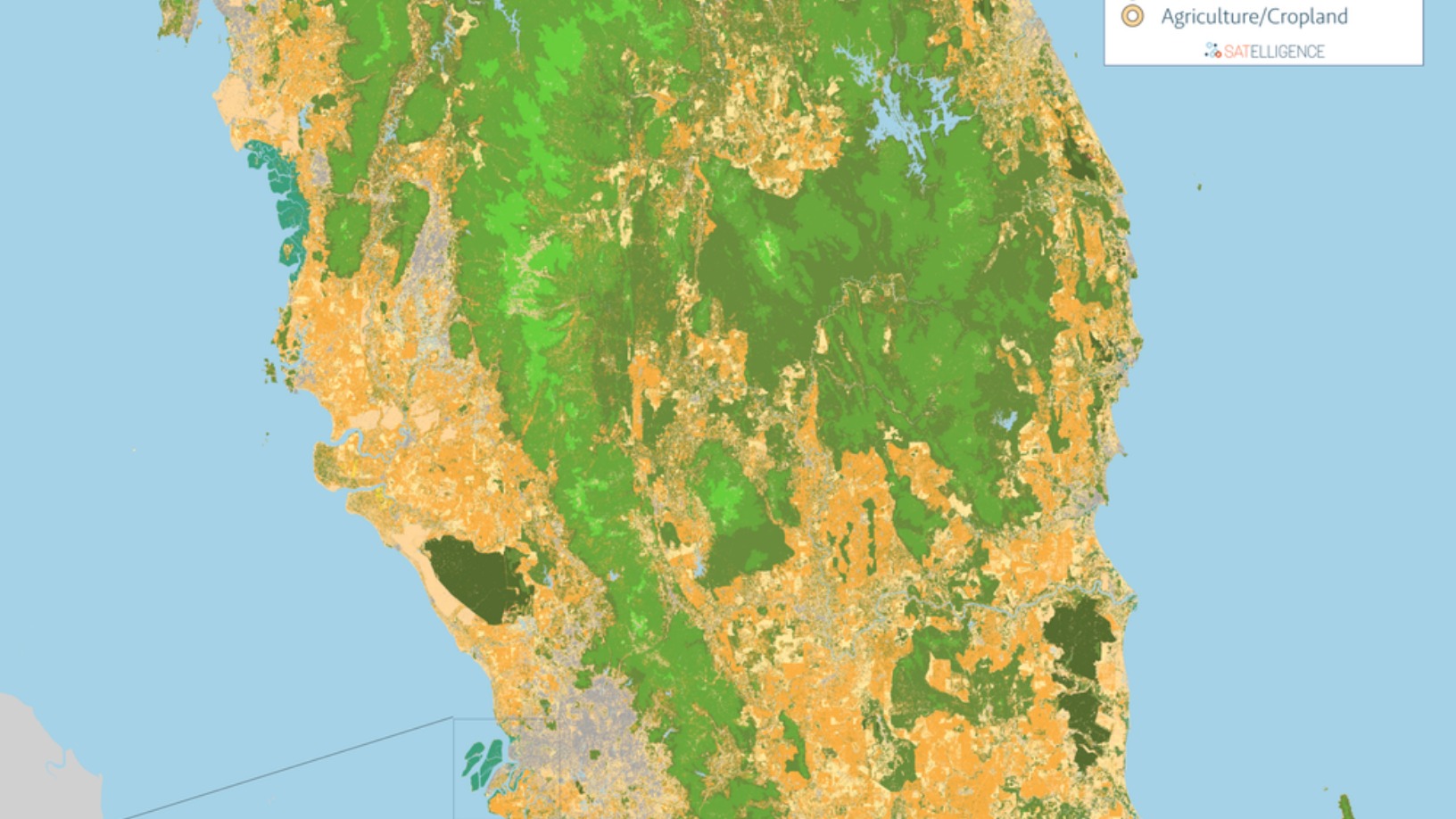

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

Some Chinese startups spot new market opportunities amid Covid-19 gloom

Crises create opportunities for startups to pivot and innovate, as Covid-19 is showing

Farm Friend: World’s first agri-drone sharing platform wins over users, investors

Gone are the days of the lone Chinese farmer toiling under the sun. Now drones are here to help – and there’s even a drone sharing platform too

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Sorry, we couldn’t find any matches for“China Minsheng Bank”.