Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

Based in Shanghai, BA Capital focuses on investments in various consumer sectors. The VC, a subsidiary of Black Ant Group in Shenzhen, was founded in 2016 by three partners Chen Feng, He Yu and Zhang Peiyuan

Based in Shanghai, BA Capital focuses on investments in various consumer sectors. The VC, a subsidiary of Black Ant Group in Shenzhen, was founded in 2016 by three partners Chen Feng, He Yu and Zhang Peiyuan

Founded by Tencent co-founder Zeng Liqing in 2007, Decent Capital had invested in some 150 companies as of mid-2017. With its roots in Tencent, Decent Capital tends to favor Tencent alumni-entrepreneurs in its investments.

Founded by Tencent co-founder Zeng Liqing in 2007, Decent Capital had invested in some 150 companies as of mid-2017. With its roots in Tencent, Decent Capital tends to favor Tencent alumni-entrepreneurs in its investments.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Pathena is a Porto-based venture capital firm founded in 2010 and focuses on IT investments, particularly medtech. Pathena closed its first portfolio fund in 2011, having invested in 10 companies and it launched its current portfolio fund in 2013 worth €56 million.

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

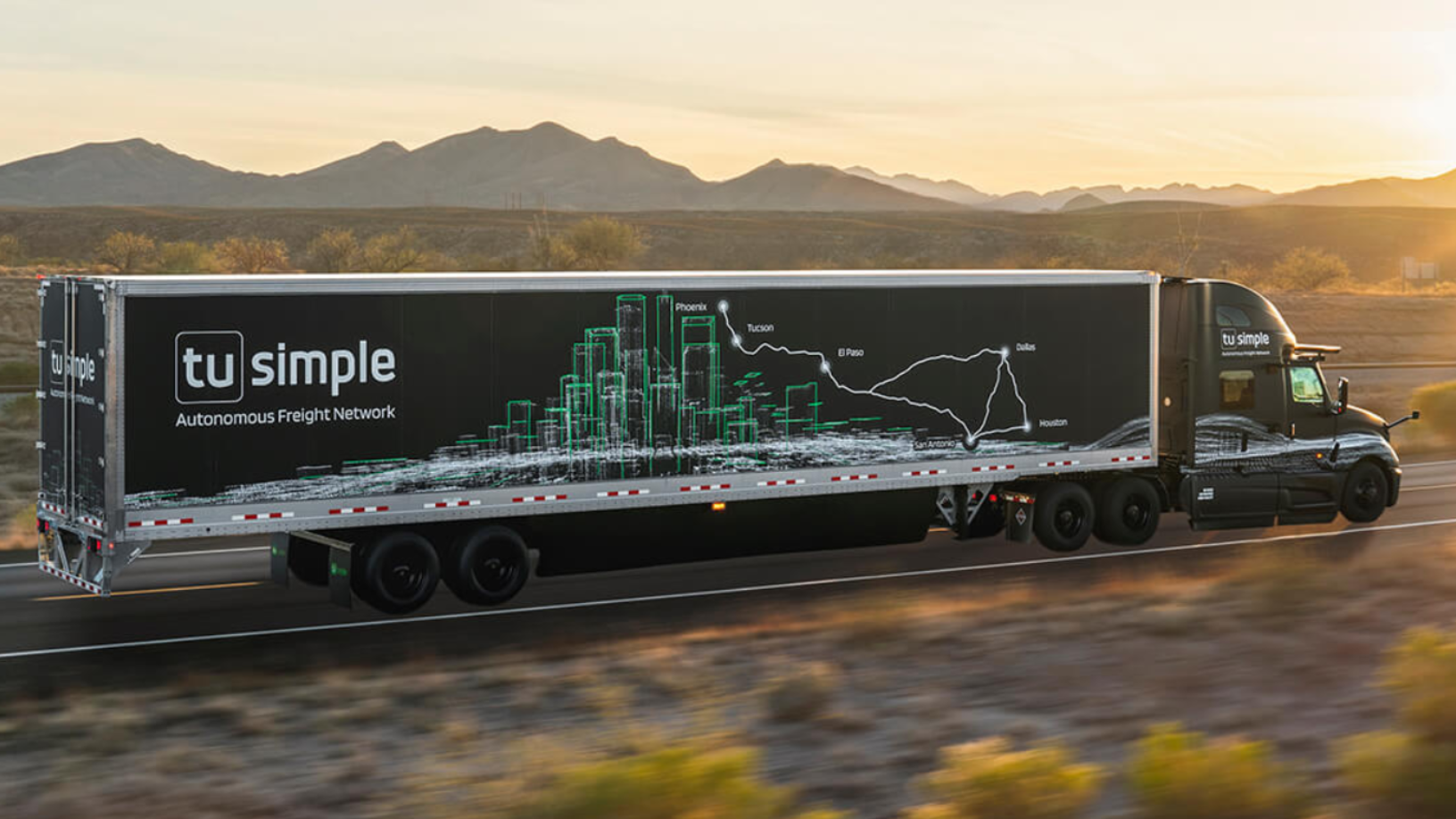

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“Concept Investments”.