Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Rolf Schrömgens is best known as the CEO and co-founder of travel marketplace Trivago, where he has worked since 2006. The German entrepreneur is also a prolific early-stage investor.His most recent investments include participation in the €1.15m seed round of fintech StudentFinance and €8m Series A funding for German biotech innes.

Rolf Schrömgens is best known as the CEO and co-founder of travel marketplace Trivago, where he has worked since 2006. The German entrepreneur is also a prolific early-stage investor.His most recent investments include participation in the €1.15m seed round of fintech StudentFinance and €8m Series A funding for German biotech innes.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

Mitsubishi UFJ Financial Group

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Led by China's largest software developer platform CSDN founder Jiang Tao and mobile games maker Linekong founder Wang Feng, GeekFounders was founded by a group of entrepreneurs in 2011. It focuses on early-stage investments in mobile gaming and entertainment, mobile vertical community, mobile SaaS, cloud technology and smart hardware. It has invested in more than 80 mobile internet startups.

Led by China's largest software developer platform CSDN founder Jiang Tao and mobile games maker Linekong founder Wang Feng, GeekFounders was founded by a group of entrepreneurs in 2011. It focuses on early-stage investments in mobile gaming and entertainment, mobile vertical community, mobile SaaS, cloud technology and smart hardware. It has invested in more than 80 mobile internet startups.

Pearson Affordable Learning Fund

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2017 by Li Li, a former partner at K2VC, Next Capital invests mainly in early-stage startups. Next Capital manages around RMB 400 million. Investments range in value from RMB 3-30 million. In just its first year, Next Capital invested in more than 10 startups. It finances mainly Chinese internet innovations, especially in Fintech and new retail.

Founded in 2010, People.cn Co., Ltd., publishes online news in China and abroad. Its information exchange platform People.cn is the online portal of the People's Daily, the Chinese Communist Party’s official newspaper. It was listed on China's A-share market in 2012. The company makes investments in early-stage media startups.

Founded in 2010, People.cn Co., Ltd., publishes online news in China and abroad. Its information exchange platform People.cn is the online portal of the People's Daily, the Chinese Communist Party’s official newspaper. It was listed on China's A-share market in 2012. The company makes investments in early-stage media startups.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

Established as an Internet forum in 1999, Kaskus is one of Indonesia's most successful online communities, outlasting many other Indonesian dotcom companies established at the turn of the century. Originally hosted in the USA where its founders lived and studied at the time, Kaskus eventually branched out into content creation and online advertisements, growing via several investments and acquisitions.

Agentes y Asesores Financieros

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

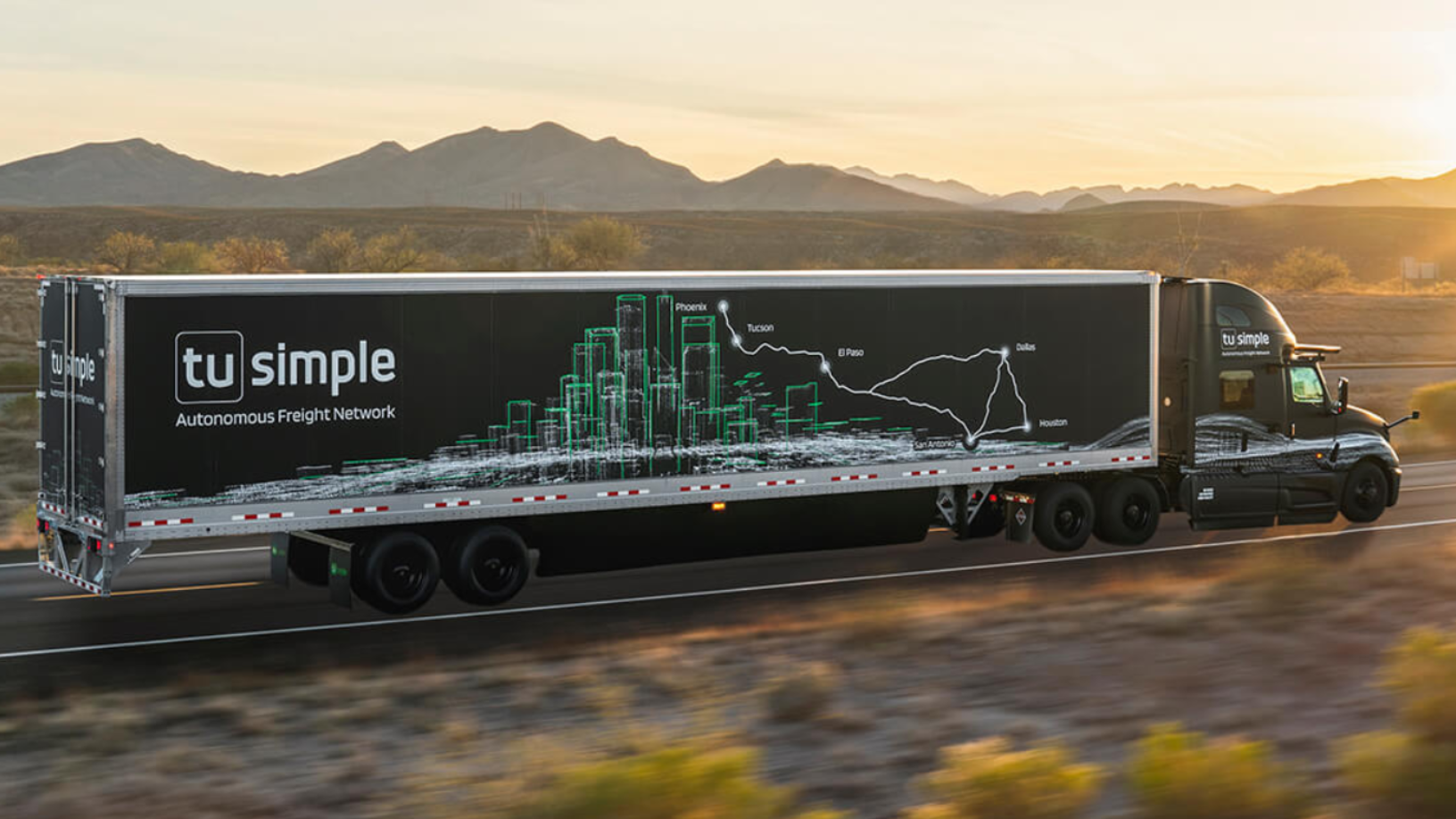

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“Concept Investments”.