Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Catalan Finance Institute (ICF)

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

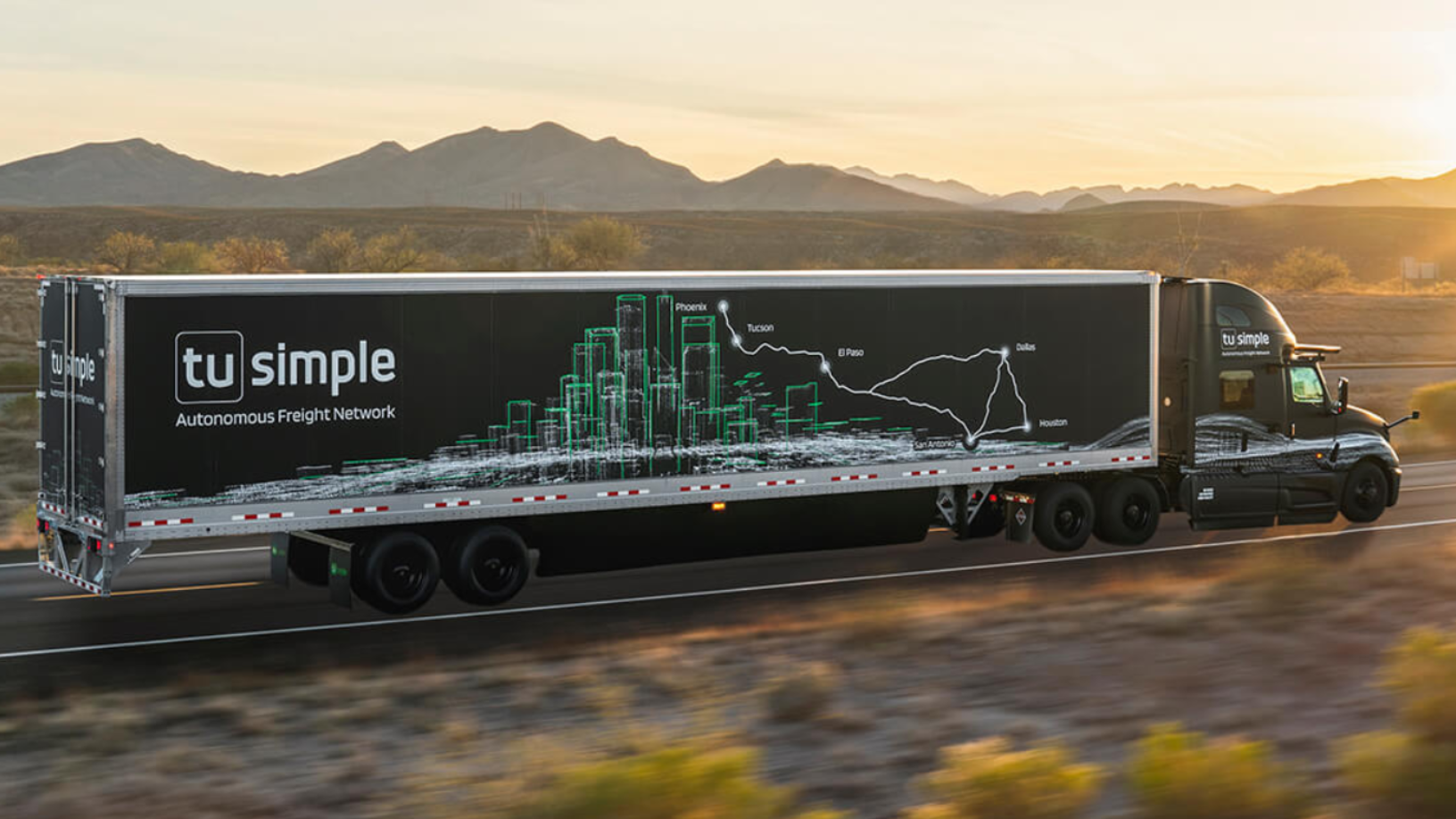

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“Concept Investments”.