Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Entrepreneurs Roundtable Accelerator

New York City’s largest accelerator program, founded in 2011, provides each accepted company with an initial $100,000 investment and the potential for follow-on funding from its fund. The accelerator also provides up to $120,000 of Azure benefits for two years from Microsoft, plus $100,000 in webhosting credits from Amazon Web Services and $100,000 from Google Cloud Platform, among other benefits. Its four-month program provides access to the largest mentor network in New York. It has accelerated and invested in more than 200 companies to date across sectors and makes diversity investments. Selected companies have a US market ambition. Its most recent cohorts include Portuguese VR gaming and cognitive training software Virtuleap, and online tire retailer Tire Agent.

New York City’s largest accelerator program, founded in 2011, provides each accepted company with an initial $100,000 investment and the potential for follow-on funding from its fund. The accelerator also provides up to $120,000 of Azure benefits for two years from Microsoft, plus $100,000 in webhosting credits from Amazon Web Services and $100,000 from Google Cloud Platform, among other benefits. Its four-month program provides access to the largest mentor network in New York. It has accelerated and invested in more than 200 companies to date across sectors and makes diversity investments. Selected companies have a US market ambition. Its most recent cohorts include Portuguese VR gaming and cognitive training software Virtuleap, and online tire retailer Tire Agent.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

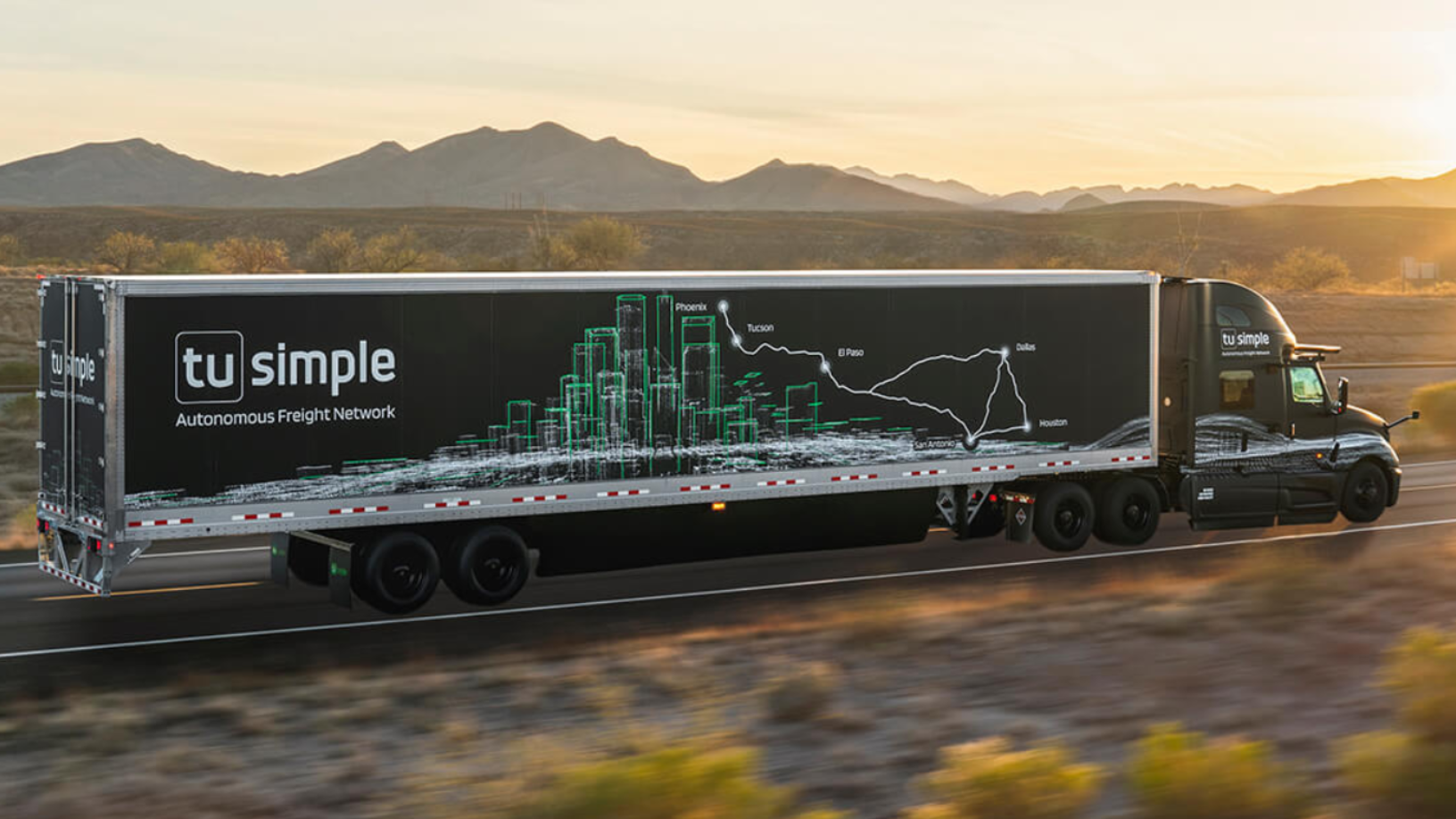

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“Concept Investments”.