Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

DCVC (formerly Data Collective)

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

1st Road Capital Management was founded in 2016. Its focus is early-stage investments. 1st Road Capital Management has funded big data platform Palm Science and virtual reality game producer Multiverse, among others.

1st Road Capital Management was founded in 2016. Its focus is early-stage investments. 1st Road Capital Management has funded big data platform Palm Science and virtual reality game producer Multiverse, among others.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

GP Bullhound is a financial advisory and investment firm founded in 1999 with offices in London, San Francisco, Stockholm, Berlin, Manchester, Paris, Hong Kong, Madrid and New York. To date, the firm has undertaken over 530 investments worldwide, with its latest fund raising €65 million in 2018. GP Bullhound's 18 exits to date include successful companies like Spotify and Avito. It has invested in renowned companies like Slack and Wallapop. Its recent investments include a Series A round in customer service platform Nivo and a Series D round in productivity software, Partnerize.

GP Bullhound is a financial advisory and investment firm founded in 1999 with offices in London, San Francisco, Stockholm, Berlin, Manchester, Paris, Hong Kong, Madrid and New York. To date, the firm has undertaken over 530 investments worldwide, with its latest fund raising €65 million in 2018. GP Bullhound's 18 exits to date include successful companies like Spotify and Avito. It has invested in renowned companies like Slack and Wallapop. Its recent investments include a Series A round in customer service platform Nivo and a Series D round in productivity software, Partnerize.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

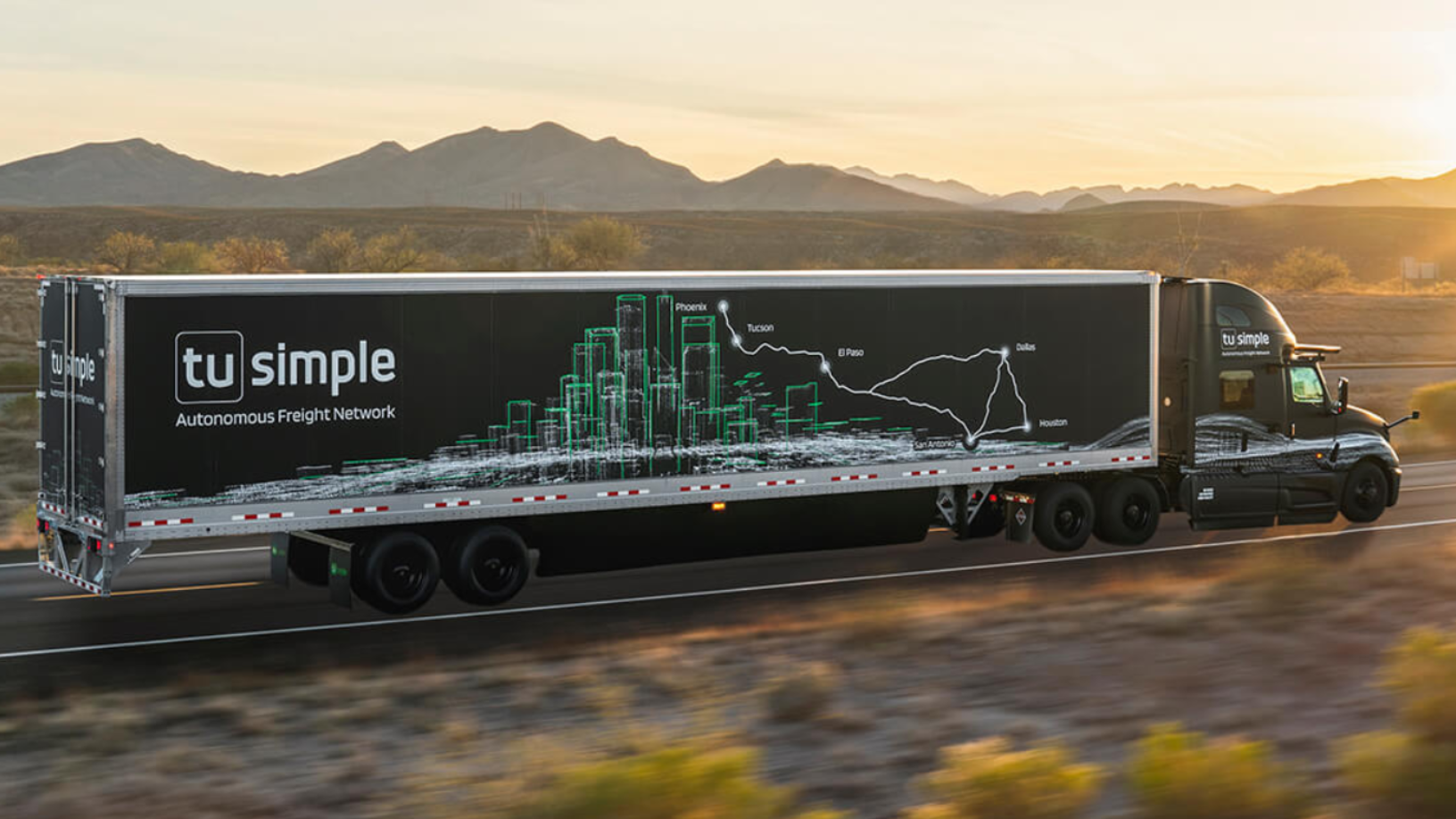

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“Concept Investments”.