Concept Investments

-

DATABASE (453)

-

ARTICLES (253)

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

CEO and Co-founder of Glovo

Oscar Pierre (b.1992) trained as an aerospace engineer at the Polytechnic University of Barcelona (UPC) in Spain and later at the Georgia Institute of Technology in Atlanta, USA. He interned at Airbus, before starting his entrepreneurial career in 2014 by founding startups like Zikkomo and FUO Concept. Zikkomo is a platform that drives education in Malawi through multiple Active Africa ONG projects. FUO Concept was an e-commerce marketplace for local handicrafts.Pierre is now the CEO and co-founder of Glovo, an on-demand delivery platform with operations in 22 markets worldwide.

Oscar Pierre (b.1992) trained as an aerospace engineer at the Polytechnic University of Barcelona (UPC) in Spain and later at the Georgia Institute of Technology in Atlanta, USA. He interned at Airbus, before starting his entrepreneurial career in 2014 by founding startups like Zikkomo and FUO Concept. Zikkomo is a platform that drives education in Malawi through multiple Active Africa ONG projects. FUO Concept was an e-commerce marketplace for local handicrafts.Pierre is now the CEO and co-founder of Glovo, an on-demand delivery platform with operations in 22 markets worldwide.

Indonesian startup Traval goes virtual to stay afloat during pandemic

The startup is also trying to set itself apart from mainstream tourism with tours like Zero Waste Journey where travelers do not bring plastic items and even plant trees

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Trudy Dai: Alibaba’s jane of all trades

Dai has played a pivotal role in the success of the world’s biggest e-commerce platform; now the tech giant is trusting her to run its VC arm

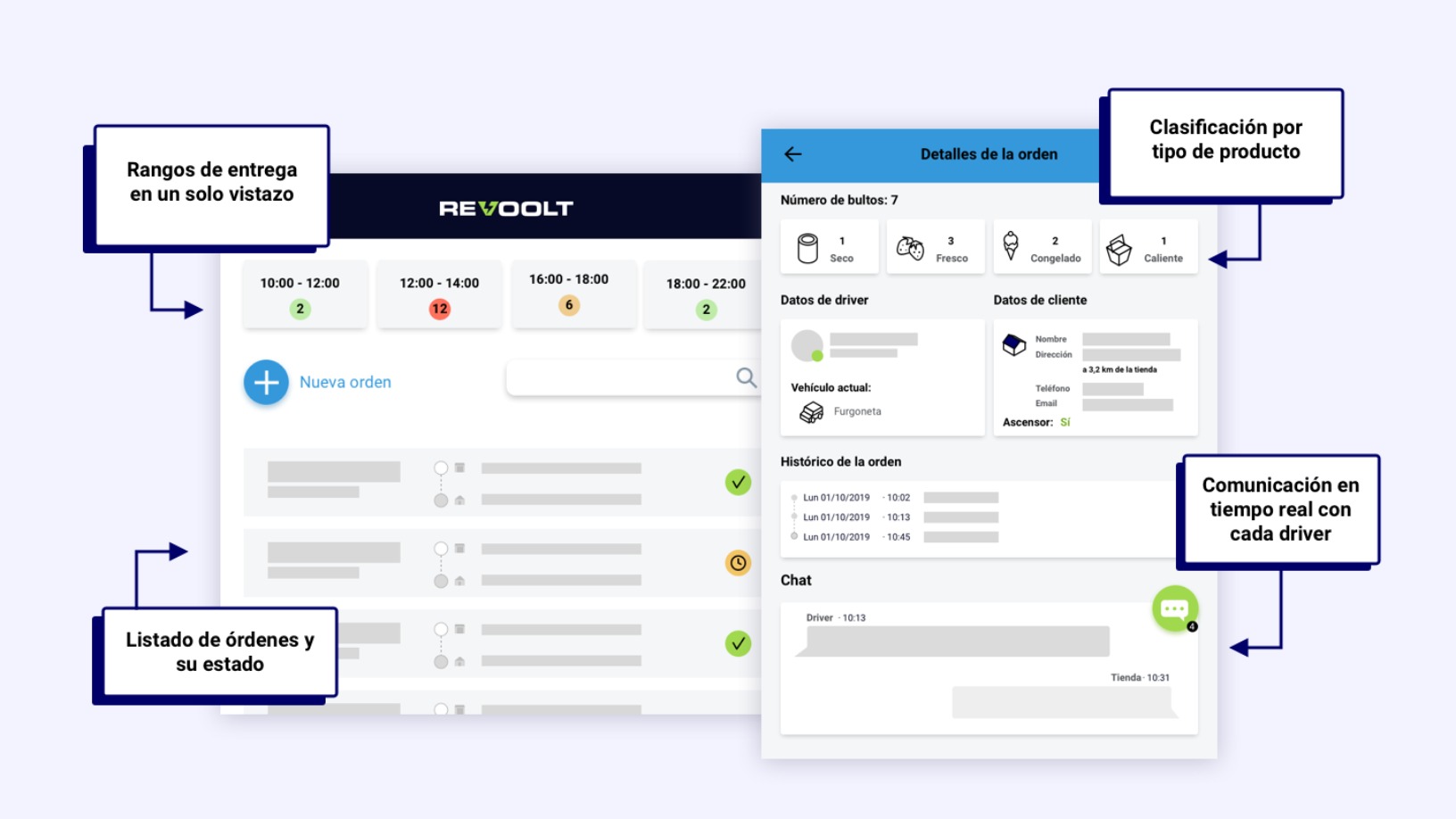

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

Salicrop protects food crops against soil salinity, boosting yields

Salicrop is raising Series A funding to support the commercialization of its non-GMO seed treatment

Thousands of Farmers: Creative subscription model to help farms sell seasonal produce

Just a few months old, Thousands of Farmers plans to add more entertaining features to its farm-to-table social commerce, attracting young consumers

Triditive: Enabling SME manufacturers to catch up, thrive in Industry 4.0

An Asturian startup has created the first automated additive manufacturing technology for round-the-clock industrial production

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

Sorry, we couldn’t find any matches for“Concept Investments”.