Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

Founder and CEO of Gouguanjia

Sun Li had his first (failed) startup in auto services, in 2013, and had previously worked for many years in an internet company.

Sun Li had his first (failed) startup in auto services, in 2013, and had previously worked for many years in an internet company.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Cane Investments is a private investment firm based in Irvington, New York, that specializes in early-stage investments in the media and communications sectors. It has nine companies in its portfolio. The firm most recently invested in autonomous and connected vehicle communication technology Veniam's US$22m Series B round in 2016. Other portfolio companies include wireless power startup uBeam and HR software company GetHired.com.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Formerly known as Tribeca Angels, the New York-based Tribeca Early Stage Partners was established in 2014 by John McEvoy. The firm's network of 50 entrepreneurs and business leaders specialize in institutional finance and enterprise technology. Tribeca focuses on early-stage investments in fintechs and ERPs, especially those based in the New York area. Initial investment per startup ranges from US$500,000 to US$1 million. It has invested in 15 startups and managed two exits, Cola and James.

Formerly known as Tribeca Angels, the New York-based Tribeca Early Stage Partners was established in 2014 by John McEvoy. The firm's network of 50 entrepreneurs and business leaders specialize in institutional finance and enterprise technology. Tribeca focuses on early-stage investments in fintechs and ERPs, especially those based in the New York area. Initial investment per startup ranges from US$500,000 to US$1 million. It has invested in 15 startups and managed two exits, Cola and James.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

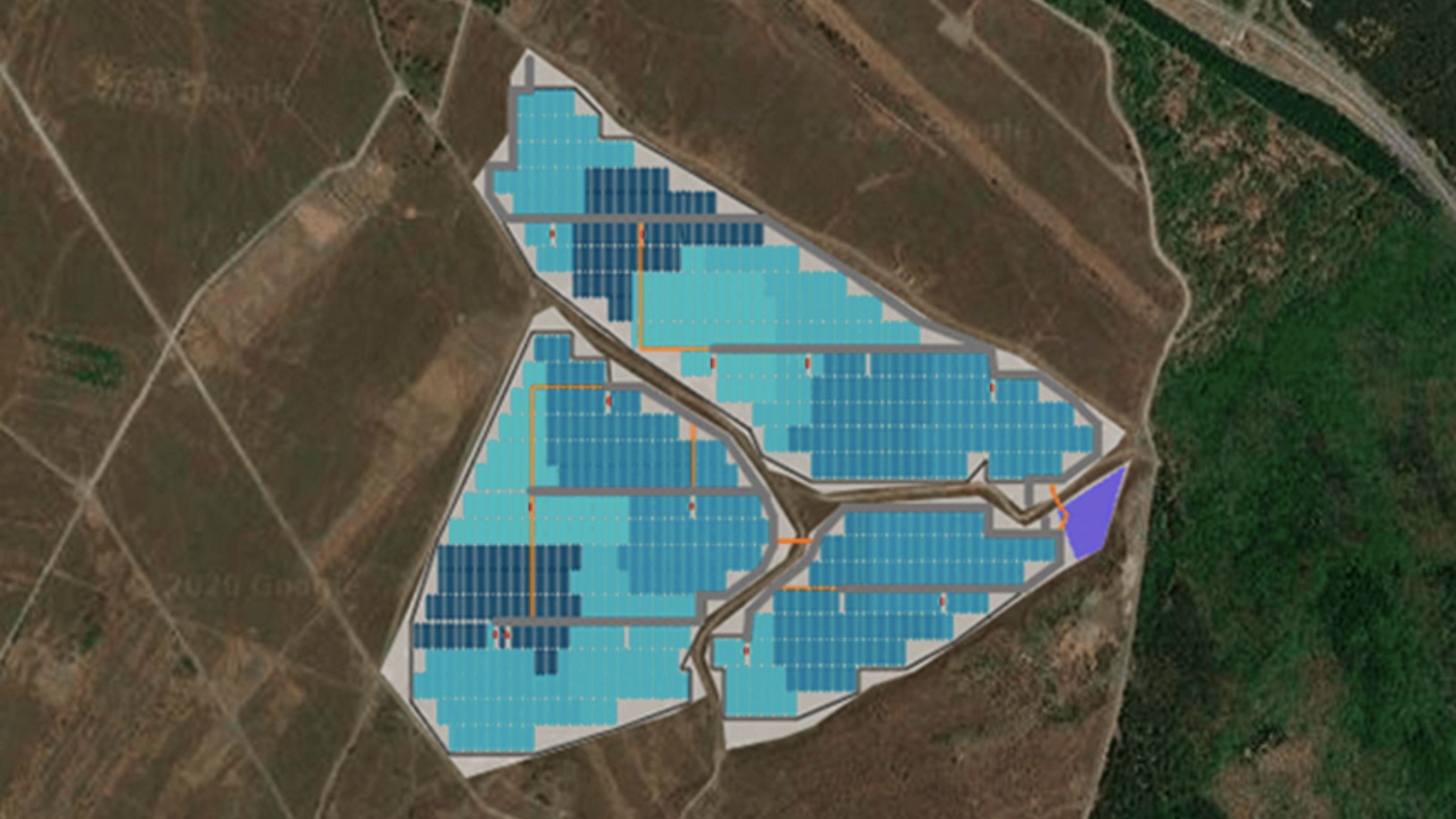

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.