Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Founder & CEO of SXBBM.com (Shixiong Bangbangmang)

A former doctoral student of the Department of Mechanical Engineering, Tsinghua University, Shen quit his studies to focus on SXBBM.com (Shixiong Bangbangmang) and subsequently, his second startup, Licaifan, in internet finance.

A former doctoral student of the Department of Mechanical Engineering, Tsinghua University, Shen quit his studies to focus on SXBBM.com (Shixiong Bangbangmang) and subsequently, his second startup, Licaifan, in internet finance.

Co-founder and COO of Kata.ai

Chris Franke is a German entrepreneur who worked as a usability designer at the German food delivery startup Lieferando.de where he met Irzan Raditya. Chris later became the Head of Design for Lieferando.de and its parent company Takeaway.com.In 2015, Chris decided to team up with Irzan to develop YesBoss that was later replaced by a chatbot engine Kata.ai, with Chris as its COO. He left Kata.ai in 2017 but remains on the board of advisors. Chris is also the CMO of Seatris, a restaurant booking management startup in Germany. He is also a guest lecturer at Technische Universität Berlin, Germany.

Chris Franke is a German entrepreneur who worked as a usability designer at the German food delivery startup Lieferando.de where he met Irzan Raditya. Chris later became the Head of Design for Lieferando.de and its parent company Takeaway.com.In 2015, Chris decided to team up with Irzan to develop YesBoss that was later replaced by a chatbot engine Kata.ai, with Chris as its COO. He left Kata.ai in 2017 but remains on the board of advisors. Chris is also the CMO of Seatris, a restaurant booking management startup in Germany. He is also a guest lecturer at Technische Universität Berlin, Germany.

CEO and founder of Kuaipeilian

Born in 1987, Lu tried to start his first business while he was still studying for his bachelor's in Vehicle Engineering at Shenyang Ligong University. After graduating in 2010, he joined 24 quan, a group-buying startup, and was eventually put in charge of its marketing department. Lu joined Baidu in 2011 as product manager and was later promoted to channel manager. In 2013, Lu joined Edaixi, an O2O laundry service startup, as founding partner and CEO. He received his MBA from China Europe International Business School in 2016 and subsequently resigned from Edaixi. In 2018, he founded Kuaipeilian.

Born in 1987, Lu tried to start his first business while he was still studying for his bachelor's in Vehicle Engineering at Shenyang Ligong University. After graduating in 2010, he joined 24 quan, a group-buying startup, and was eventually put in charge of its marketing department. Lu joined Baidu in 2011 as product manager and was later promoted to channel manager. In 2013, Lu joined Edaixi, an O2O laundry service startup, as founding partner and CEO. He received his MBA from China Europe International Business School in 2016 and subsequently resigned from Edaixi. In 2018, he founded Kuaipeilian.

Co-founder, CIO, Head of R&D of BEEVERYCREATIVE

In April 2013, Jorge Pinto became the Head of R&D, CIO and Co-founder of BEEVERYCREATIVE . He was also a co-founder and Head of R&D at bitBOX Electronic Systems that was pivoted into BEEVERYCREATIVE in 2013.Pinto is also working as a software and firmware developer at German startup BFO Mobility and at an international open-source project for Chinese startup Ebike Motor Controllers. He was previously employed as an electronics engineer at Portuguese firmware company Tetracis Plurirede and energy company Aveicabo. Pinto has a degree in Electronic Engineering from the University of Aveiro, Portugal.

In April 2013, Jorge Pinto became the Head of R&D, CIO and Co-founder of BEEVERYCREATIVE . He was also a co-founder and Head of R&D at bitBOX Electronic Systems that was pivoted into BEEVERYCREATIVE in 2013.Pinto is also working as a software and firmware developer at German startup BFO Mobility and at an international open-source project for Chinese startup Ebike Motor Controllers. He was previously employed as an electronics engineer at Portuguese firmware company Tetracis Plurirede and energy company Aveicabo. Pinto has a degree in Electronic Engineering from the University of Aveiro, Portugal.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

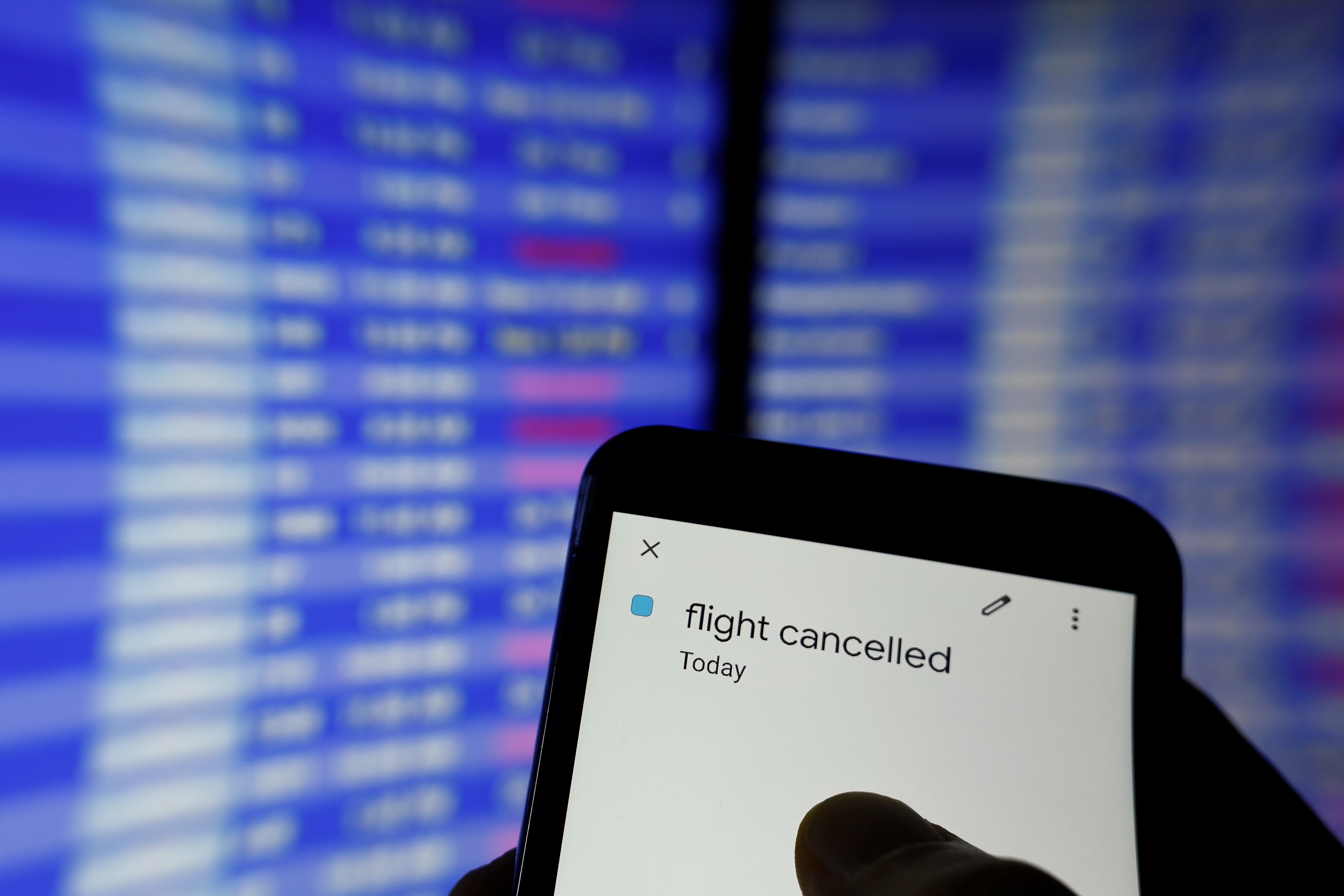

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

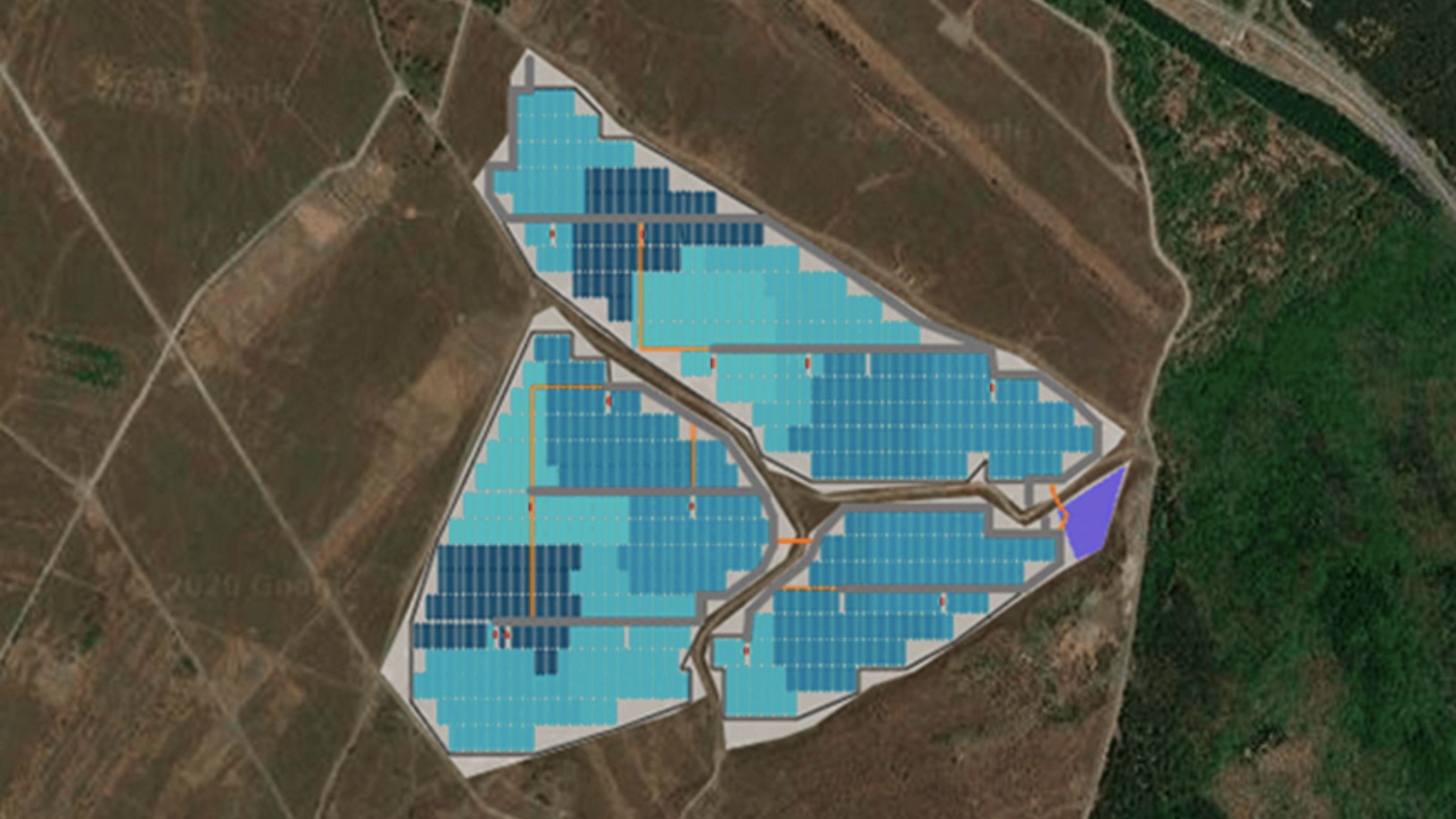

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.