Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

CTO of NutraSign

Enrique Alcázar Garzas holds a double bachelor's degree in Computer Science and Business Administration from Carlos III University in Madrid. He spent one year as an exchange student at Hanyang University in South Korea and returned home to work as an R&D intern for app development at a Spanish startup Natureh in 2016. He is the co-founder and CTO of blockchain startup Lingotts. The full stack blockchain developer also works on various projects at Grant Thornton and Santander Technology’s innovation lab. He co-founded NutraSign in 2018 and is in charge of the company's app and blockchain development as CTO.

Enrique Alcázar Garzas holds a double bachelor's degree in Computer Science and Business Administration from Carlos III University in Madrid. He spent one year as an exchange student at Hanyang University in South Korea and returned home to work as an R&D intern for app development at a Spanish startup Natureh in 2016. He is the co-founder and CTO of blockchain startup Lingotts. The full stack blockchain developer also works on various projects at Grant Thornton and Santander Technology’s innovation lab. He co-founded NutraSign in 2018 and is in charge of the company's app and blockchain development as CTO.

CEO and co-founder of Infraspeak

Serial entrepreneur Felipe Ávila da Costa is today the Portuguese co-founder and CEO of facilities management platform Infraspeak. He is also a co-founder of Founders Founders startup community in Porto. He met Infraspeak's other co-founder while working at the University of Porto's Science and Technology Park (UPTEC), where he held various posts over the course of five years, including Startup Acceleration Program Manager. He had previously founded two startups, Talks 2.0, a conference and networking initiative, and Cooltive-ty, a cultural organization, as well as holding other IT-associated posts. He has an MBA from Porto Business School.

Serial entrepreneur Felipe Ávila da Costa is today the Portuguese co-founder and CEO of facilities management platform Infraspeak. He is also a co-founder of Founders Founders startup community in Porto. He met Infraspeak's other co-founder while working at the University of Porto's Science and Technology Park (UPTEC), where he held various posts over the course of five years, including Startup Acceleration Program Manager. He had previously founded two startups, Talks 2.0, a conference and networking initiative, and Cooltive-ty, a cultural organization, as well as holding other IT-associated posts. He has an MBA from Porto Business School.

Co-founder and CTO of Veniam

Founding CTO of US car sharing platform Zipcar, Roy Russell received his bachelor's in Computer Engineering at MIT. Before Zipcar, he was in charge of speech recognition software development at Kurzweil AI and Lernout & Hauspie. He has served as co-founder and CTO of Veniam since 2013. Russell is married to Robin Chase, co-founder and executive chairman of Veniam and co-founder of Zipcar. Starting in 2010, Russell served as CTO of French car sharing startup Buzzcar (since merged with Drivy). Starting in 2007, he was CTO at US consultancy Meadow Networks and rideshare startup GoLoco. He is based in Boston.

Founding CTO of US car sharing platform Zipcar, Roy Russell received his bachelor's in Computer Engineering at MIT. Before Zipcar, he was in charge of speech recognition software development at Kurzweil AI and Lernout & Hauspie. He has served as co-founder and CTO of Veniam since 2013. Russell is married to Robin Chase, co-founder and executive chairman of Veniam and co-founder of Zipcar. Starting in 2010, Russell served as CTO of French car sharing startup Buzzcar (since merged with Drivy). Starting in 2007, he was CTO at US consultancy Meadow Networks and rideshare startup GoLoco. He is based in Boston.

Co-founder, COO of SingularCover

Hoffman is the COO and co-founder of Spanish AI-enhanced insurtech SingularCover, where he has worked since 2018. He previously worked as COO for Spain-based gaming startup Playtomic and in Indonesia as the CEO and founder of e-commerce startup eTailwind, a partner of Lazada Group. Previously, he worked in Indonesia as the Vice-President of Strategy at Alibaba Group and in management positions covering southern Europe for Berlin-based Zalando, Europe’s leading online fashion platform.Hoffman holds a master’s degree from Madrid’s Carlos III University in International Business Management, with exchange program participation in Switzerland and Brazil.

Hoffman is the COO and co-founder of Spanish AI-enhanced insurtech SingularCover, where he has worked since 2018. He previously worked as COO for Spain-based gaming startup Playtomic and in Indonesia as the CEO and founder of e-commerce startup eTailwind, a partner of Lazada Group. Previously, he worked in Indonesia as the Vice-President of Strategy at Alibaba Group and in management positions covering southern Europe for Berlin-based Zalando, Europe’s leading online fashion platform.Hoffman holds a master’s degree from Madrid’s Carlos III University in International Business Management, with exchange program participation in Switzerland and Brazil.

CEO, co-founder of Psquared

Argentinian native Nicolas Manrique is CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces, where he has worked since 2019. He is also a part-time advisor and investor at startup development agency We Are Grit, since its foundation in 2020. Since 2014, he has also been the owner of a marketing agency for SMEs in his native Buenos Aires, called Estudio Cuervo. In 2018, Manrique founded the Barcelona chapter of Argentinian startup co-working agency La Maquinita. Manrique holds a bachelor’s in business administration from Buenos Aires’ Pontifical Catholic University.

Argentinian native Nicolas Manrique is CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces, where he has worked since 2019. He is also a part-time advisor and investor at startup development agency We Are Grit, since its foundation in 2020. Since 2014, he has also been the owner of a marketing agency for SMEs in his native Buenos Aires, called Estudio Cuervo. In 2018, Manrique founded the Barcelona chapter of Argentinian startup co-working agency La Maquinita. Manrique holds a bachelor’s in business administration from Buenos Aires’ Pontifical Catholic University.

Founder and CEO of Daojia Meishi (“Daojia”)

Undergrad Tsinghua University (Electronics); EMBA, University of Michigan Ann Arbor. Was senior vice-president of online media company Hurray, and founder of failed yellow pages startup. Later joined Lihua Fast Food, where he became CEO.

Undergrad Tsinghua University (Electronics); EMBA, University of Michigan Ann Arbor. Was senior vice-president of online media company Hurray, and founder of failed yellow pages startup. Later joined Lihua Fast Food, where he became CEO.

Co-founder and CEO of Findster

David Barroso (b. 1989) graduated from the University of Aveiro with a master’s in Electronics Engineering and Telecommunications. He is co-founder and CEO of Findster Technologies, the startup behind pet-tracking device Findster Duo.

David Barroso (b. 1989) graduated from the University of Aveiro with a master’s in Electronics Engineering and Telecommunications. He is co-founder and CEO of Findster Technologies, the startup behind pet-tracking device Findster Duo.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

According to INADEM, Mexico's organization of entrepreneurs, DILA Capital is estimated to hold the largest and most valuable VC deal flows in Mexico. Headquartered in Mexico City and founded in 2004, the firm is dedicated to seed and early-stage investments in Latin American markets. Its latest and third fund saw 800 million pesos (US$41.7 million) invested in regional startups.Banking on a diverse and vast network of partners who are mentors and serial startup entrepreneurs, DILA also supports foreign companies in penetrating and establishing their position in the Mexican market. It has managed one exit to date: Petsy, a pet marketplace.

According to INADEM, Mexico's organization of entrepreneurs, DILA Capital is estimated to hold the largest and most valuable VC deal flows in Mexico. Headquartered in Mexico City and founded in 2004, the firm is dedicated to seed and early-stage investments in Latin American markets. Its latest and third fund saw 800 million pesos (US$41.7 million) invested in regional startups.Banking on a diverse and vast network of partners who are mentors and serial startup entrepreneurs, DILA also supports foreign companies in penetrating and establishing their position in the Mexican market. It has managed one exit to date: Petsy, a pet marketplace.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

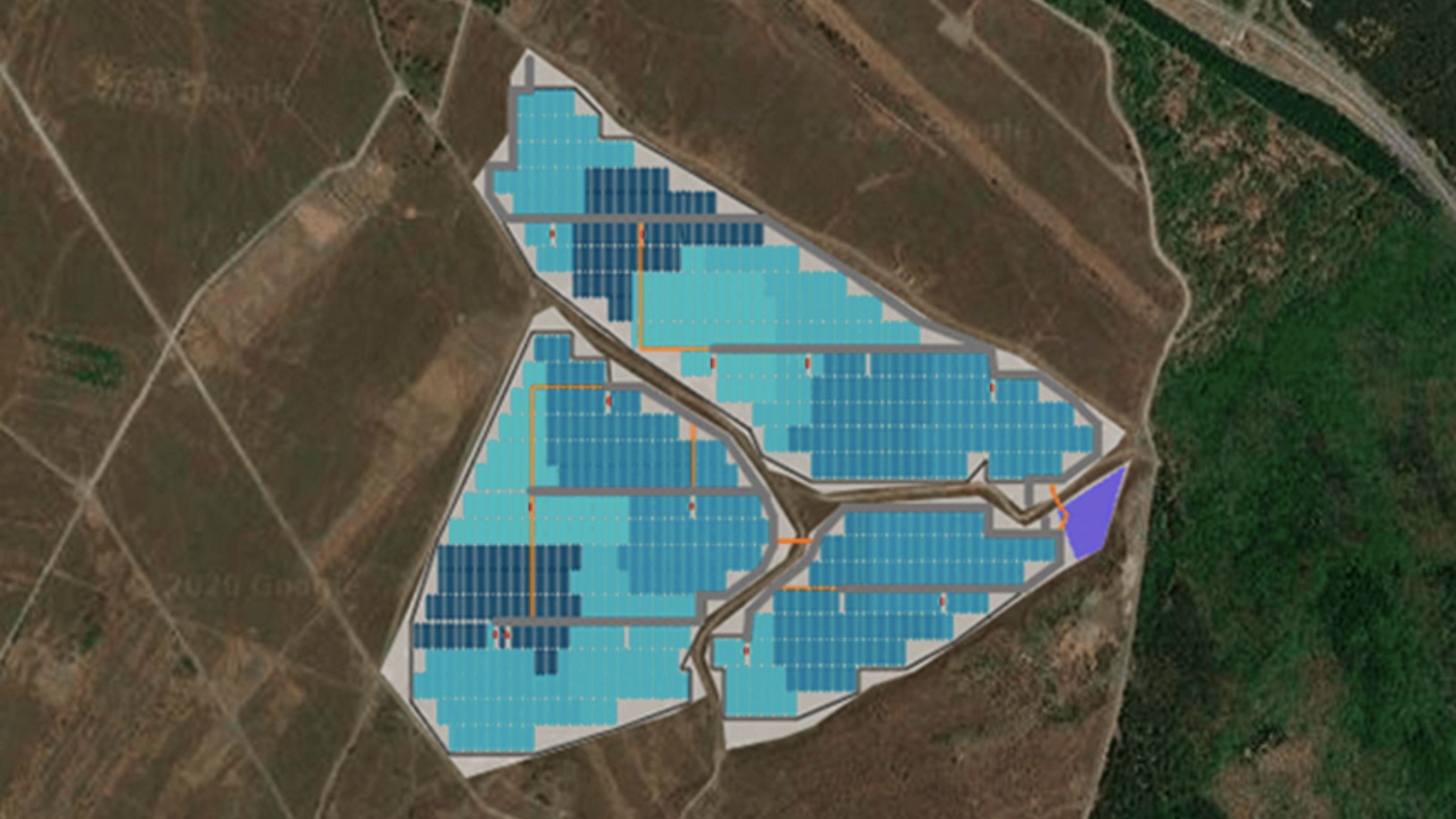

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

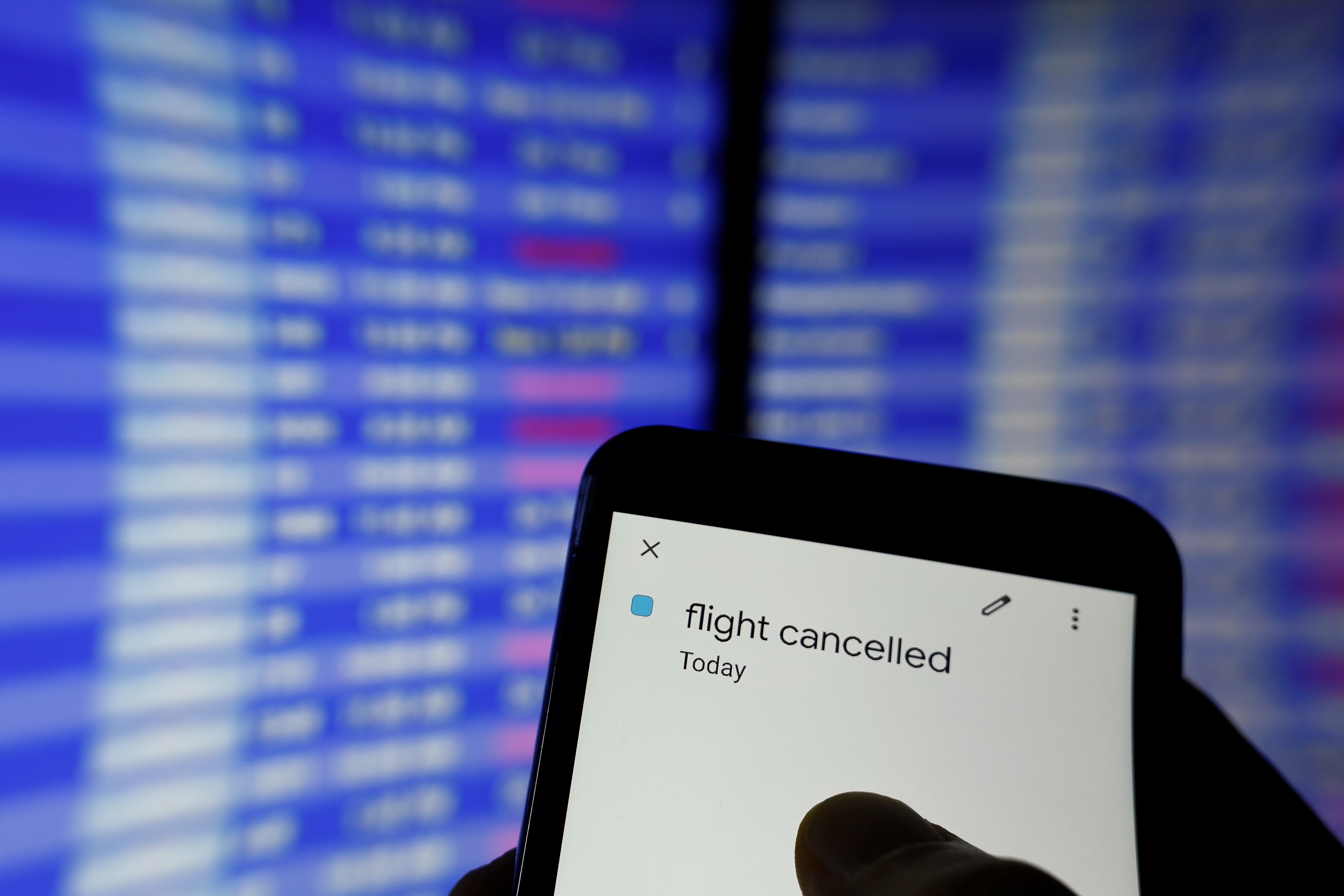

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.