Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Laura González- Estéfani is best known as the co-founder of Venture City. Established in 2017, the tech accelerator has offices in Miami in the US and Madrid in Spain. The director of one of Spain’s largest banks CaixaBank is also a board member of the European Commission’s Innovation Council. She has also worked for Facebook as a country manager for Spain and Portugal.González- Estéfani has also been a prolific private investor and business angel since 2016. She invests across ecosystems and market verticals, including success stories like Cabify and Spotahome. In 2020, she participated in the seed round of Spanish femtech WOOM.

Laura González- Estéfani is best known as the co-founder of Venture City. Established in 2017, the tech accelerator has offices in Miami in the US and Madrid in Spain. The director of one of Spain’s largest banks CaixaBank is also a board member of the European Commission’s Innovation Council. She has also worked for Facebook as a country manager for Spain and Portugal.González- Estéfani has also been a prolific private investor and business angel since 2016. She invests across ecosystems and market verticals, including success stories like Cabify and Spotahome. In 2020, she participated in the seed round of Spanish femtech WOOM.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Amand Ventures is a venture capital firm established in 2016. Based in Singapore, it has backed the payments startup Wallex and Indonesian online jewelry business Orori.

Amand Ventures is a venture capital firm established in 2016. Based in Singapore, it has backed the payments startup Wallex and Indonesian online jewelry business Orori.

Money Forward is a Japanese fintech startup that provides software for corporate accounting and personal finance management. The company has been listed on the Tokyo Stock Exchange since late 2017.

Money Forward is a Japanese fintech startup that provides software for corporate accounting and personal finance management. The company has been listed on the Tokyo Stock Exchange since late 2017.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

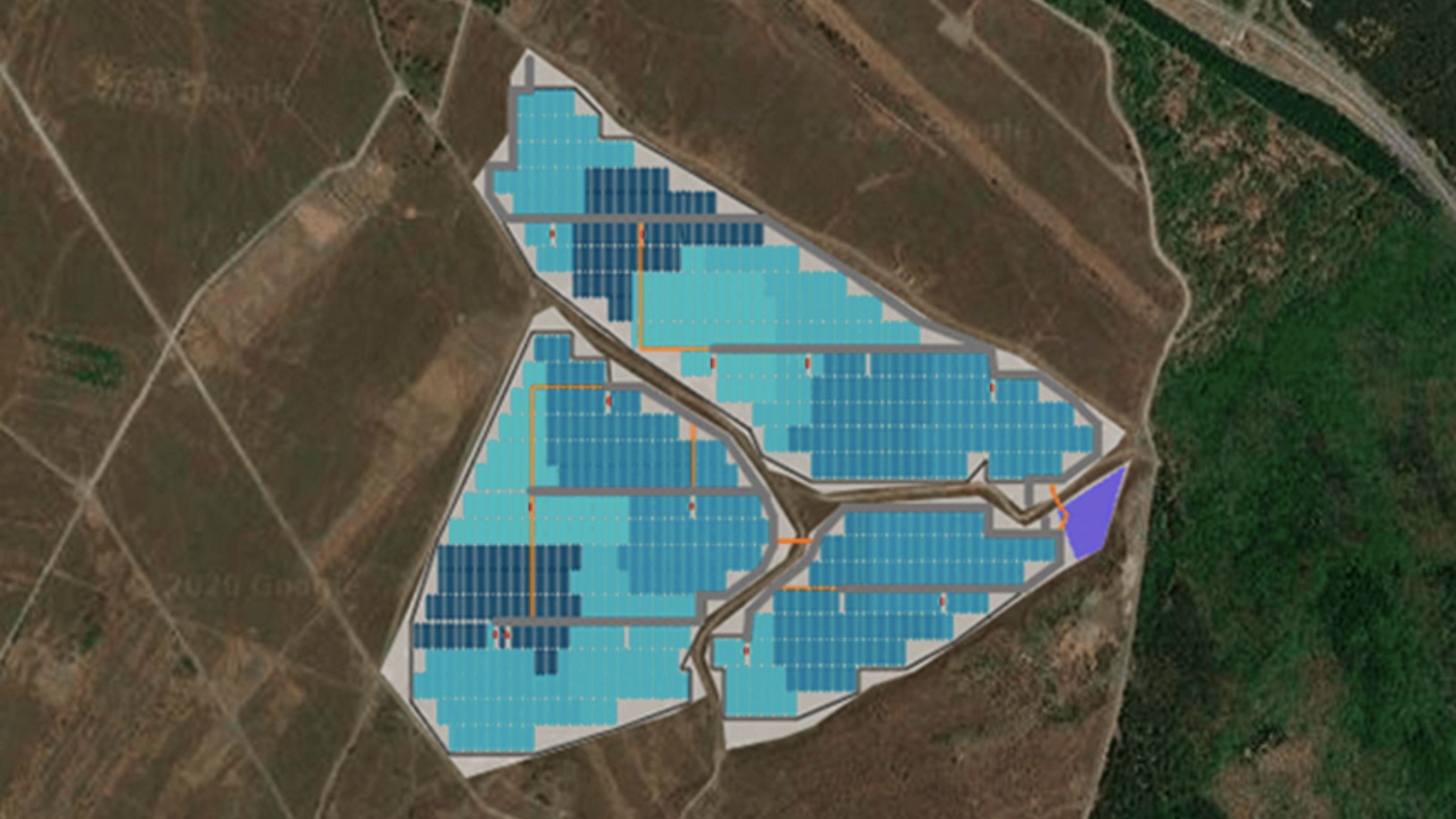

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.