Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

IDEPA is the governmental Agency for Economic Development of the Principality of Asturias, under the Ministry of Employment, Industry, and Economic Promition, founded in 1983. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

IDEPA is the governmental Agency for Economic Development of the Principality of Asturias, under the Ministry of Employment, Industry, and Economic Promition, founded in 1983. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Wang, a former CCTV host, is the founder and CEO of Kaishu Story. His startup operates a WeChat official account with 20 million followers that generates RMB 200 million in revenue annually. Wang participated in Kuaipeilian's seed funding round.

Wang, a former CCTV host, is the founder and CEO of Kaishu Story. His startup operates a WeChat official account with 20 million followers that generates RMB 200 million in revenue annually. Wang participated in Kuaipeilian's seed funding round.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Smart Delivery Routes is a last-mile delivery startup based in Andalucia and founded in 2017. Its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed €520,000 in a 2021 seed funding round. It is also Visualfy’s distribution partner for the Andalucian region.

Smart Delivery Routes is a last-mile delivery startup based in Andalucia and founded in 2017. Its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed €520,000 in a 2021 seed funding round. It is also Visualfy’s distribution partner for the Andalucian region.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

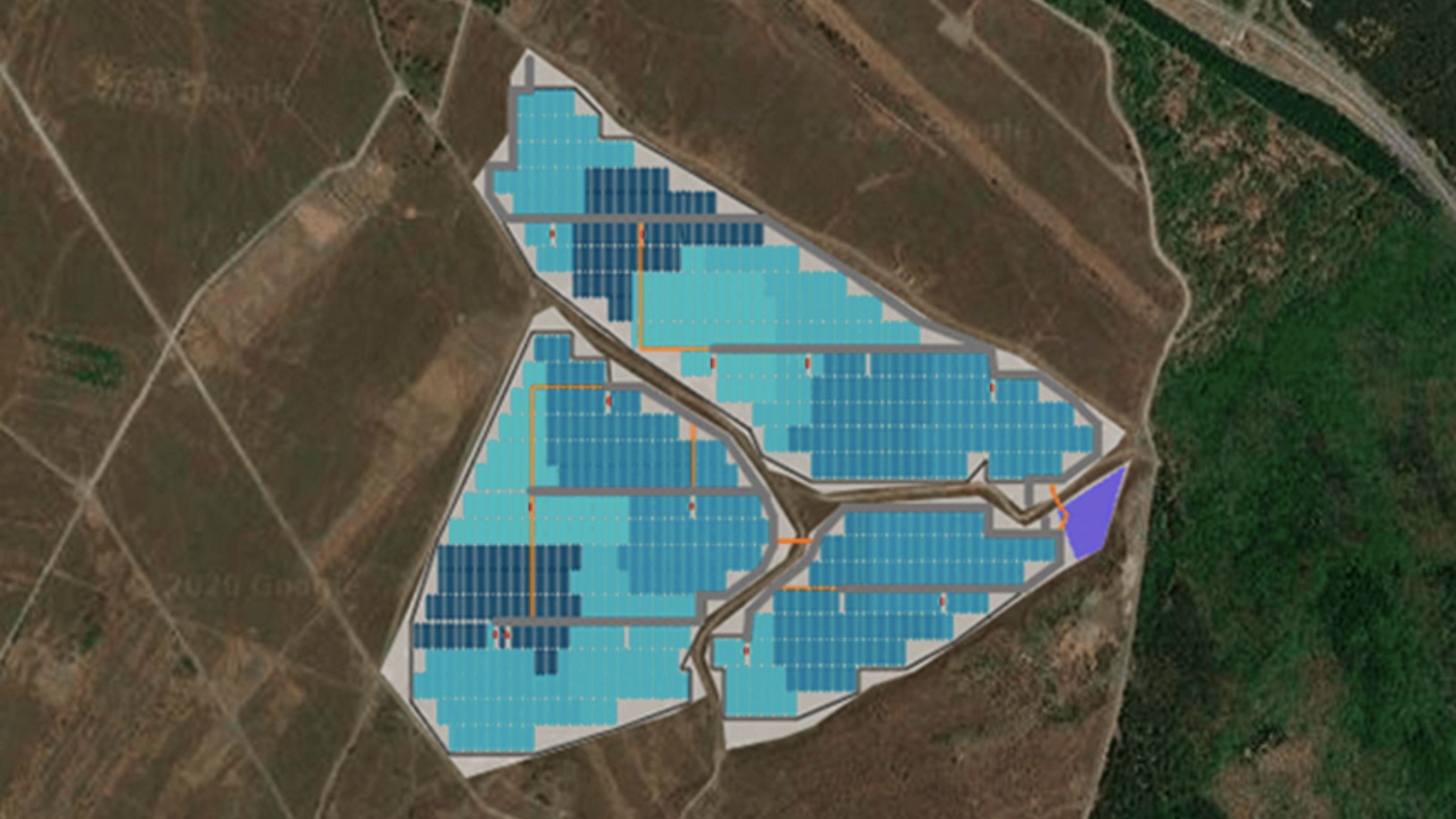

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.