Continental Grain Company

-

DATABASE (824)

-

ARTICLES (722)

CEO and co-founder of AgroCenta (Holdings)

Francis Obirikorang completed a bachelor’s degree in materials engineering in 2006 at Kwame Nkrumah University of Science and Technology (KNUST) in Kumasi, Ghana.In 2008, Obirikorang started work as a technical writer at Esoko, a Ghanaian digital development agency in Accra, where he met web developer Michael Ocansey. Obirikorang left Esoko in 2010 and became lead technical writer for Corenett, a transactions processing management company. In 2013, he worked at digital advertising agency TXT Ghana as a business analyst until 2015.In January 2015, Obirikorang and Ocansey established their first startup Swappaholics Holdings in the British Virgin Islands. In 2016, the two friends also co-founded AgroCenta (Holdings) Limited in Mauritius with Obirikorang as CEO and Ocansey as CTO. Ocansey left the Swappaholics in 2016 to focus on building AgroCenta.Obirikorang still runs both companies as CEO and joined the global entrepreneur community Startup Grind in 2016 as chapter director of Kumasi, Ghana’s second-largest city.

Francis Obirikorang completed a bachelor’s degree in materials engineering in 2006 at Kwame Nkrumah University of Science and Technology (KNUST) in Kumasi, Ghana.In 2008, Obirikorang started work as a technical writer at Esoko, a Ghanaian digital development agency in Accra, where he met web developer Michael Ocansey. Obirikorang left Esoko in 2010 and became lead technical writer for Corenett, a transactions processing management company. In 2013, he worked at digital advertising agency TXT Ghana as a business analyst until 2015.In January 2015, Obirikorang and Ocansey established their first startup Swappaholics Holdings in the British Virgin Islands. In 2016, the two friends also co-founded AgroCenta (Holdings) Limited in Mauritius with Obirikorang as CEO and Ocansey as CTO. Ocansey left the Swappaholics in 2016 to focus on building AgroCenta.Obirikorang still runs both companies as CEO and joined the global entrepreneur community Startup Grind in 2016 as chapter director of Kumasi, Ghana’s second-largest city.

Co-founder of Therapixal

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

Olivier Clatz is the French co-founder of AI medical diagnosis company Therapixel, creator of MammoScreen breast cancer screening and diagnosis tool. Prior to co-founding Therapixel, Clatz worked for six years as a research scientist at INRIA (National Institute for Research in Digital Science and Technology) based at the Sophia Antipolis technology park near Antibes, in the south of France. His later work with INRIA focused on exploiting machine learning algorithms for medical imaging processing. Prior to this, he was a research associate at Harvard Medical School, in the US. In 2006, he completed his PhD at INRIA on the concept of personalized medicine. Clatz also holds a PhD in philosophy from the Ecole des Mines de Paris, and a master's degree in applied mathematics from the Ecole Normale Supérieure Paris-Saclay. Currently, he works at the French Government’s Commissariat Générale pour l’Investissement managing the national program AI For Diagnostics. He left Therapixel in 2019.

CTO, co-founder of Teliman

Abdoulaye Maiga is CTO and co-founder at Teliman, Mali’s first on-demand mobility startup and one of francophone Africa’s first, where he has worked since its launch in 2018. Before that, he was CTO and co-founder at French real estate startup Wemblee where he still works part-time from Mali, initially simultaneously working as a salesforce administrator and developer in chemical company SEPPIC.Maiga previously worked at Rakuten in Tokyo for one year as a research and development VR scientist and also completed a stint at Accenture in Paris as an information system consultant. He also completed short stints in engineering at BCS Group in New Zealand and in business development at EATOPS in the Netherlands. The Malian national obtained two master’s degrees in innovation economics from Universite Paris-Saclay (2017) and in computer science from Keio University in Tokyo (2015), after winning scholarships to study overseas.

Abdoulaye Maiga is CTO and co-founder at Teliman, Mali’s first on-demand mobility startup and one of francophone Africa’s first, where he has worked since its launch in 2018. Before that, he was CTO and co-founder at French real estate startup Wemblee where he still works part-time from Mali, initially simultaneously working as a salesforce administrator and developer in chemical company SEPPIC.Maiga previously worked at Rakuten in Tokyo for one year as a research and development VR scientist and also completed a stint at Accenture in Paris as an information system consultant. He also completed short stints in engineering at BCS Group in New Zealand and in business development at EATOPS in the Netherlands. The Malian national obtained two master’s degrees in innovation economics from Universite Paris-Saclay (2017) and in computer science from Keio University in Tokyo (2015), after winning scholarships to study overseas.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Founded under a different name in 2002, the company became UCAR in 2016. A comprehensive car services provider, it now operates in nearly 300 cities across China. It has served around 60 million Chinese users and manages a total of 400,000 vehicles. UCAR has four business units: car rental service provider zuche.com, chauffeured car service provider 10101111.com, auto e-commerce platform maimaiche.com and automotive financing service platform carbank.cn. It invests in automotive businesses and startups.

Founded under a different name in 2002, the company became UCAR in 2016. A comprehensive car services provider, it now operates in nearly 300 cities across China. It has served around 60 million Chinese users and manages a total of 400,000 vehicles. UCAR has four business units: car rental service provider zuche.com, chauffeured car service provider 10101111.com, auto e-commerce platform maimaiche.com and automotive financing service platform carbank.cn. It invests in automotive businesses and startups.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

Future Food Asia: Temasek, Continental Grain on investing in agrifood in Singapore and China

The two heavyweight investors discuss opportunities, needs and how agrifood startups can scale in Asian markets

SmartAHC: Wearables for pigs and smart farm management to boost productivity

SmartAHC has also expanded beyond pig farms to related sectors in the supply chain, including insurance, banking and local government

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

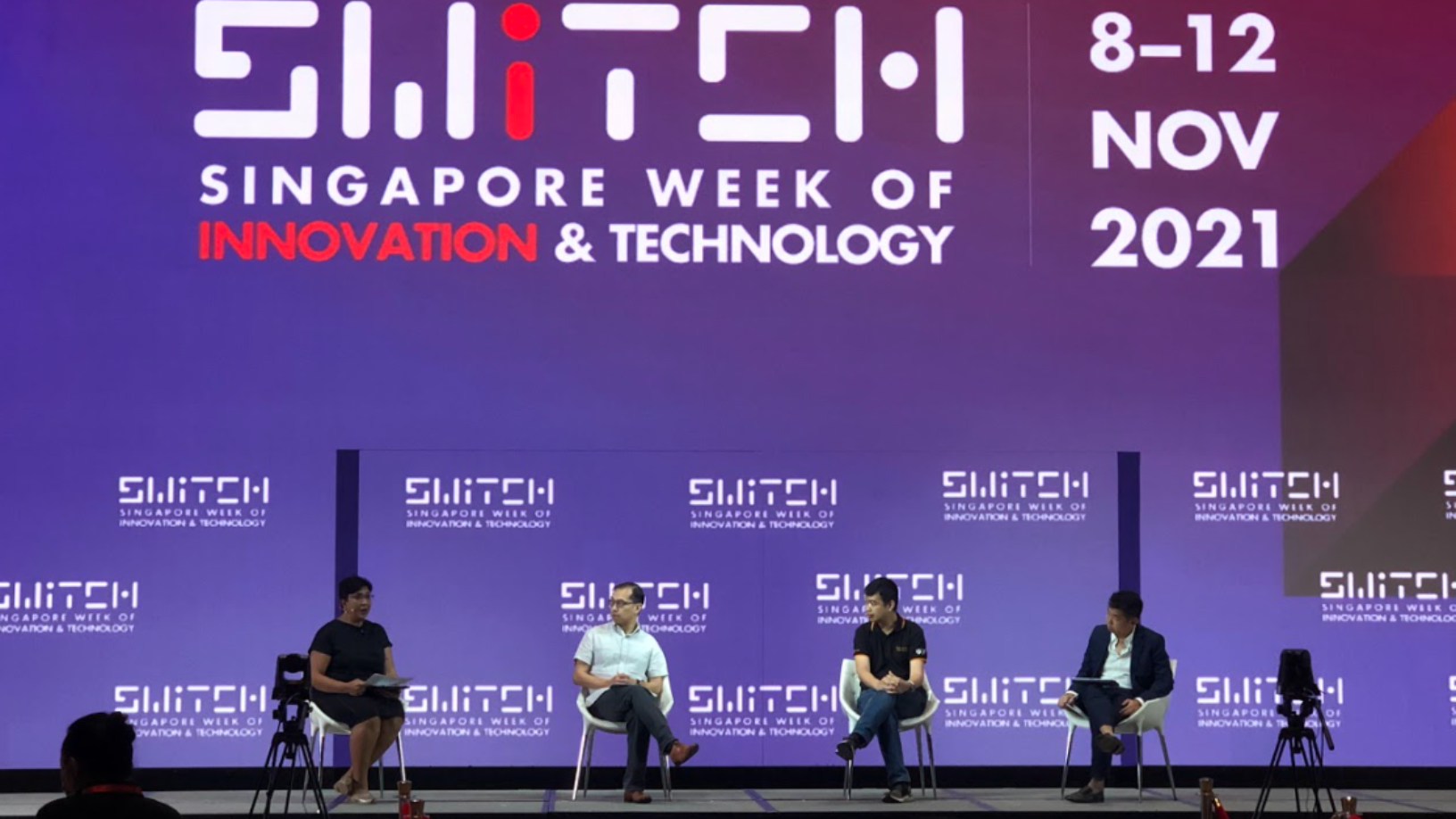

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Consumers Trust: The company that gives consumers a voice

Consumers Trust has become Portugal's go-to company for customer complaint resolution; it is seeking funding to enable it to replicate its success in new markets

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Sorry, we couldn’t find any matches for“Continental Grain Company”.