Covid

-

DATABASE (7)

-

ARTICLES (240)

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Game developer Digital Happiness promotes Indonesia with its ghosts and ghouls

The Indonesian studio behind the popular horror game, DreadOut, recently released a sequel after its first game saw 2.5m downloads worldwide and raked in $7.5m, and was even made into a movie

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

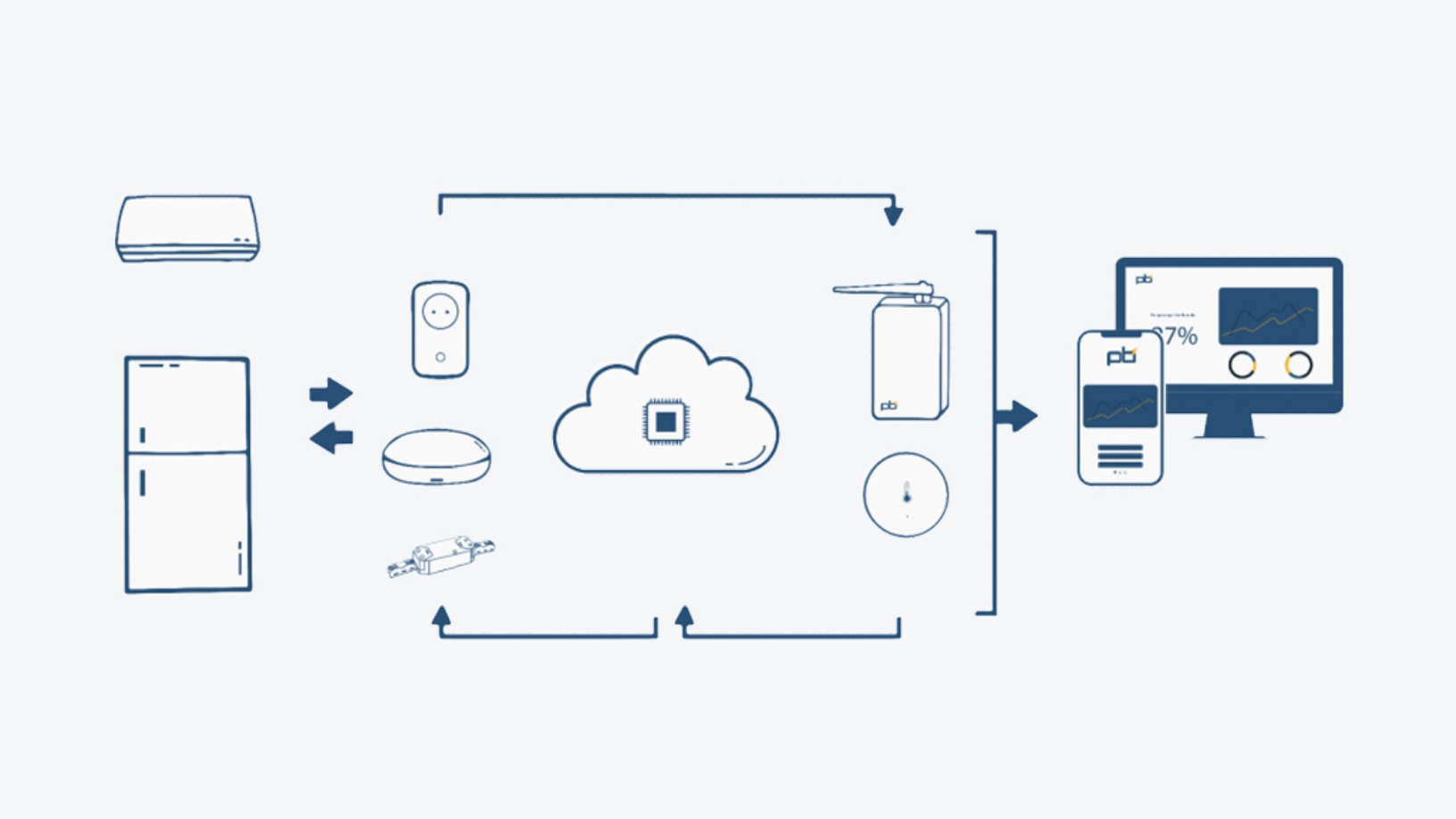

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Kuaishou: Grabbing a share of China's near-trillion-RMB livestreaming e-commerce market

With 300m daily users, the short video app for the grassroots has partnered JD.com to offer discounts to convert users into online shoppers

More Asian men are into skincare and health products, and Elio is here to help (discreetly)

Elio believes offering privacy, free online consultations and discreet product packaging will encourage more men to take better care of their health

BukaPengadaan: The B2B procurement service from e-commerce giant Bukalapak

Bukalapak’s e-procurement arm taps a growing market while helping vendors get online and access a broader range of clients

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

Bizhare equity crowdfunding attracts over 50,000 retail investors, starts secondary trading

A partner of the Indonesia Central Securities Depository, Bizhare also lowered minimum investment amounts, implemented scripless trading and handpicked businesses on its platform

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

Sweden's imogo pioneers eco-friendly dye spraying system

The startup’s dyeing and finishing solutions convert the most resource-consuming parts of textile value chains into sustainable processes, with virtually no wastewater and using less energy and chemicals

Sorry, we couldn’t find any matches for“Covid”.