DO Ventures

-

DATABASE (309)

-

ARTICLES (536)

Founded in 1986 by global industrialist and philanthropist Len Blavatnik, Access Industries is a privately held industrial group with long-term holdings worldwide. It is headquartered in New York City with additional offices in London and Moscow. In 2015, Access Industries established Access Technology Ventures which has invested in Snapchat, Yelp, Alibaba, Spotify, etc.

Founded in 1986 by global industrialist and philanthropist Len Blavatnik, Access Industries is a privately held industrial group with long-term holdings worldwide. It is headquartered in New York City with additional offices in London and Moscow. In 2015, Access Industries established Access Technology Ventures which has invested in Snapchat, Yelp, Alibaba, Spotify, etc.

BiG Start Ventures is an early-stage investor in European startups involved in fintech, insurance and cybersecurity. Established in Lisbon in 2015, it is part of the Portuguese bank Banco de Investimento Global (BiG) with its headquarters in Lisbon. To date, it has participated in three seed funding rounds.

BiG Start Ventures is an early-stage investor in European startups involved in fintech, insurance and cybersecurity. Established in Lisbon in 2015, it is part of the Portuguese bank Banco de Investimento Global (BiG) with its headquarters in Lisbon. To date, it has participated in three seed funding rounds.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Co-founder and CEO of HelloBeauty

Prior to establishing the beauty services marketplace HelloBeauty, Dennish Tjandra was the Head of Account Management and Procurement at Zen Rooms, a budget hotel network founded by Rocket Internet. Before that, he had founded a few short-lived ventures and worked at Rodamas, a major Indonesian group of FMCG companies. Dennish graduated in Management at Universitas Katolik Parahyangan, Indonesia.

Prior to establishing the beauty services marketplace HelloBeauty, Dennish Tjandra was the Head of Account Management and Procurement at Zen Rooms, a budget hotel network founded by Rocket Internet. Before that, he had founded a few short-lived ventures and worked at Rodamas, a major Indonesian group of FMCG companies. Dennish graduated in Management at Universitas Katolik Parahyangan, Indonesia.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Founded in 2017 by the ex-COO of Deutsche Bank Henry Ritchotte, Ritmir Ventures is based in London and has invested in nine companies internationally. Ritchotte is passionate about digital innovation within the banking sector and established Ritmir specifically to invest in fintech startups during the seed and Series A funding stages.

Founded in 2017 by the ex-COO of Deutsche Bank Henry Ritchotte, Ritmir Ventures is based in London and has invested in nine companies internationally. Ritchotte is passionate about digital innovation within the banking sector and established Ritmir specifically to invest in fintech startups during the seed and Series A funding stages.

Founded by Hillhouse Capital in February 2020, GL Ventures mainly invests in early-stage startups from diverse sectors like pharmaceutical, SaaS, internet-based consumption/technology and emerging consumer goods/services.The RMB/USD dual currency VC-arm of Hillhouse currently manages total funds worth RMB 10bn from limited partners including university endowments, sovereign wealth funds, pension funds, FOF and family offices. The VC has made nearly 200 investments in its first year of operations.

Founded by Hillhouse Capital in February 2020, GL Ventures mainly invests in early-stage startups from diverse sectors like pharmaceutical, SaaS, internet-based consumption/technology and emerging consumer goods/services.The RMB/USD dual currency VC-arm of Hillhouse currently manages total funds worth RMB 10bn from limited partners including university endowments, sovereign wealth funds, pension funds, FOF and family offices. The VC has made nearly 200 investments in its first year of operations.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

Co-founder and CEO of Ekrut

Prior to establishing headhunting platform Ekrut in 2016, Steven Suliawan was an Entrepreneur-in-Residence at East Ventures. While at East Venture, he helped portfolio companies identify potential employees and recognized the need to streamline the manual process of sorting through job applications and resumes. Steven graduated with a bachelor's in Industrial Engineering from Ohio State University, USA.

Prior to establishing headhunting platform Ekrut in 2016, Steven Suliawan was an Entrepreneur-in-Residence at East Ventures. While at East Venture, he helped portfolio companies identify potential employees and recognized the need to streamline the manual process of sorting through job applications and resumes. Steven graduated with a bachelor's in Industrial Engineering from Ohio State University, USA.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

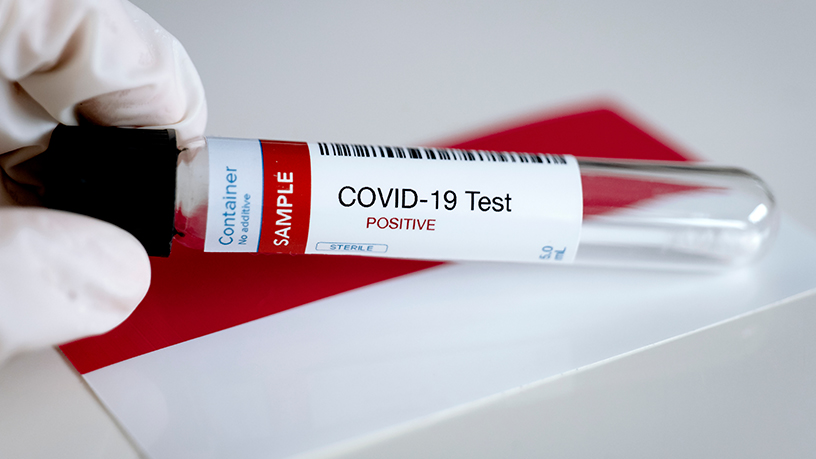

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

Sorry, we couldn’t find any matches for“DO Ventures”.