Deep tech

-

DATABASE (439)

-

ARTICLES (447)

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

SPRI is the Business Development Agency of the Basque Government under the Department of Economic Development and Infrastructures. Established in 1982, the Bilbao-based agency primarily invests in local startups, including non-tech companies from the Spanish Basque Country.

SPRI is the Business Development Agency of the Basque Government under the Department of Economic Development and Infrastructures. Established in 1982, the Bilbao-based agency primarily invests in local startups, including non-tech companies from the Spanish Basque Country.

CEO and founder of Diamond Foundry

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Headquartered in Shenzhen, Ren Capital was founded in March 2015 by a group of young entrepreneurs. The VC invests mainly in tech startups and manages assets worth RMB 500m. It offers management expertise to portfolio companies including support for tax planning and IPO preparation.

Headquartered in Shenzhen, Ren Capital was founded in March 2015 by a group of young entrepreneurs. The VC invests mainly in tech startups and manages assets worth RMB 500m. It offers management expertise to portfolio companies including support for tax planning and IPO preparation.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Founder & President of Eimageglobal

As a graduate in Biomedical Engineering from Southeast University as well as Clinical Medicine from Nanjing Medical University, Chai Xueting has always been aware of the issues plaguing the traditional medical imaging system. The exorbitant cost of archiving past records and the lack of a comprehensive medical image sharing system between hospitals for a fully effective diagnosis have long raised concerns in his mind. But it was while taking his young daughter to the hospital for a health checkup, personally experiencing these issues, that Chai became ever more determined to build a cloud-based medical system – hence his founding of Eimageglobal. In 2017, Chai won the “Young Tech Giant” Award by Zhejiang Entrepreneur Committee.

As a graduate in Biomedical Engineering from Southeast University as well as Clinical Medicine from Nanjing Medical University, Chai Xueting has always been aware of the issues plaguing the traditional medical imaging system. The exorbitant cost of archiving past records and the lack of a comprehensive medical image sharing system between hospitals for a fully effective diagnosis have long raised concerns in his mind. But it was while taking his young daughter to the hospital for a health checkup, personally experiencing these issues, that Chai became ever more determined to build a cloud-based medical system – hence his founding of Eimageglobal. In 2017, Chai won the “Young Tech Giant” Award by Zhejiang Entrepreneur Committee.

Co-founder of Veniam

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

Cofounder of VUE Vlog

Co-founder of VUE Vlog, Li Zaolu graduated from Beijing University of Technology in computer science although she was more interested in business management. Upon graduation, she worked in business development for Nokia, NetEase and Wandoujia. She was one of the founding partners of NetEase's Youdao dictionary. In Wandoujia, she led the business development team to bring in new users. Some 700,000 new users started to use the app everyday compared to only 10,000 a day when she started. From 2014 to 2015, Wandoujia's business share was taken by tech giants. In 2016, Li Zaolu left Wandoujia and co-founded VUE.

Co-founder of VUE Vlog, Li Zaolu graduated from Beijing University of Technology in computer science although she was more interested in business management. Upon graduation, she worked in business development for Nokia, NetEase and Wandoujia. She was one of the founding partners of NetEase's Youdao dictionary. In Wandoujia, she led the business development team to bring in new users. Some 700,000 new users started to use the app everyday compared to only 10,000 a day when she started. From 2014 to 2015, Wandoujia's business share was taken by tech giants. In 2016, Li Zaolu left Wandoujia and co-founded VUE.

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

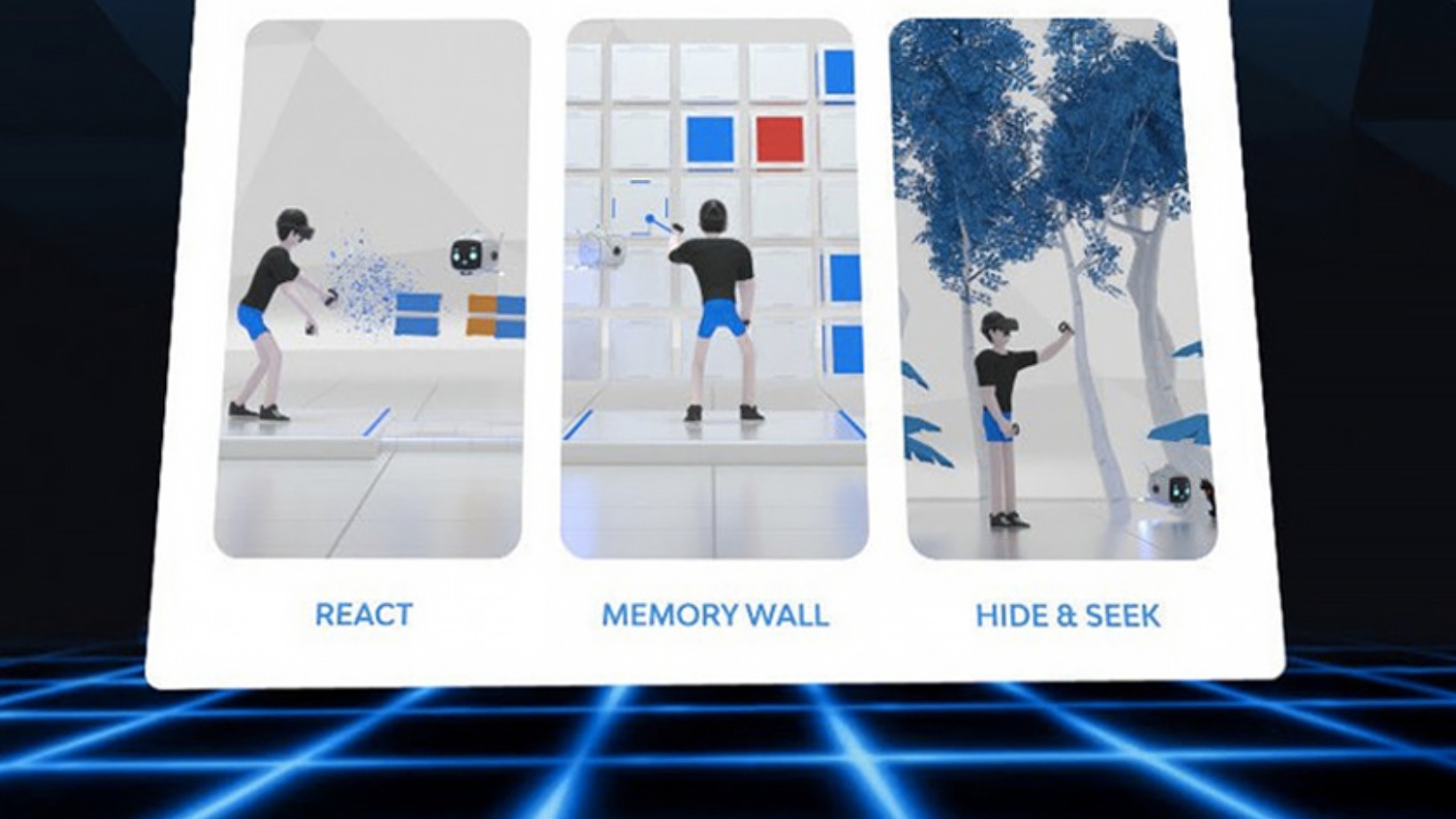

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

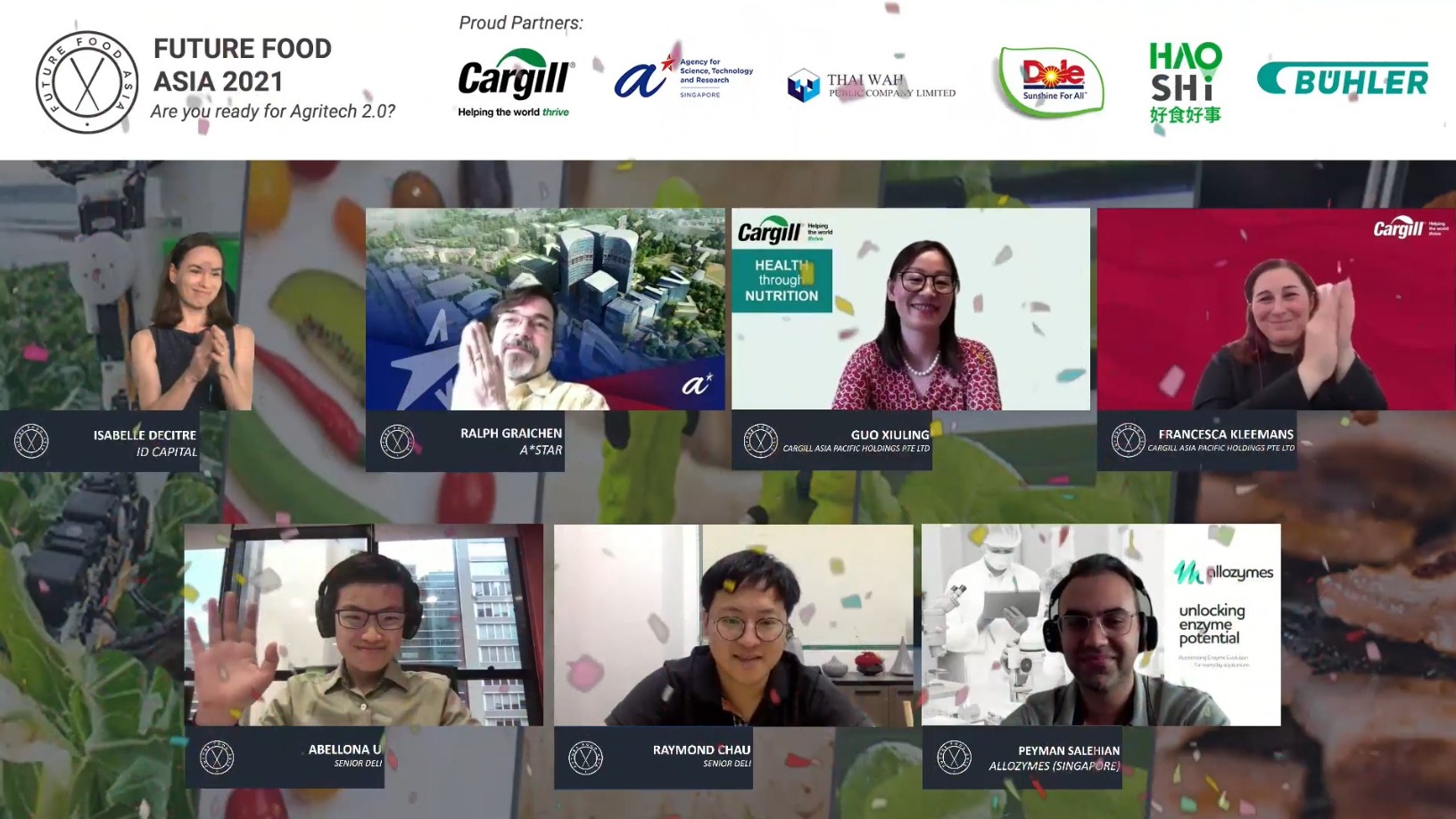

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Sorry, we couldn’t find any matches for“Deep tech”.