Deep tech

-

DATABASE (439)

-

ARTICLES (447)

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Founded in 1996. With over US$3 billion under management, DCM Ventures has invested more than 280 tech companies in the US and Asia. They focus on seed, early and mid-stage companies in the mobile, consumer internet, software and services sectors. They are behind the A-Fund, which is the world’s first Android-focused VC fund.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Established in 2014 by Niu Wenwen, chief editor, president and publisher of Entrepreneur magazine, Dark Horse Ventures invests in early-stage startups in the internet, consumption upgrade, pan-entertainment and high-tech fields. Its backers include many well-known founders, institutional and individual investors such as Liu Qiangdong, Yao Jingbo, Wang Changtian, Bobo Xu, Sequoia Capital China, etc.

Established in 2014 by Niu Wenwen, chief editor, president and publisher of Entrepreneur magazine, Dark Horse Ventures invests in early-stage startups in the internet, consumption upgrade, pan-entertainment and high-tech fields. Its backers include many well-known founders, institutional and individual investors such as Liu Qiangdong, Yao Jingbo, Wang Changtian, Bobo Xu, Sequoia Capital China, etc.

Established in Shanghai in 2011, PreAngel Fund has set up six funds with a total of RMB 600 million in assets under management. So far, the firm has invested RMB 300 million in over 300 Chinese and American tech companies in the fields of mobile internet, hardware, healthcare, finance, insurance, e-commerce, sports, among others.

Established in Shanghai in 2011, PreAngel Fund has set up six funds with a total of RMB 600 million in assets under management. So far, the firm has invested RMB 300 million in over 300 Chinese and American tech companies in the fields of mobile internet, hardware, healthcare, finance, insurance, e-commerce, sports, among others.

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

The Gassó family is a Spanish entreprenurial family known for its GAES auditive solutions and centers for the hearing-impaired, in existence since 1949. Though the family has many charitable interests, it had not disclosed any investments in tech startups until leading the 2019 seed round of biotech startup VEnvirotech, which produces bioplastics from corporates’ organic waste.

CEO of Shenzhourong

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Paris-based micro VC Kima Ventures was founded in 2010 by French tech billionaire Xavier Niel and French-Israeli angel investor/entrepreneur Jeremie Berrebi. They invest in early-stage companies in any sector, regardless of geography, and invest in 2–3 companies on a weekly basis. As of end-2016, Kima had a portfolio of more than 450 companies in 30 countries worldwide.

Paris-based micro VC Kima Ventures was founded in 2010 by French tech billionaire Xavier Niel and French-Israeli angel investor/entrepreneur Jeremie Berrebi. They invest in early-stage companies in any sector, regardless of geography, and invest in 2–3 companies on a weekly basis. As of end-2016, Kima had a portfolio of more than 450 companies in 30 countries worldwide.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

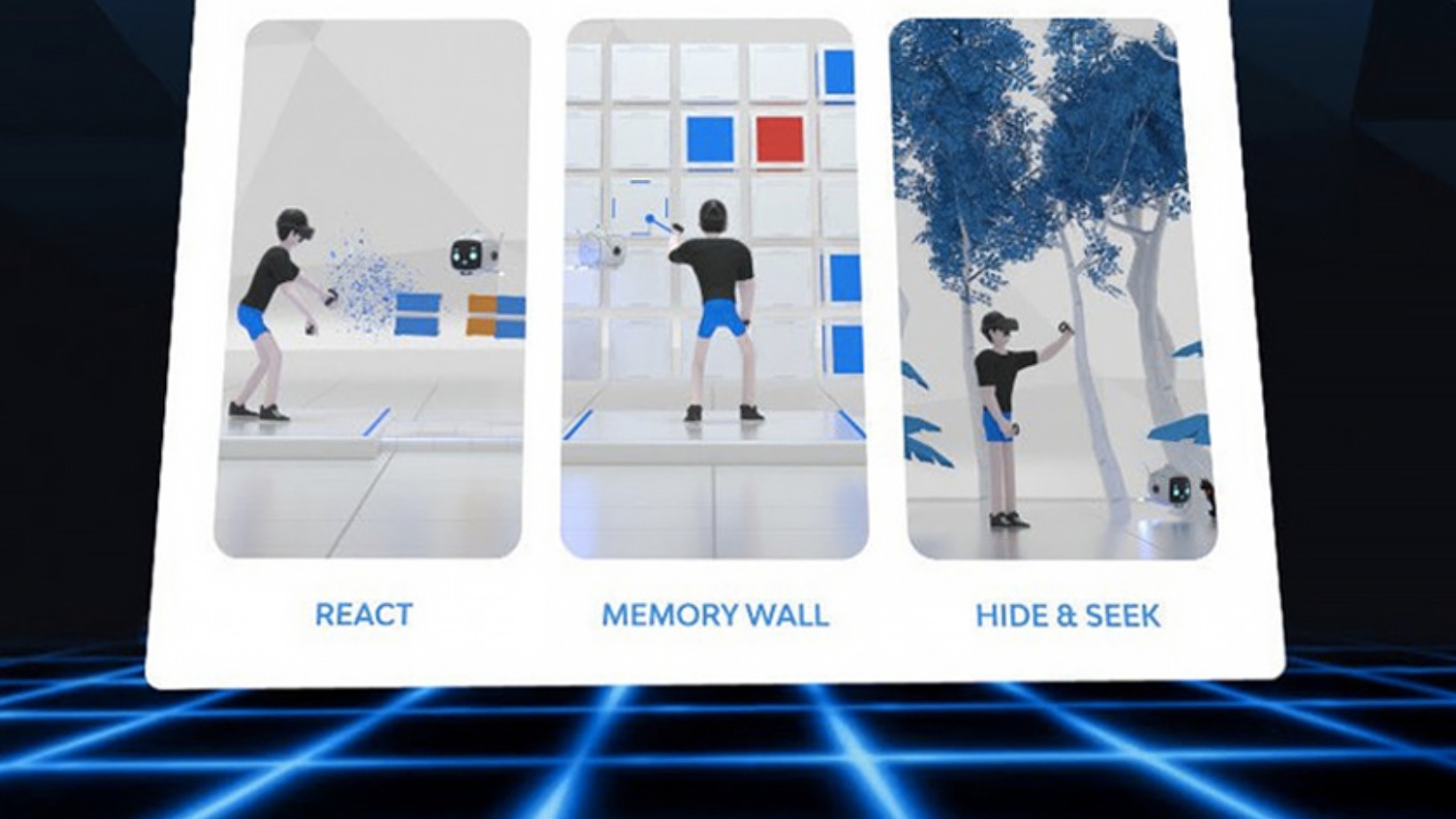

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Sorry, we couldn’t find any matches for“Deep tech”.