Deep tech

-

DATABASE (439)

-

ARTICLES (447)

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

In January 2006, Chen Hua (Tony Chen) co-founded Kuxun.cn, a Chinese travel and hotel search engine that was acquired by TripAdvisor in 2009. Chen exited Kuxun in late 2008 and joined Alibaba in early 2009, working on the application of search engine technology. He resigned in February 2011 and started a mobile tech enterprise. In May 2012, he released Changba, an app offering users a portable solo KTV booth that attracted over 1m users in just one week after its release.

In January 2006, Chen Hua (Tony Chen) co-founded Kuxun.cn, a Chinese travel and hotel search engine that was acquired by TripAdvisor in 2009. Chen exited Kuxun in late 2008 and joined Alibaba in early 2009, working on the application of search engine technology. He resigned in February 2011 and started a mobile tech enterprise. In May 2012, he released Changba, an app offering users a portable solo KTV booth that attracted over 1m users in just one week after its release.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

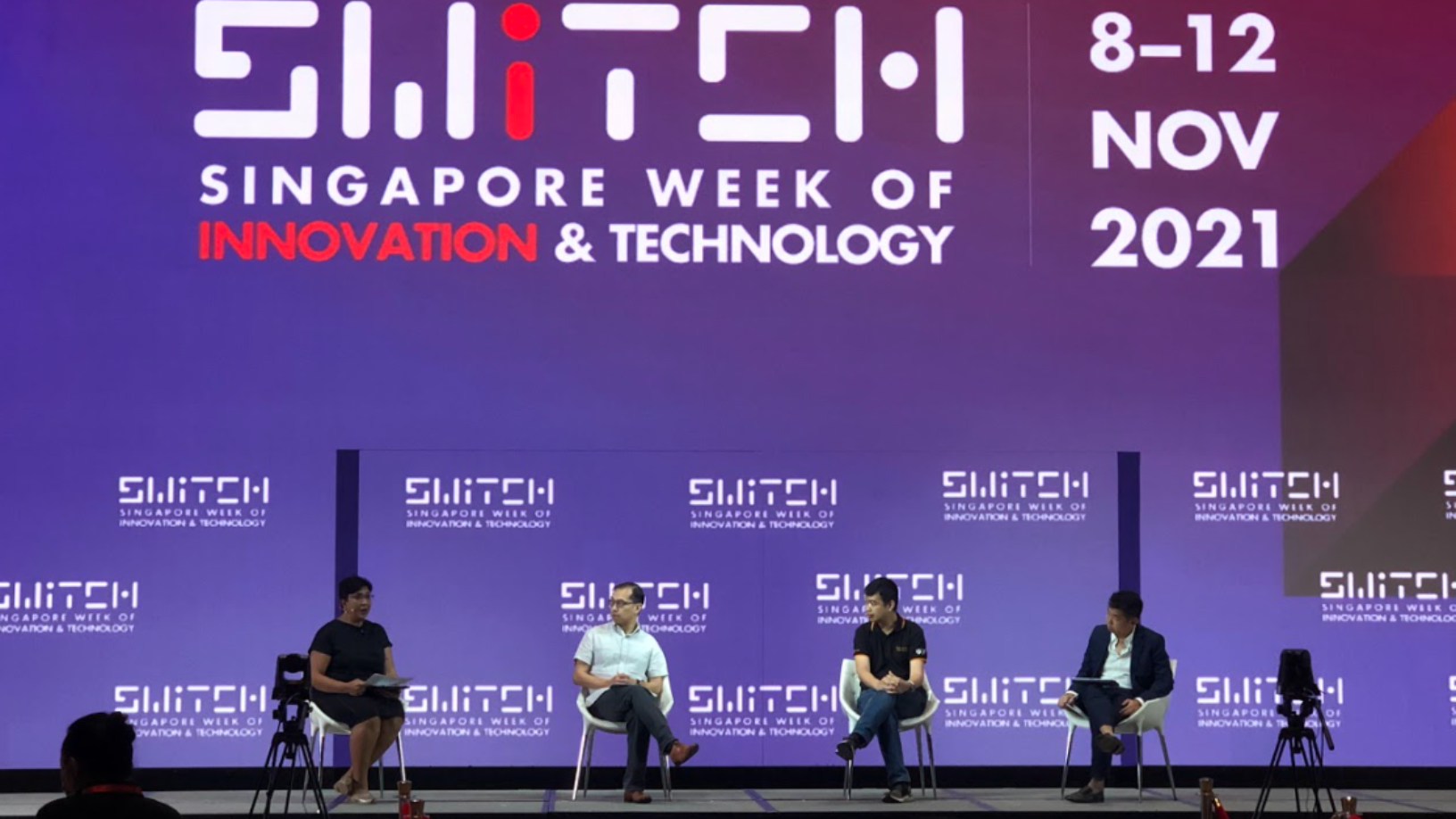

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

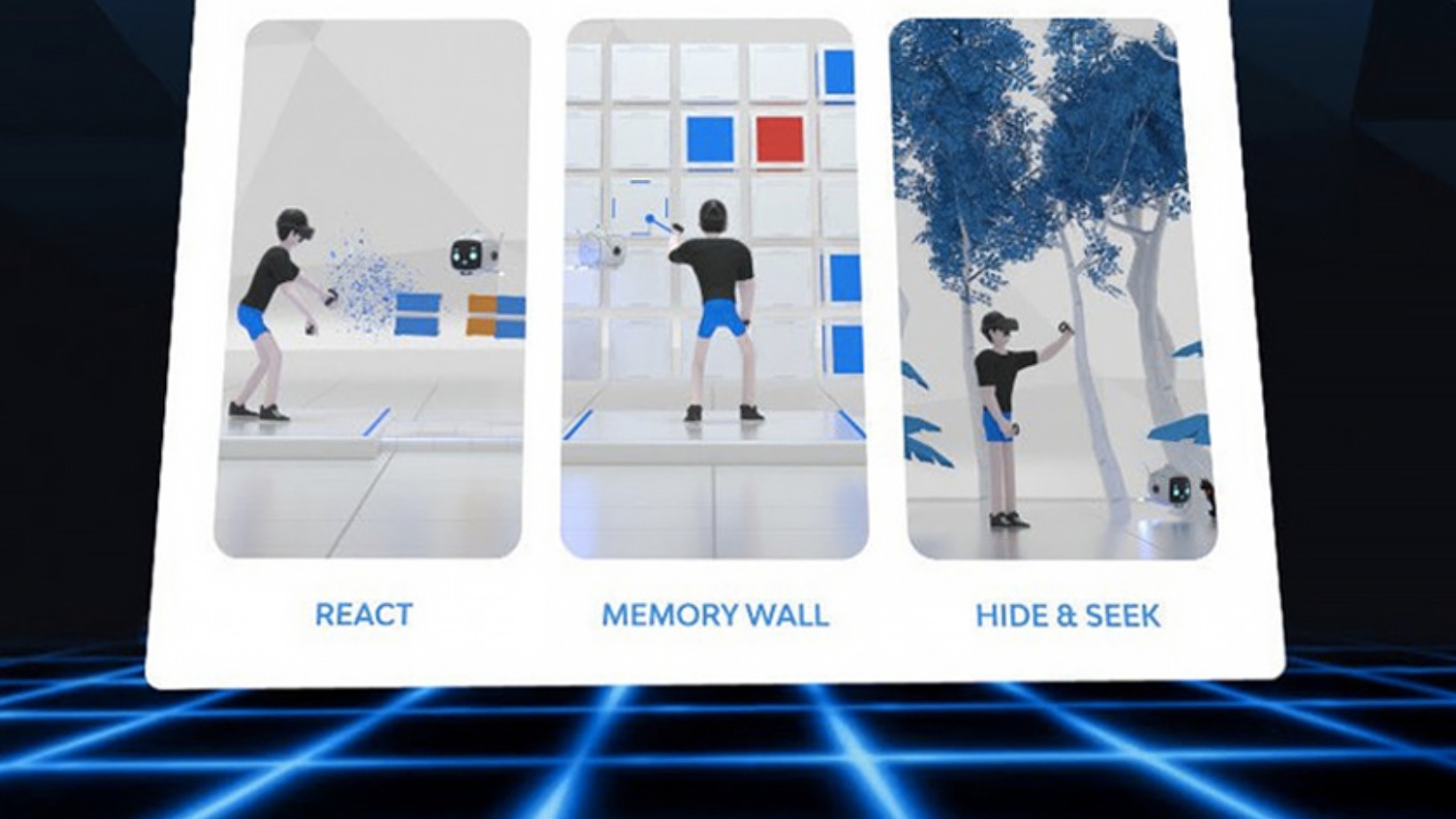

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

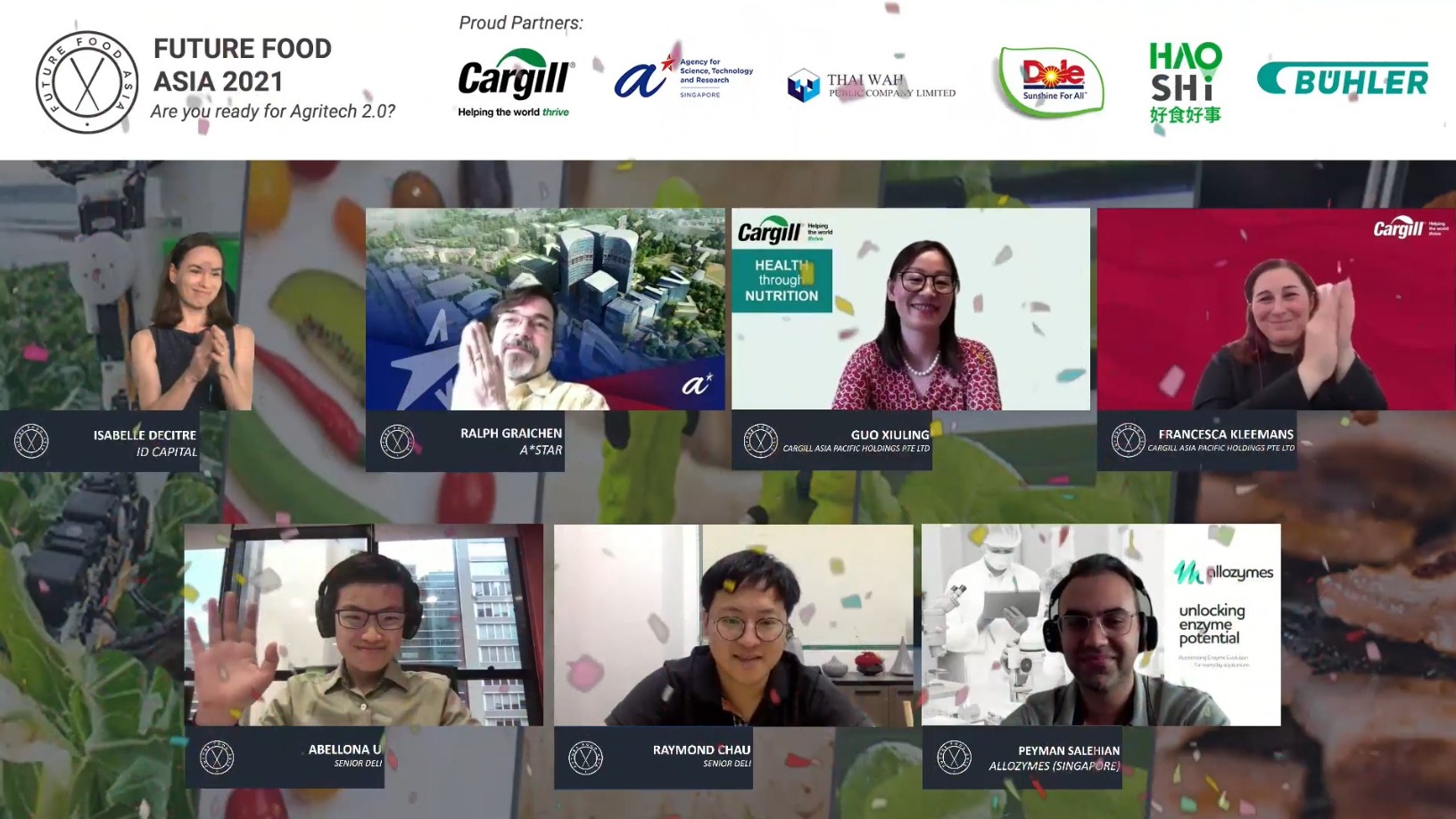

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Sorry, we couldn’t find any matches for“Deep tech”.