Deep tech

-

DATABASE (439)

-

ARTICLES (447)

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

CEO and co-founder of Kobo360

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

CEO and co-founder of Xendit

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Founded by Xiaomi founder Lei Jun and former GIC executive Koh Tuck Lye (or Xu Dalai), Shunwei Capital invests in early- and growth-stage startups in the internet technology and high-tech sectors. It has about US$750 million in capital under management.

Founded by Xiaomi founder Lei Jun and former GIC executive Koh Tuck Lye (or Xu Dalai), Shunwei Capital invests in early- and growth-stage startups in the internet technology and high-tech sectors. It has about US$750 million in capital under management.

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

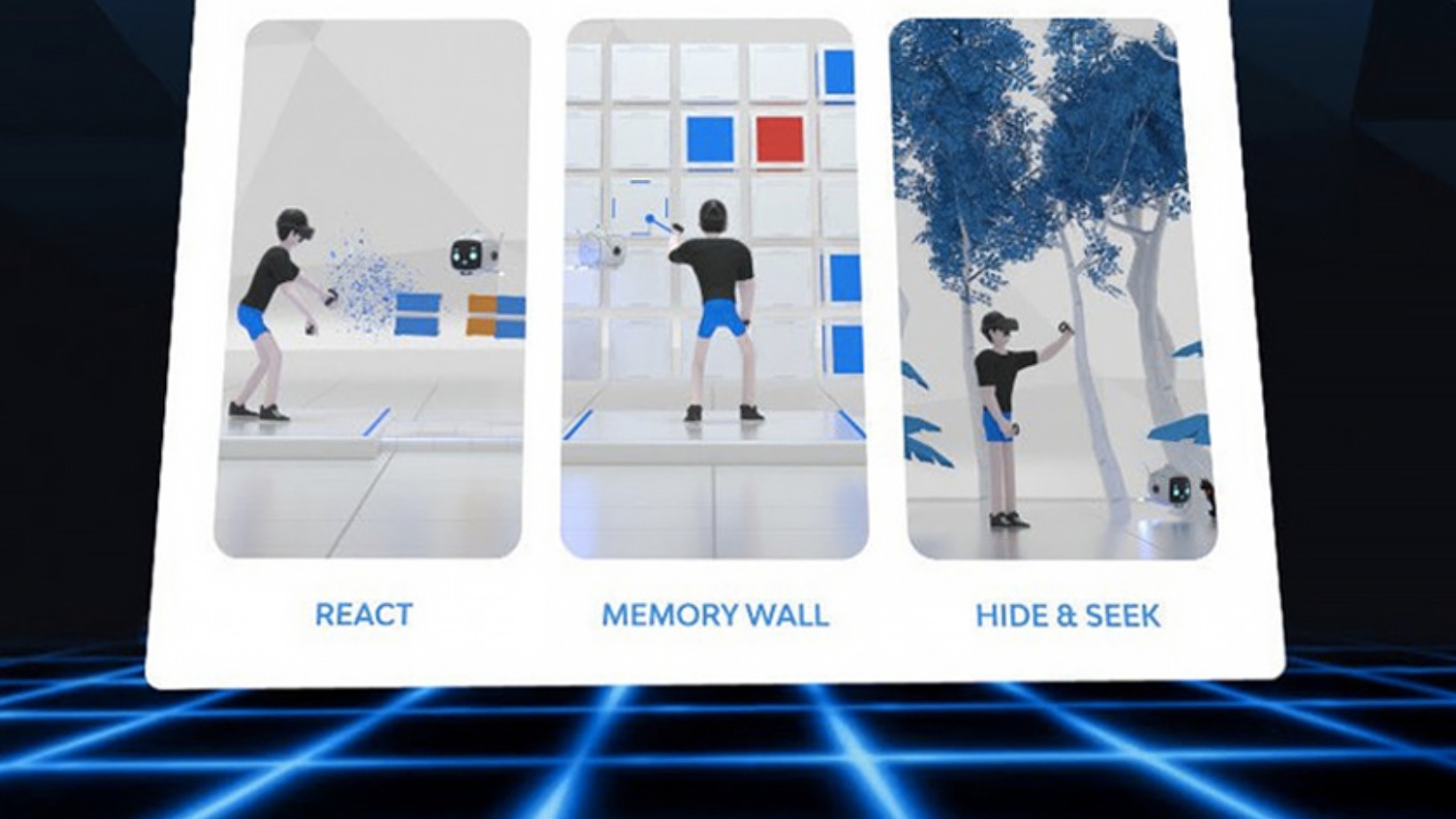

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

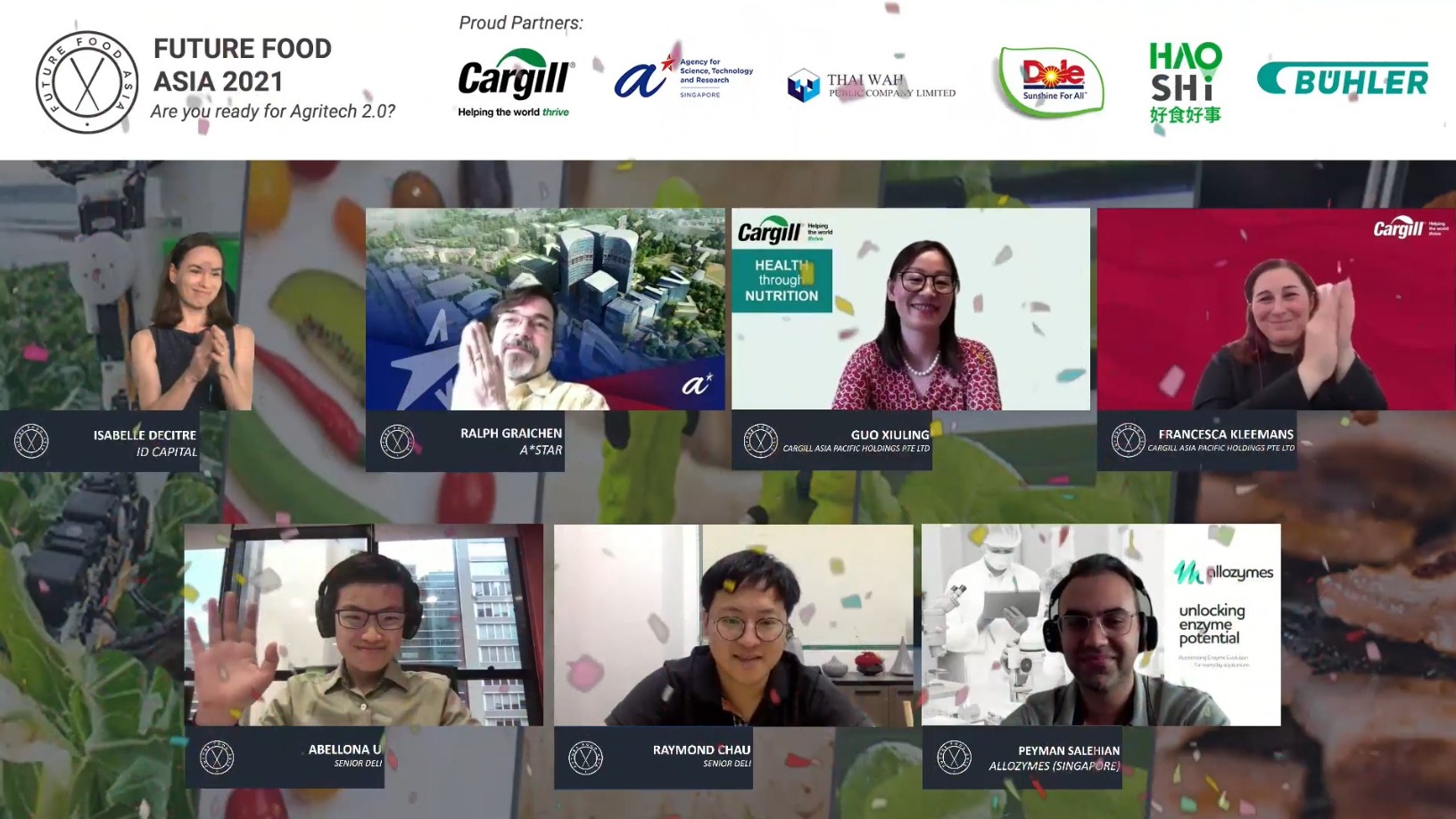

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Sorry, we couldn’t find any matches for“Deep tech”.