Dynamic Growth

-

DATABASE (162)

-

ARTICLES (383)

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

CTO and Founder of CH Biomedical

With a doctorate in mechanical engineering from the University of Maryland, Frank Lin has over 25 years of technical and managerial experience in medtech and aerospace. Before founding CH Biomedical in 2008, he was the principal staff engineer at Kriton Medical, the predecessor of HeartWare International (now Medtronic), leading the computational fluid dynamic design of its Heartware Ventricular Assist Device (HVAD) system. Lin holds 15 US and international patents in left ventricular assist device and turbomachinery. He is also an adjunct professor at the Academy of Engineering and Technology, Fudan University.

With a doctorate in mechanical engineering from the University of Maryland, Frank Lin has over 25 years of technical and managerial experience in medtech and aerospace. Before founding CH Biomedical in 2008, he was the principal staff engineer at Kriton Medical, the predecessor of HeartWare International (now Medtronic), leading the computational fluid dynamic design of its Heartware Ventricular Assist Device (HVAD) system. Lin holds 15 US and international patents in left ventricular assist device and turbomachinery. He is also an adjunct professor at the Academy of Engineering and Technology, Fudan University.

Former co-founder of Qiscus

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

General Manager and Co-founder of DGene

An expert in the field of VR and 3D imaging and display, Hong Xu was in charge of the glass-free 3D project when he worked as R&D director at Chongqing Dromax Photoelectronic Co Ltd in 2013.In 2016, he co-founded DGene to design and build a complete dynamic and static light-field acquisition system, currently the only one of its kind in the world. The system has been applied by Alibaba Group in its God of Creation project that allows consumers to view 3D visuals while browsing through physical shops online from home.

An expert in the field of VR and 3D imaging and display, Hong Xu was in charge of the glass-free 3D project when he worked as R&D director at Chongqing Dromax Photoelectronic Co Ltd in 2013.In 2016, he co-founded DGene to design and build a complete dynamic and static light-field acquisition system, currently the only one of its kind in the world. The system has been applied by Alibaba Group in its God of Creation project that allows consumers to view 3D visuals while browsing through physical shops online from home.

Co-founder of Jimaisong

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Armed with total Series C funding of $100m, Tezign is expanding its CMGO middle platform to help more companies manage their creative resources more efficiently.

Armed with total Series C funding of $100m, Tezign is expanding its CMGO middle platform to help more companies manage their creative resources more efficiently.

Kantox targets the trillion dollar foreign exchange market, offering transparency, lower fees and risk management tools to corporate clients on its P2P platform.

Kantox targets the trillion dollar foreign exchange market, offering transparency, lower fees and risk management tools to corporate clients on its P2P platform.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

Produced by pet specialists, Gouguanjia is a comprehensive, reliable source of information for dog owners in China, where having pets is a relatively new culture.

Produced by pet specialists, Gouguanjia is a comprehensive, reliable source of information for dog owners in China, where having pets is a relatively new culture.

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

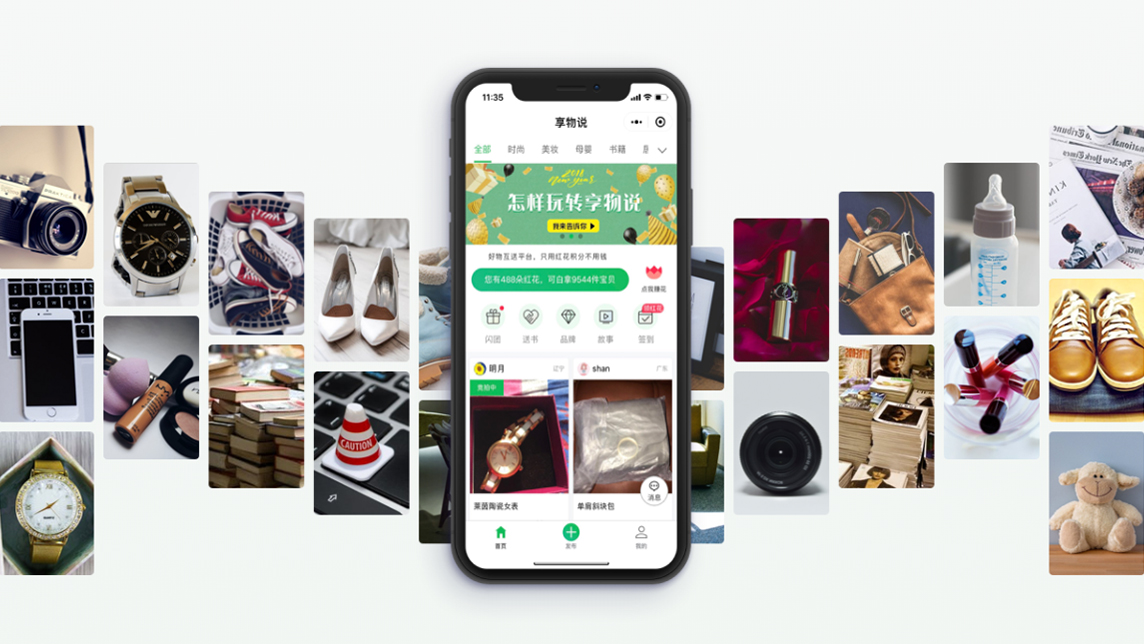

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Storial: Budding writers test their talent and turn a profit

By helping new authors monetize their work, Storial gives budding literary talent a launching pad

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

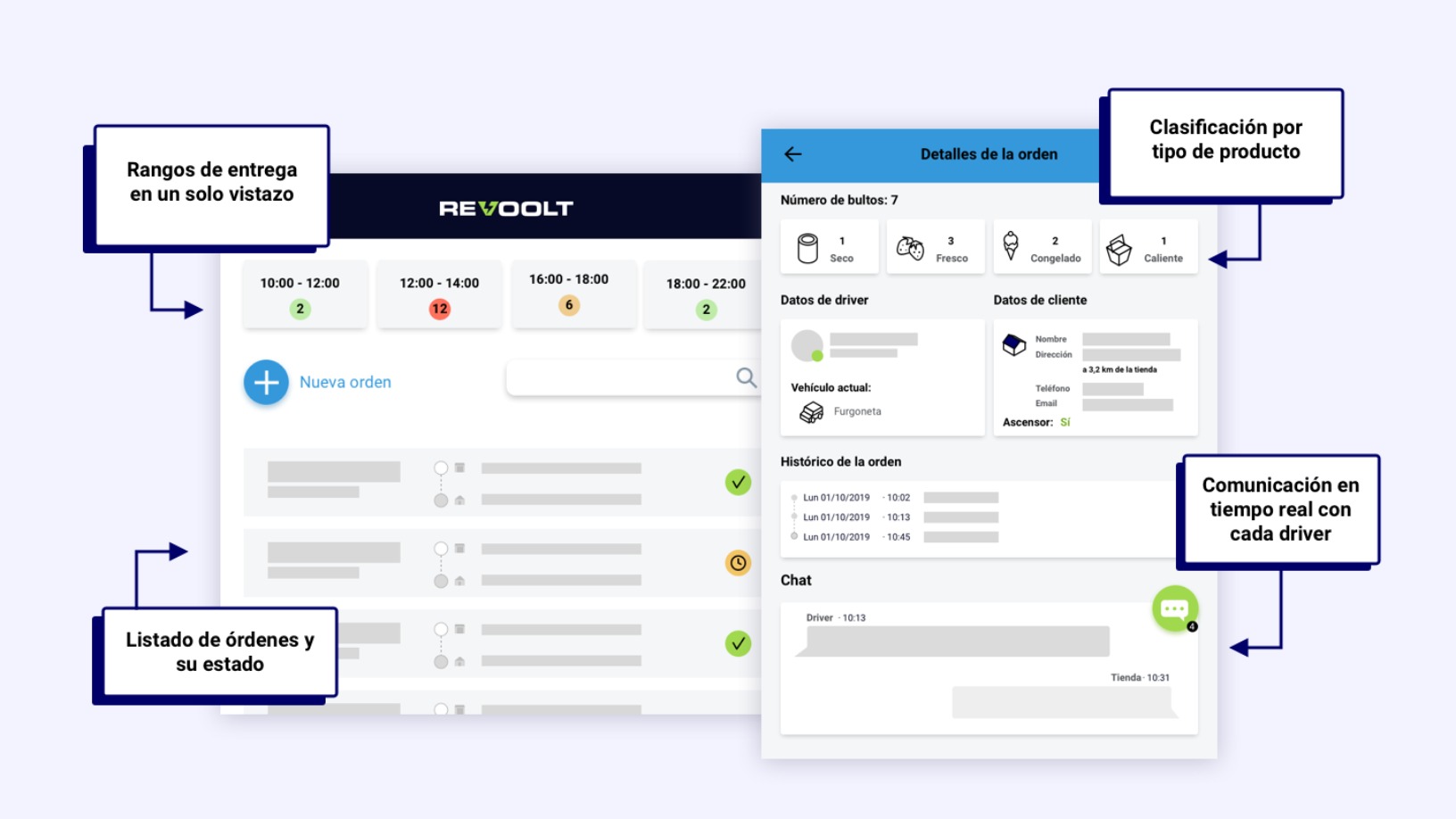

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Using sensors and machine learning, Jejak.in wants to make conservation programs count

Launched this year, Jejak.in is helping big corporates like Danone-Aqua in environmental projects and a major B2C carbon-offsetting partnership is next

Growing together: a look at the Indonesia Fintech Association (Aftech)

The Indonesia Fintech Association sets an example of how professional associations can help new industries grow faster and better

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

Modoo: Reducing stillbirth risk with fetal heart monitoring wearable

Weighing just 15g, the world’s smallest wearable “patch” with passive fetal monitoring technology by Modoo seeks to offer a safer alternative to ultrasound devices

Sorry, we couldn’t find any matches for“Dynamic Growth”.