Dynamic Growth

-

DATABASE (162)

-

ARTICLES (383)

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

CTO and Founder of CH Biomedical

With a doctorate in mechanical engineering from the University of Maryland, Frank Lin has over 25 years of technical and managerial experience in medtech and aerospace. Before founding CH Biomedical in 2008, he was the principal staff engineer at Kriton Medical, the predecessor of HeartWare International (now Medtronic), leading the computational fluid dynamic design of its Heartware Ventricular Assist Device (HVAD) system. Lin holds 15 US and international patents in left ventricular assist device and turbomachinery. He is also an adjunct professor at the Academy of Engineering and Technology, Fudan University.

With a doctorate in mechanical engineering from the University of Maryland, Frank Lin has over 25 years of technical and managerial experience in medtech and aerospace. Before founding CH Biomedical in 2008, he was the principal staff engineer at Kriton Medical, the predecessor of HeartWare International (now Medtronic), leading the computational fluid dynamic design of its Heartware Ventricular Assist Device (HVAD) system. Lin holds 15 US and international patents in left ventricular assist device and turbomachinery. He is also an adjunct professor at the Academy of Engineering and Technology, Fudan University.

Former co-founder of Qiscus

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

General Manager and Co-founder of DGene

An expert in the field of VR and 3D imaging and display, Hong Xu was in charge of the glass-free 3D project when he worked as R&D director at Chongqing Dromax Photoelectronic Co Ltd in 2013.In 2016, he co-founded DGene to design and build a complete dynamic and static light-field acquisition system, currently the only one of its kind in the world. The system has been applied by Alibaba Group in its God of Creation project that allows consumers to view 3D visuals while browsing through physical shops online from home.

An expert in the field of VR and 3D imaging and display, Hong Xu was in charge of the glass-free 3D project when he worked as R&D director at Chongqing Dromax Photoelectronic Co Ltd in 2013.In 2016, he co-founded DGene to design and build a complete dynamic and static light-field acquisition system, currently the only one of its kind in the world. The system has been applied by Alibaba Group in its God of Creation project that allows consumers to view 3D visuals while browsing through physical shops online from home.

Co-founder of Jimaisong

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Armed with total Series C funding of $100m, Tezign is expanding its CMGO middle platform to help more companies manage their creative resources more efficiently.

Armed with total Series C funding of $100m, Tezign is expanding its CMGO middle platform to help more companies manage their creative resources more efficiently.

Kantox targets the trillion dollar foreign exchange market, offering transparency, lower fees and risk management tools to corporate clients on its P2P platform.

Kantox targets the trillion dollar foreign exchange market, offering transparency, lower fees and risk management tools to corporate clients on its P2P platform.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

Produced by pet specialists, Gouguanjia is a comprehensive, reliable source of information for dog owners in China, where having pets is a relatively new culture.

Produced by pet specialists, Gouguanjia is a comprehensive, reliable source of information for dog owners in China, where having pets is a relatively new culture.

Now called Wanwu Xinsheng, the startup recycles over 70,000 used electronic goods in China daily, clocking over RMB 2bn of transactions every month

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Genuine or fake? Sneakers resale platform Poizon tackles counterfeit issues

Gearing up for IPO in 2019 with just pre-A funding raised so far, fast-growing sneakers trading portal Poizon rides craze for branded sneakers and sneakerheads' willingness to pay

Airhopping: Breakthrough in the OTA sector for millennials

Offering cheap and flexible multi-destination flight packages is helping the platform become the go-to reservation agent for budget travelers

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

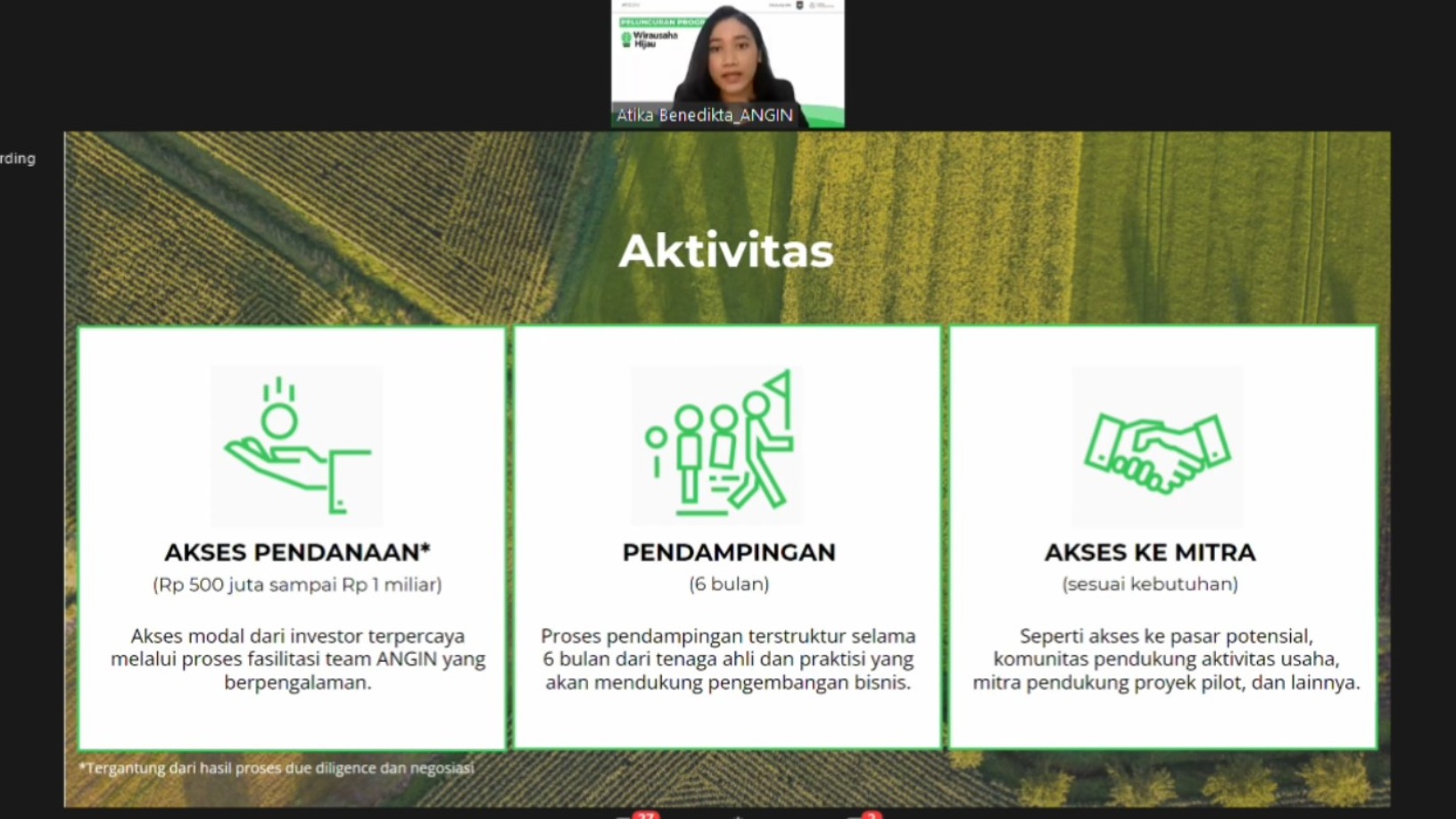

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Sorry, we couldn’t find any matches for“Dynamic Growth”.