EastWest Bank

-

DATABASE (142)

-

ARTICLES (141)

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Sribu connects small businesses with tight budgets with self-employed designers delivering fast turnaround and quality work. Clients get over 100 designs to choose from.

Sribu connects small businesses with tight budgets with self-employed designers delivering fast turnaround and quality work. Clients get over 100 designs to choose from.

Ralali is speeding up Indonesia’s B2B procurement process by creating a more transparent and user-friendly marketplace for buyers and vendors of industrial and wholesale goods.

Ralali is speeding up Indonesia’s B2B procurement process by creating a more transparent and user-friendly marketplace for buyers and vendors of industrial and wholesale goods.

HelloBeauty aims to be Indonesia’s top beauty services platform, providing customers with “Beauty anytime, anywhere” by trusted and vetted makeup artists and hairdressers.

HelloBeauty aims to be Indonesia’s top beauty services platform, providing customers with “Beauty anytime, anywhere” by trusted and vetted makeup artists and hairdressers.

Co-founder of Kioson

Viperi Limiardi is the commissioner of Artav, the national distributor for mobile network operator XL Axiata. Artav was an early investor in Kioson and is now a majority shareholder of the recently public-listed fintech in Indonesia. A Computer Science graduate from Universitas Trisakti, Viperi had also worked as a professional banker at Bank Indonesia for more than 15 years.

Viperi Limiardi is the commissioner of Artav, the national distributor for mobile network operator XL Axiata. Artav was an early investor in Kioson and is now a majority shareholder of the recently public-listed fintech in Indonesia. A Computer Science graduate from Universitas Trisakti, Viperi had also worked as a professional banker at Bank Indonesia for more than 15 years.

Powered by analytics, this homework app relieves teachers from setting/marking homework while analyzing individual progress, so teachers can deliver more personalized, productive teaching.

Powered by analytics, this homework app relieves teachers from setting/marking homework while analyzing individual progress, so teachers can deliver more personalized, productive teaching.

An integrated communication and information platform for schools, accessible by teachers, students and parents, which aims to modernize and improve the Indonesian education system.

An integrated communication and information platform for schools, accessible by teachers, students and parents, which aims to modernize and improve the Indonesian education system.

The world’s highest valued edtech, with 400m users, will be the first education startup to sponsor the Olympic and Paralympic Winter Games, come 2022.

The world’s highest valued edtech, with 400m users, will be the first education startup to sponsor the Olympic and Paralympic Winter Games, come 2022.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Backed by Temasek Holdings and United Overseas Bank, InnoVen Capital has offices in Mumbai, Singapore and China. InnoVen Capital is the largest provider of venture debt to venture capital firms in India. The firm’s China office was established in April 2017.

Backed by Temasek Holdings and United Overseas Bank, InnoVen Capital has offices in Mumbai, Singapore and China. InnoVen Capital is the largest provider of venture debt to venture capital firms in India. The firm’s China office was established in April 2017.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Banco Sabadell is one of the biggest and oldest banking groups in Spain. Based in Barcelona, it was established in 1881 and has an annual revenue exceeding US$9.8 billion. The bank caters to small and medium enterprises and serves 12 million customers. Banco Sabadell's subsidiary, BStartup, was founded in 2014 to support entrepreneurs through two investment vehicles: BSartup10, which targets startups during their set-up phase and offers highly customized services and Sabadell Venture Capital, which invests in startups seeking Series A or B funding. The bank currently has 50 offices focused on catering to the needs of startups.

Banco Sabadell is one of the biggest and oldest banking groups in Spain. Based in Barcelona, it was established in 1881 and has an annual revenue exceeding US$9.8 billion. The bank caters to small and medium enterprises and serves 12 million customers. Banco Sabadell's subsidiary, BStartup, was founded in 2014 to support entrepreneurs through two investment vehicles: BSartup10, which targets startups during their set-up phase and offers highly customized services and Sabadell Venture Capital, which invests in startups seeking Series A or B funding. The bank currently has 50 offices focused on catering to the needs of startups.

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

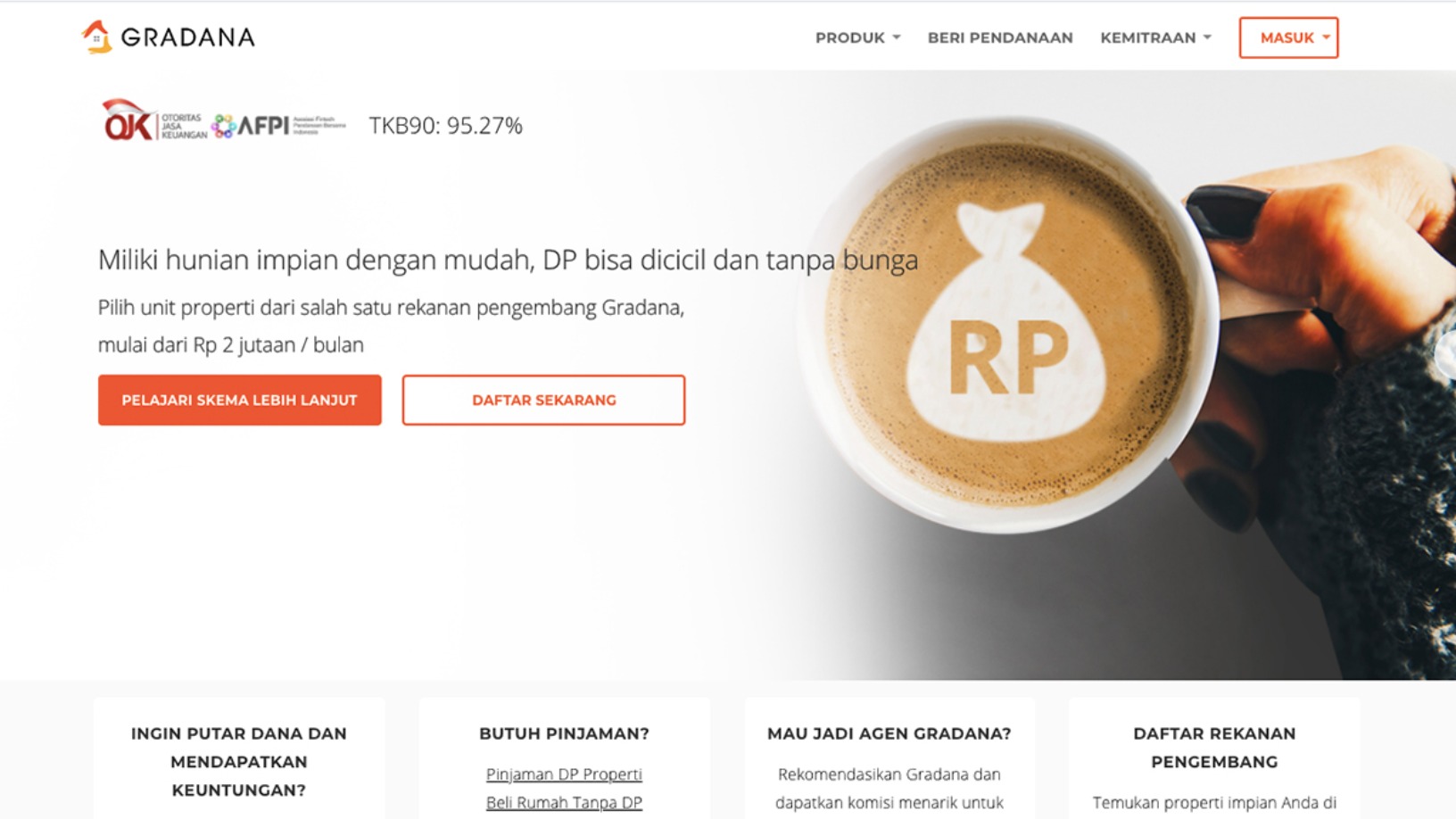

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“EastWest Bank”.